Xponential Fitness Inc (NYSE:XPOF) Pitch

Scaled fitness franchise Brand with new rockstar management team, growing royalties double-digit, trading at a 10%+ FCF yield, with share repurchases incoming

Summary

Scaled franchise brand growing units double-digit with mid-single-digit same-studio sales, trading at 8.5x 2025’s EBITDA and 11x EPS vs comparables at 17.5x and 27.6x, respectively

Boasts a newly refreshed board & executive team comprised of high-profile professionals (CFO of Domino’s Pizza, CTO of Microsoft, President of Adidas)

High visibility into future unit growth is completely disregarded by the market

The recent acquisition of a subscale competitor supports a significantly higher valuation

My model showcases a stock that could be $60 in 3-4 years (versus $17.35 today)

Company Overview

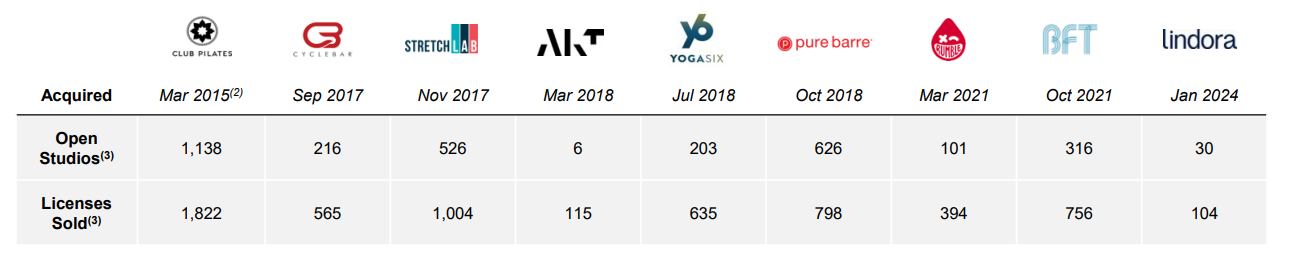

Xponential Fitness is a franchisor of boutique fitness studios. The company owns and licenses eight fitness-focused brands and one health-focused brand. It is the biggest franchisor of fitness studios, having surpassed Orange Theory during the pandemic. Studios are usually small retail locations with an average size of 1,500-2,500 sqft. Here is a snapshot of each brand and their size:

Club Pilates and Stretch Lab are the company’s ‘crown jewels’, with the other brands still in their infancy. As of the latest quarter, 3,178 studios were open globally, and LTM system-wide sales totaled $1.6 billion. This is important because this is not just some small, unscaled franchisor but a global powerhouse of fitness brands.

Context on Recent Weakness

On June 23, 2023, Fuzzy Panda published a short report on Xponential Fitness. I respect short-sellers who make their work public. It is not an easy job and requires significant due diligence. Many of the points brought forth by Fuzzy Panda were valid criticism. I do not want to dwell too much on the issues, but here are some of the main points:

Prior CEO Anthony Geisler had a questionable past and was involved in questionable business practices.

Many of XPOF’s smaller brands were not properly supported, and the projected economics for franchisees were a pipe dream.

The company was acquiring ‘failing’ studios from franchisees for pennies on the dollar to avoid reporting closures and allow it to claim that no studio had ever closed.

Some of the report's points were true, some were hypothesized but ultimately didn’t pan out, and some have been debunked. Regardless, the short report caused the stock to crash from $27 to $7.49 at its low. Government agencies such as the SEC and the US Attorney’s Office for the Central District of California initiated multiple investigations, and investors lost confidence.

All right, this all sounds really bad, right? Bear with me; a lot has changed since then.

Cleaning-up Shop

Following the short report, the board of directors took decisive actions to improve governance & investor perception :

In April 2024, Jeffrey Lawrence was appointed to the board of directors. Mr. Lawrence was the previous CFO of Domino’s Pizza and director of Shake Shack. Interestingly, he joined amidst the scandal, which piqued my curiosity. Mr. Lawrence must have done significant due diligence before joining the board. He wouldn’t hurt his reputation for a small retainer fee on the board of a $600m market cap company.

