Thryv Holdings Inc. (NASDAQ:THRY) Pitch

A SaaS Business Growing 29% for 1.3x revenue? Count me In!

Summary

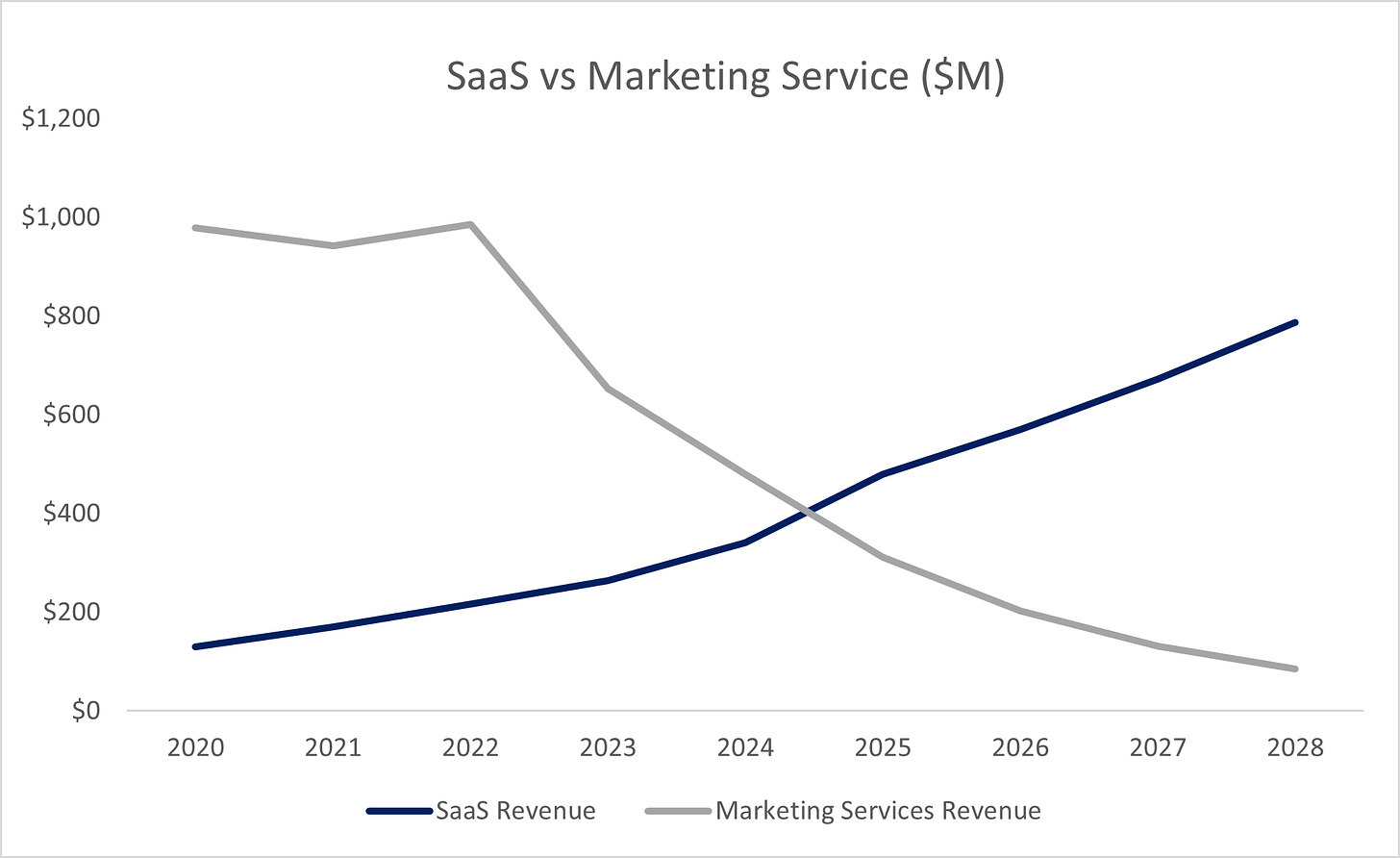

An aggressive decline in a legacy segment is masking a profitable rule of 40 software business, which now represents over 50% of revenue

the CEO has implemented the same strategy in a prior publicly traded company and 15-bagged the stock

Multiple tailwinds provide visibility into growth for the foreseeable future

The SaaS segment is significantly undervalued against both its comparables and any software name of similar size

Segments Overview

Thryv operates in two segments. The first is the legacy Yellow Pages digital and print business, which represents a little under 50% of revenue. The second is a fast-growing software product: a CRM targeted for small businesses with 5 to 25 employees. It has historically been geared toward blue-collar companies, with the biggest verticals being construction, contractors, home and garden, and professional services. Software now accounts for a little over 50% of revenue.