In May of 2024, they fired the prior CEO, Anthony Geisler.

In June of 2024, Mark King was hired as CEO and on the board of directors. Mr. King was Taco Bell's CEO, Adidas's President, and TaylorMade Golf Company's CEO.

In November of 2024, Bruce Haase was appointed to the board of directors. He was the prior CEO of Extended Stay America, a $3b+ publicly traded company. Like Mr. Lawrence, there is no chance he joined without due diligence and risked jeopardizing his reputation.

However, in my opinion, the board/CEO's most telling action (or inaction) was their decision to retain CFO John Meloun. If you are actively trying to turn around a business that is deep in regulatory investigations related to its accounting practices, would you keep the CFO? Unlikely. But Mr. King kept him. Not only did he keep him, but he also praised him. Here is a quote from him:

Before turning the call over to John, I'd like to provide a heartfelt thanks to John, our chief financial officer, for all his support prior to my arrival and over the past 100 days.

I don't have to tell all of you how integral John is to the success of Xponential, but he's really gone above and beyond as a partner during my first 100 days, and I look forward to having him by my side as we make the most of the opportunity in front of us. With that, I'll turn the call over to John.

This is an extremely important detail, as it helped me believe that XPOF’s concerns might be overblown and that the stock should not be trading at the current multiples.

Mr. King also significantly strengthened the executive team:

He hired John Kawaja as President of its North America division. Mr Kawaja was the prior head of marketing at Adidas and president of TaylorMade, where he worked with Mr. King.

He hired Kevin Beygi, a former Microsoft director, as CTO. Oh, Did I mention that Microsoft's old CTO is also on the board? He probably recommended Mr. Beygi.

He hired Eric Simon, Senior Vice President of Franchise Sales and Development at The Joint Chiropractic.

I think you get the picture. The board and management team are now comprised of highly reputable individuals with significant experience in consumer brands. XPOF’s team is completely different, and the market is slow to realize this.