A Bit of History

Thryv was formed following the merger of Dex Media and YP Holdings, both Yellow Pages (YP) companies. Dex Media was led by CEO Joe Walsh, who owned a small software product called DexHub, built in 2015. He rolled over his equity stake and remains the largest shareholder of THRY with 2.2m shares. He rebranded the business and software to Thryv before its IPO in 2020. At the time, SaaS comprised only 7% of revenue, while digital and print YP comprised the rest of its business.

Mr. Walsh strategically pushed to harvest the cash flow from the YP companies in secular decline to accelerate the SaaS transition. It resonated well with the market, as THRY saw its stock skyrocket from $9 to $41 during the ‘SaaS at any multiple’ frenzy of 2020/2021. The stock quickly returned to earth as investors realized the SaaS transition would be significantly slower than expected. Today, the stock languishes at $16.58.

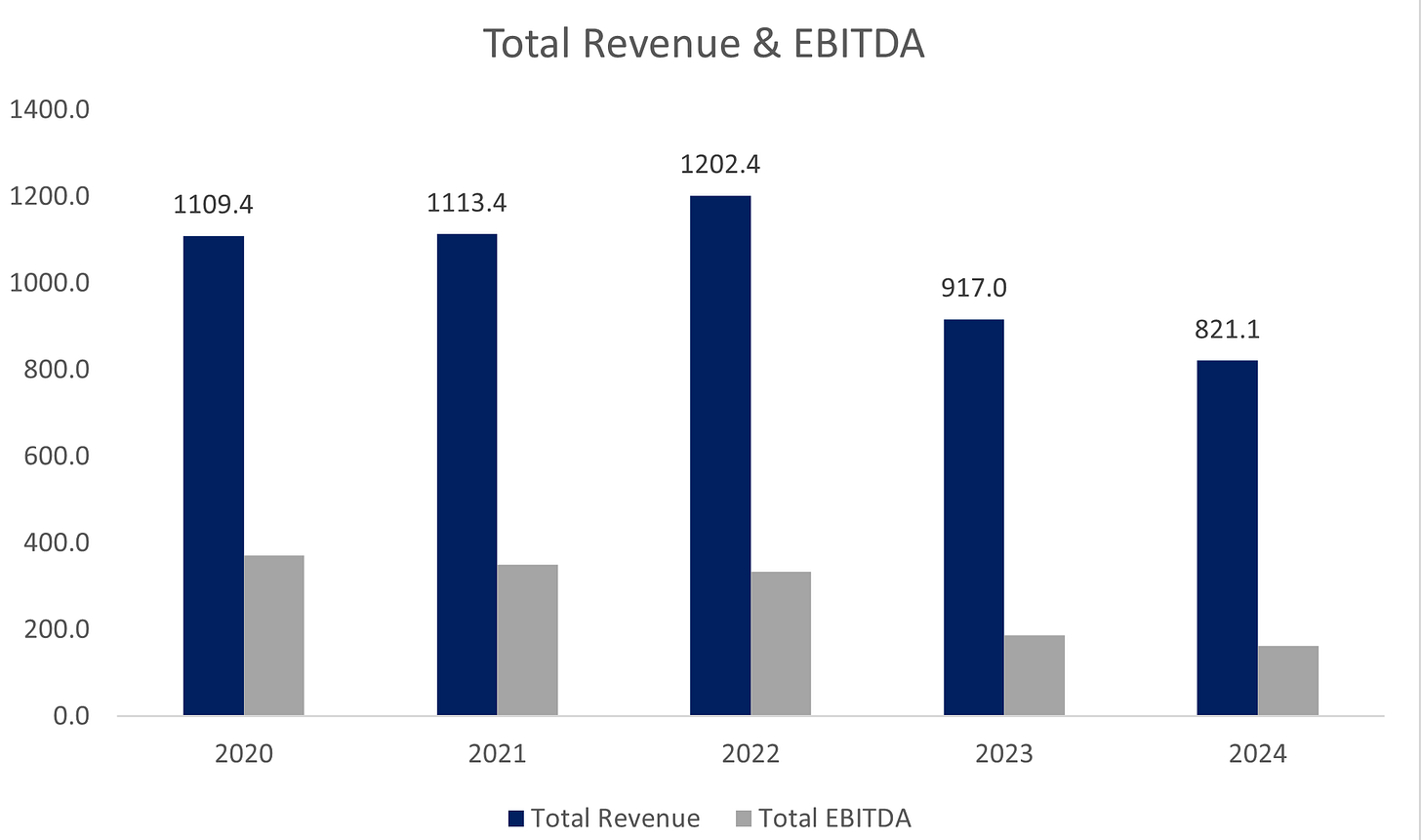

From 2021 to 2024, I felt it was too early to invest in THRY. The rapid decline in overall Revenue & EBITDA far outweighed the small contribution of the SaaS business. While the stock has been abysmal, I have always been impressed by management’s transparency, execution, and ability to stick to the strategy despite the stock market’s pressures.

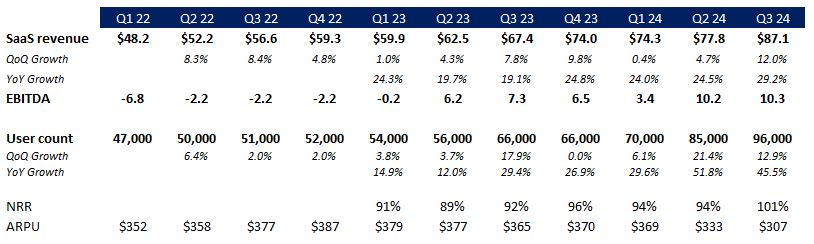

I believe now is the time to invest. The business has hit a major milestone: software revenue is set to exceed marketing services revenue, while organic SaaS growth has materially accelerated to 29%. The software hit the rule of 40, net retention dollar eclipsed 100%, and its customer count has reached 45% growth.

The CEO Has Successfully Implemented this Playbook Before

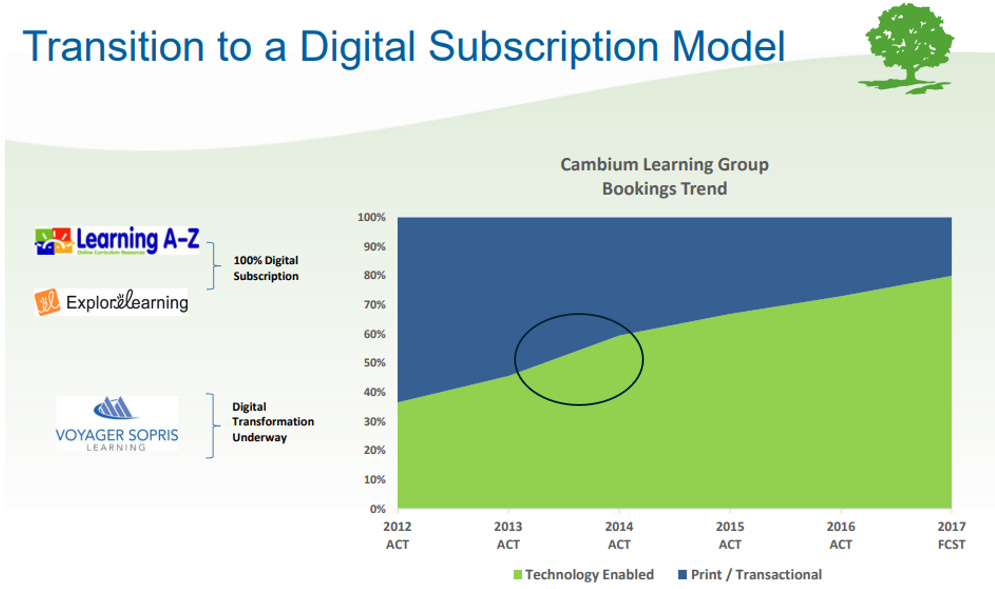

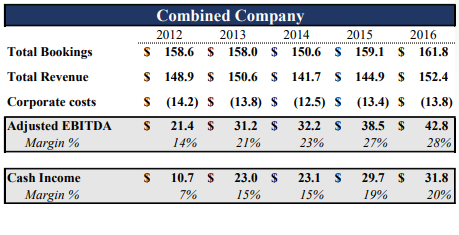

Mr. Walsh was Chairman of Cambium Learning, ticker ABCD. He joined in March of 2013, following the resignation of most of the executive team. The new board was instrumental in shaping the company’s strategic pivot. The stock price was $1.01 then, dropping from a high of >$40 a decade prior. Cambium was struggling, with EBITDA declining rapidly and the balance sheet deteriorating at 6x net debt/EBITDA. The new management team stabilized the company and made a significant push into digital and technology-enabled solutions, away from printed educational content.