Impact of Short Report on Fundamental Dynamics

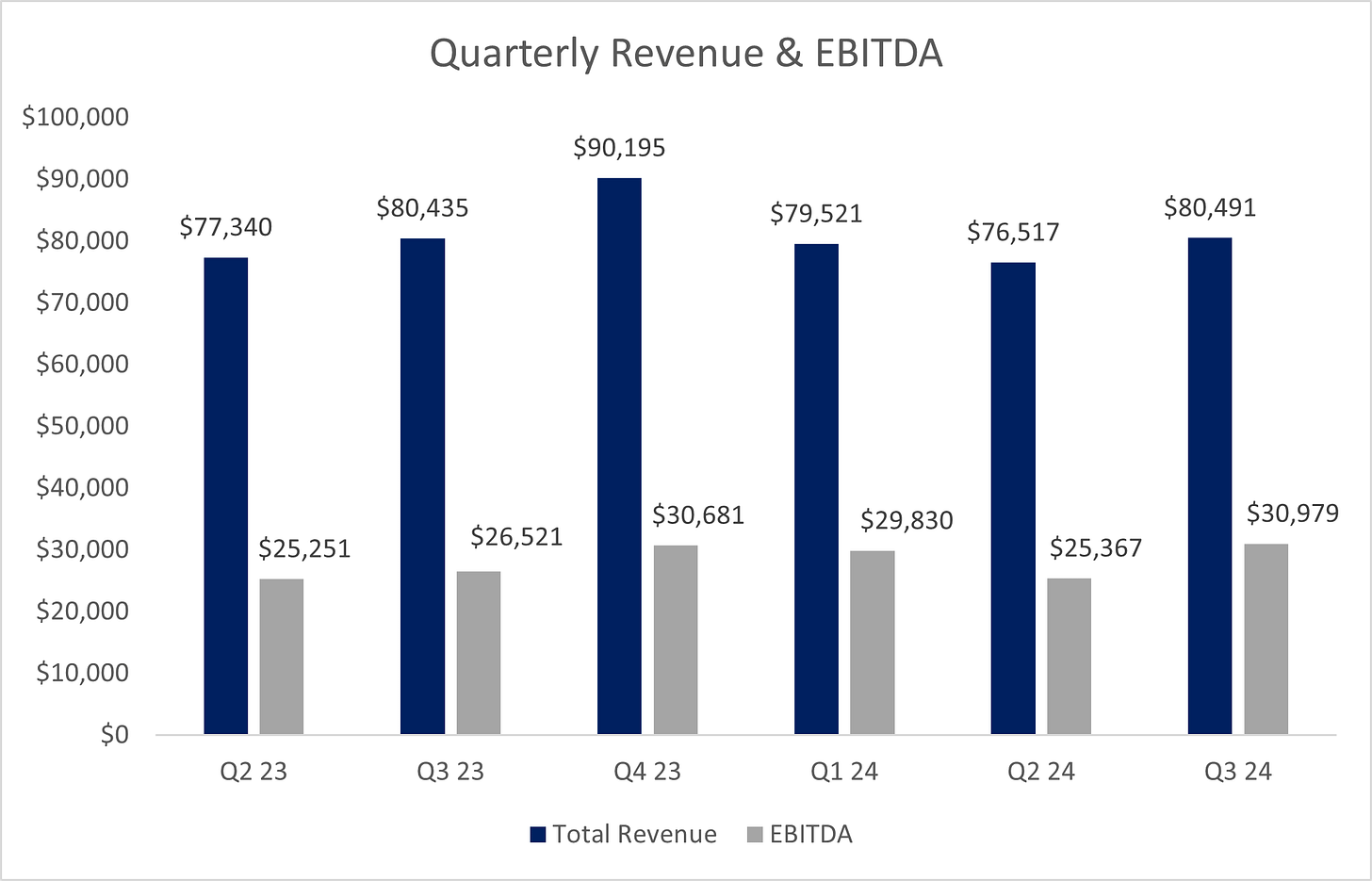

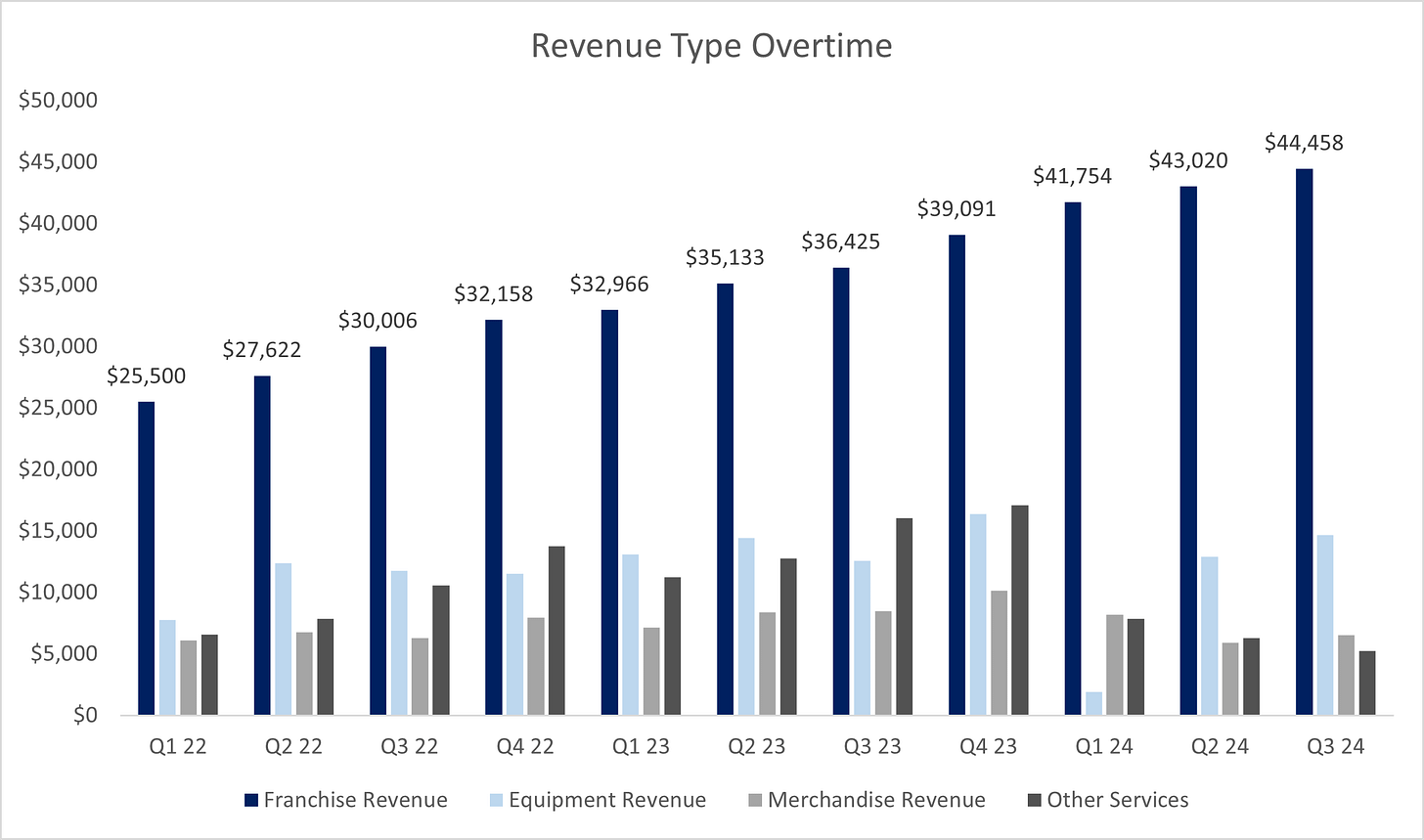

If one quickly looks at recent trends, it appears growth has stalled:

However, this dynamic has been partly driven by the short report. Following backlash on its treatment of underperforming studios, management initiated the closure of all company-owned transition studios. This dragged ‘other services revenue’, which dropped from $17.1m in Q4 2023 to $5.2m in the latest quarter. They’ve also divested two underperforming brands.

If one looks under the hood, the performance is significantly better than it appears:

These closures have also significantly impacted cash flow and profitability. Management reduced the number of company-owned studios from 84 to zero. Each closed location had to pay its remaining lease obligation, leading to significant restructuring charges. Year-to-date, cash flow was impacted by $19.6m of restructuring charges and $14.5m in litigation expenses.

Beyond transitioning studios, the board/management cleaned up a lot of other issues:

Two underperforming brands were divested: Row House & STRIDE Fitness, and one is being wound down (AKT).

The California Department of Financial Protection concluded its investigation, fined the company $450K, and forced officers and directors to attend franchise law compliance classes. The California branch is known to be one of the most aggressive in pursuing cases. No wrongdoing was admitted.

The SEC’s Division of Corporation Finance reviewed the company’s financial statement and found no issues with the financials.

Mr. King materially slowed the development of new studios to focus on franchise support and sustainably growing internationally. The number of new studio openings was revised to 490-510, down from 540-560 for this year.

All of this is already showing up in the P&L, with adjusted EBITDA in Q3 improving to 38% from 33% last year. It’s worth noting that franchise revenue gross margin is 91% versus 20% for equipment and merchandise. With the unwinding of its leases and the resolution of litigations, I estimate the business could generate $80-90m in FCF for 2025, or a 10% FCF yield for a business with mid-single-digit same-studio growth and double-digit unit growth. Before the release of the short report, management was aggressively buying back shares. Since the new management has little appetite for additional acquisitions, I expect them to use all excess FCF to buy back stock starting in 2025. The growth and buybacks would materially expand FCF/share from $1.56 in 2025 to $3.40 by 2028! I discuss this a bit more in my valuation section below.

You must probably think my assumptions about getting to $3.40 in FCF/share are aggressive. After all, growth this year has been minimal, so why should you believe growth is set to re-accelerate? Well, my belief in double-digit growth is anchored by multiple strategic initiatives that are already in place, which I will outline next.

Significant Embedded Growth Ahead

Xponential Fitness has high visibility in its growth pipeline. As of Q3 2024, they’ve sold 1,980 franchise licenses that have not opened yet. This backlog would add 62% to the existing unit base and provide visibility into the next 4-5 years, at a minimum. The company estimates it could have over 8,000 units in the US alone. While this seems optimistic, I think the opportunity remains ample, especially internationally: 1,093 studios are contractually obligated to open, with over 28 countries having contracts in place. Management has recently signed multiple Master Franchise Agreements in various Latin American, European, and Asian jurisdictions, which should add to its backlog. I forecast 300-400 net studio openings (400-500 gross minus 3% closure rate) every year, which represents 8-10% net unit growth over the next 2-3 years. Two-thirds of the openings will come from Club Pilates & StretchLab in the near term.

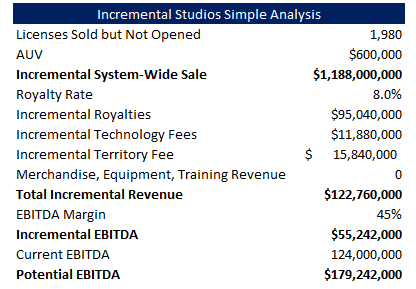

I believe there is visibility into an incremental $55m+ of EBITDA using extremely conservative assumptions:

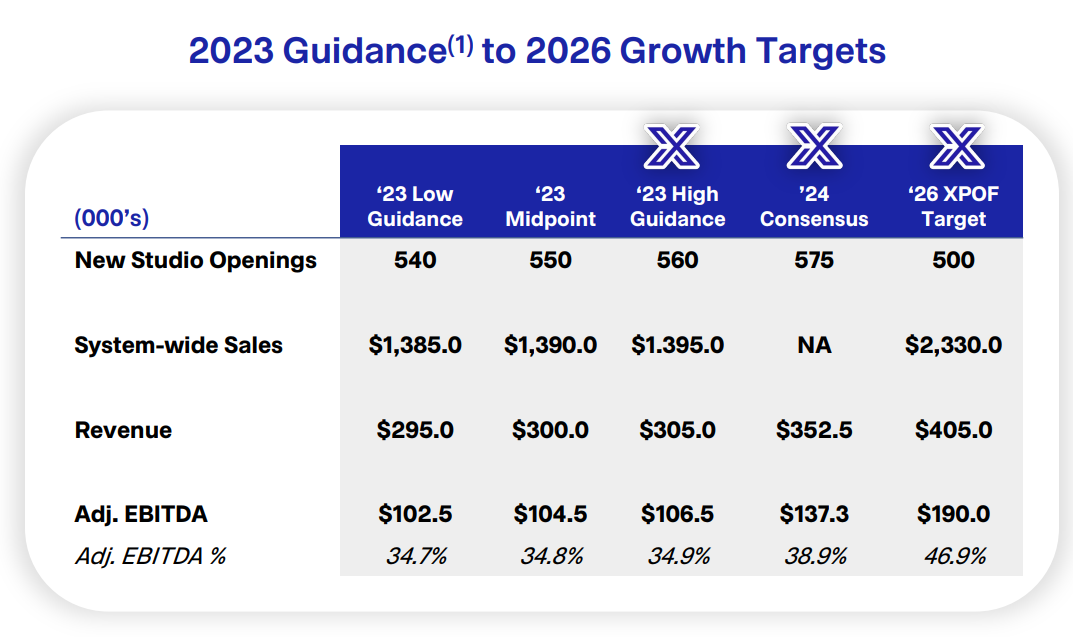

The old management hosted an investor day in September of 2023. While many of the timelines provided are not relevant anymore, the targets serve as a good reference point for its potential growth:

The stock is currently 6.6x the targeted $190m of EBITDA, which is achievable in 2027/2028, in my opinion.

Interestingly, franchisors are usually tied to a single brand; XPOF has 8 brands with a different value proposition. For now, brands outside of Club Pilates and StretchLab individually contribute marginally to the company’s performance, but a few could be primed for a breakout (BFT & YogaSix come to mind). This portfolio approach allows it to diversify the ‘fad’ risk to which fitness companies are usually exposed. One brand to watch out for is Lindora, acquired in 2023. Lindora is a medically supervised weight loss and wellness studio brand that capitalizes on GLP-1s, hormones, and wellness therapy.

The story isn’t all about unit growth. As of the latest quarter, traffic was up 16%, representing the bulk of their systemwide sales growth. Same-studio growth has been consistent and is likely to continue growing at a low to mid-single-digit pace. Xponential has pushed very little pricing over the years. It has relied on implementing price increases for new members while keeping existing member pricing frozen. On their Q3 2024 call, management stated that 96% of their SSS growth had been volume-driven and 4% from price increases. What happens if they start ramping up pricing, like other fitness brands? Especially in the context of their main brands’ classes being consistently sold out. We could see a re-acceleration of same-studio growth from the estimated 4% in Q4 2024 to 5-6%+, driven partly by price increases.

Club Pilates, the Crown Jewel, is Worth All of XPOF’s Enterprise Value. A Recent Transaction Supports This

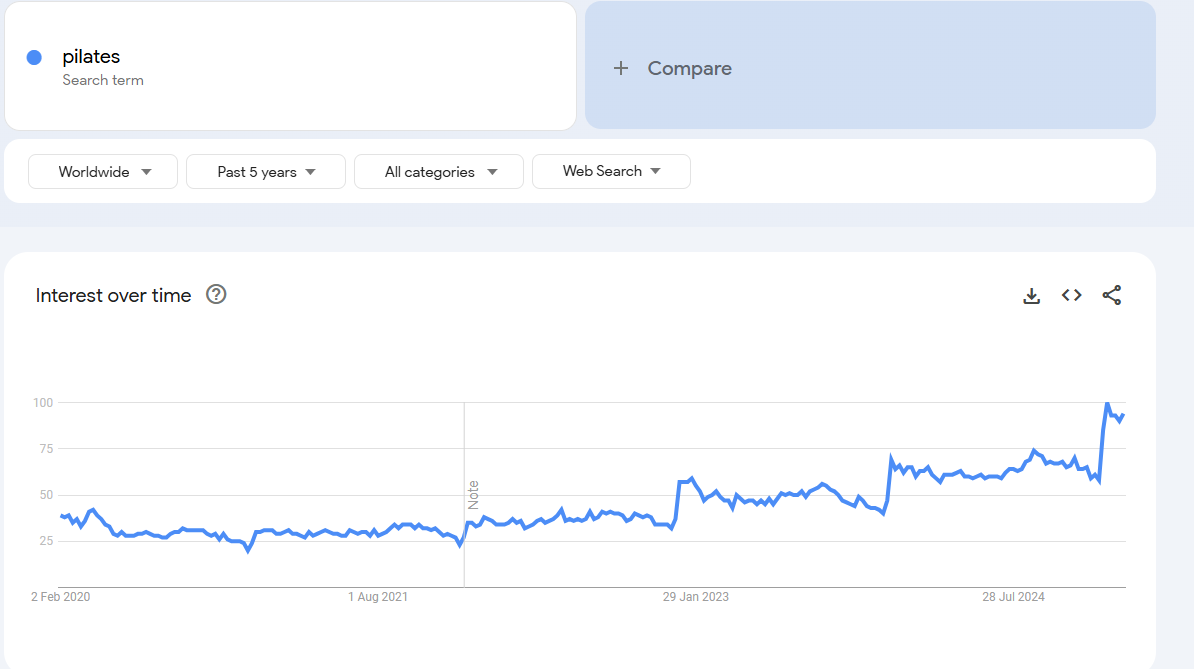

Club Pilates is XPOF’s crown jewel. Its growth has been consistent, and franchisees rave about the brand. More individuals want to open a studio than the business has available, and these trends are likely to continue for a while. An article published by Athletech News in early January shows that the majority of Pilates studios are growing. Interest in Pilates has rapidly grown, as evidenced by Google's trend toward the word ‘Pilates’ or ‘Club Pilates’.

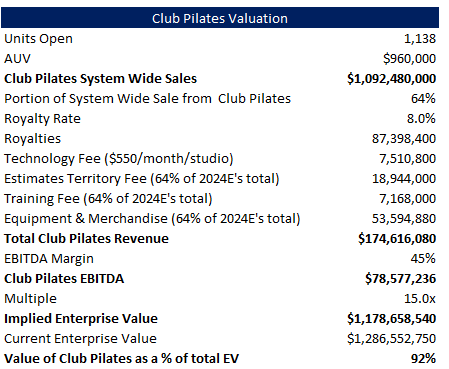

It’s not only consumers who have an interest in Pilates. In September 2024, Private Equity giant L Catterton took a stake in a Pilates boutique studio, Solidcore. According to a Reuters article, the deal was valued at $600 to $700m. Solidcore at the time had 125 locations, significantly lower than Club Pilates at 1,138. An older article from Reuters outlined that the company was expected to generate $150m in revenue and $50m in EBITDA for 2024. L Cartetton effectively paid 4-4.7x revenue and 12-14x EBITDA. This private equity giant clearly sees interest in Pilates lasting. They paid 12-14x EBITDA for an operator. How much would a scaled franchisor like Club Pilates fetch? Well, let’s do the math:

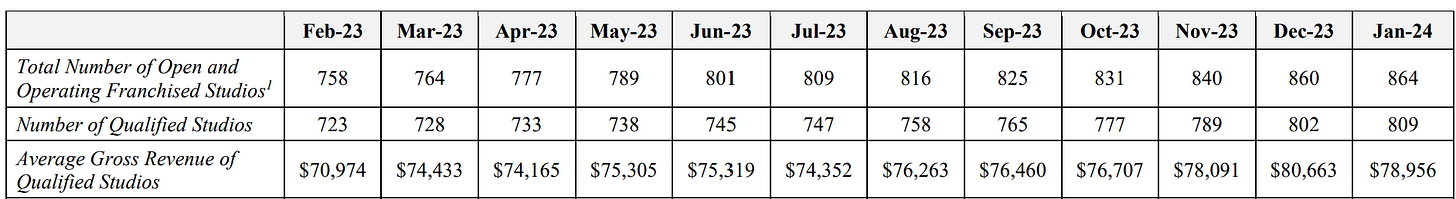

Club Pilates’ Franchise Disclosure Documents are public records. The latest one from January 2024 shows $78,956 in monthly gross revenue for the average studio:

For simplicity, let’s assume some growth in 2024 and use $80,000/month or $960,000 per year:

At today’s valuation, you are buying Club Pilates and getting every other brand and their associated growth for free. That's pretty wild if you ask me.

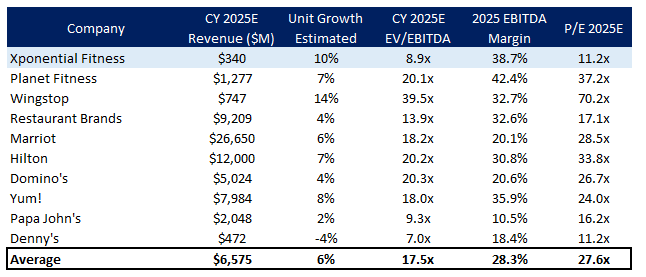

Valuation & Comparables

Public markets have, and continue to pay, a significant premium for durable high-unit growth franchises. Yet, Xponential Fitness trades below the valuation of declining and mature franchise assets like Denny’s or Papa John’s:

Despite having one of the highest unit growth and margin profile, XPOF trades at a 50% discount to the peer group. You could add almost every other possible publicly traded North American scaled franchise brand to this comp sheet, and the stock would still look cheap.

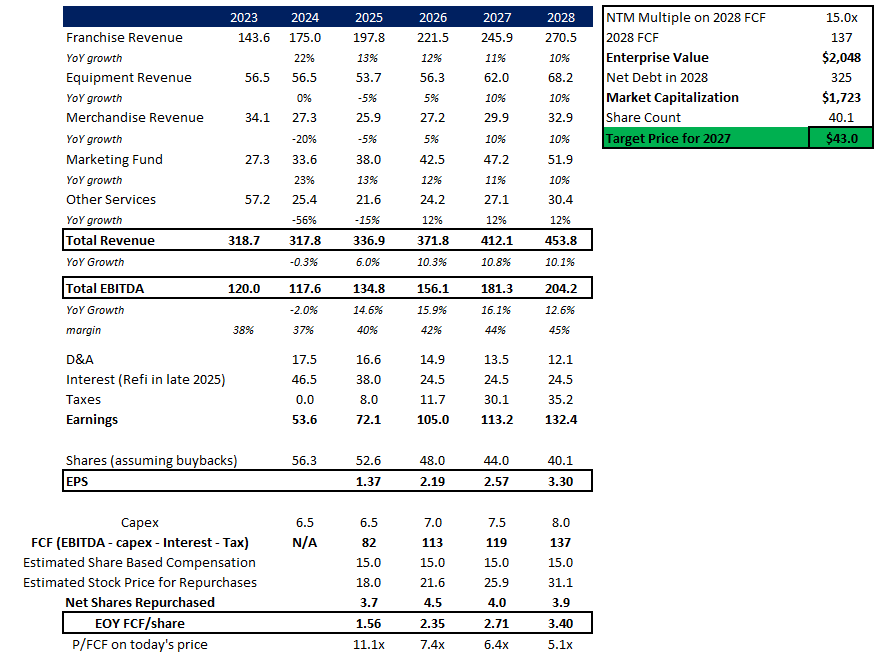

I’ve done a simple model to showcase the upside 3 years down the line if the company starts aggressively buying back stock and the stock remains at a somewhat depressed valuation:

XPOF has approximately 56.3m diluted shares (assuming the conversion of its prefs and class B shares) and 325m of net debt (including contingent consideration). My model assumes 10% unit growth in 2025, with a conservative 3% same-studio growth and decelerating trends from thereon for conservatism. There is also an opportunity to refinance the variable debt to a fixed rate of 7% by the end of 2025. With buybacks, management could repurchase 30% of the business over the next three years. Shares are expected to decline from 56.3 million today to 40.1 million by 2028, while free cash flow (FCF) growing from $82 million to $137 million! FCF per share would rise from $1.56 in 2025 to $3.40 in 2028! These assumptions suggest the stock could be trading at 7.5x the FCF of 2026 and 5.2x the FCF of 2028. It is pretty good value if you ask me.

It is not crazy to believe that XPOF can trade at 15x NTM FCF, given its a capex-light, high-unit growth stock. That would still be significantly lower than its comp set. At 15x 2028’s FCF, my target price would be $43 in two years (versus $17.35 today), or a 150% upside. At 20x FCF, which would still be a material discount to its comp set, the target price would be $60 or 242% upside.

Risks

Xponential Fitness, like most other franchises, relies on a very limited number of brands (Club Pilates & StretchLab). If those and all future brands prove to be ‘fads,’ then there is a case to be made that valuation should be low. So far, everything points to the opposite.

Given that most of XPOF’s franchisees are local entrepreneurs, the company’s franchise closure hit is higher than that of other typical public companies. Management estimates ‘churn’ to be around 3%.

A few legacy lawsuits/investigations remain - while I expect them to be dismissed or immaterial at worst, there could still be near-term noise which can create volatility in the stock.

The change in the new management team's strategy could affect estimates in the near term. More details will be provided during their Q4 2024 earnings call. However, I don’t think the strategy will change significantly, as Mr. King has already partly discussed it in the last two earnings calls.

Closing Remarks

Potential near-term noise remains, but we are moving further away from the short report’s thesis while business fundamentals remain solid. This is a phenomenal set-up, as most of the old investor base churns out and is replaced by new investors who slowly discover the ‘new’ company Xponential Fitness has become. It can ultimately lead to an aggressive re-rating of the stock.

Disclaimer: I am long NYSE:XPOF. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

what do you think about the Q4 Results?

Thoughts on recession risk? Boutique fitness seems like the worst category to be in right now...