The strategy is so similar to Thryv that I thought I had a Deja Vu! Here’s Cambium’s old investor presentation:

Interestingly, the stock started rising as soon as Technology-enabled solutions crossed the 50% mark. We are already there with less leverage. Even though Cambium’s revenue only started growing in 2015, the stock was $4.98 by the end of that year, five times higher than in 2013. Thryv in early 2025 is what Cambium was in early 2013.

Cambium Learning was ultimately acquired by a Private Equity firm in 2018 for $14.50, or 13.5x more than when Mr. Walsh joined. The PE paid 4.6x trailing EV/Revenue and 18x trailing EV/EBITDA.

The CEO clearly believes he can replicate this playbook; He has consistently bought the stock in the open market since 2022 and as recently as September 2024.

YP’s Fast Decline is Engineered; Thus Why This Opportunity Exists

Anybody screening and finding Thryv would see the below and move on to another stock:

Thryv’s Marketing Services revenue decline is quite aggressive. Many think it’s primarily due to the secular challenges affecting the business, but it’s not the only story. As a reference point, Yellow Pages Canada is a publicly traded company on the TSX. Unlike Thryv, its Yellow Pages business hasn’t fallen off a cliff. It’s been consistently declining at a high single-digit to low double-digit clip. So why is YP in the US declining at 25%+? Are the dynamics so different in Canada relative to the United States? No. Thry’s management has been engineering the fast decline of its print business, and it has all the incentives in the world to do so.

Under ASC606 accounting rules, Thryv recognizes its print revenue upon delivery. Initially, the US publication cycle was once every 12 months. Management lengthened it to 18 months and, more recently, to 24 months. This allows the company to recognize revenue immediately. However, it also means revenue for future quarters within Marketing Services drops significantly, accelerating the pace of its SaaS mix shift. That said, cash flow is unaffected, as customers are billed monthly.

The company also carries some debt, which scares investors away. The debt itself isn’t an issue; in April of 2024, management refinanced it. Interestingly, the terms were favorable. The maturity was pushed out to 2029, the interest rate dropped from SOFR+850bps to SOFR +675bps, capital return is now allowed, and the mandatory annual repayment dropped from $70m to $52.5m (which drops to $35m after 2 years). It seems like a decisive vote of confidence from debtholders. Management has already pre-paid three quarters worth of amortization as of their investor day.

It also didn’t help that the company completed an equity offering in October 2024 to acquire another software company, Keap. The $80m equity offering was priced at $14.00, 24% lower than the previous day’s closing price of $18.34. While the optics of the acquisition look bad, I think this is a long-term positive.

According to a leaked email circulating on X, Keap was actively looking for investors. They were unable to find one and were getting desperate. Thryv swooped in and opportunistically bought the company, effectively wiping out Keap’s common equity holders. Keap’s revenue has flattened since 2018. While that seems scary, the founder explains what happened in a video on YouTube. Significant changes were made to the strategy following the founder's exit, leading to flat revenue. The video corroborates Thryv’s management’s explanation of the issues.

Keap is expected to generate 75-78m of revenue. The management team paid 1x revenue and 8x EBITDA pre-synergies. Thryv expects $10m in cost synergies and $50m in potential cross-selling synergies over time. More importantly, Keap benefits Thryv in multiple ways:

It improves product capabilities through the addition of automation tools, such as automatic lead responses depending on specific prompts, lead follow-up, internal reminders, and automatic client onboarding

Accelerates the transition to a pure-play software stock, adds 15,000 clients for cross-selling opportunities, and slightly increases its upmarket capabilities.

It comes with 700 channel partners that can sell the Thryv product. Thryv did not have channel partners in the past.

This acquisition is a key catalyst, accelerating the SaaS mix shift while further bolstering its product offering.

SaaS: The Hidden Gem

I want to spend a bit of time discussing the software product. Thryv built itself a niche focusing on providing a CRM for small businesses. When I speak of small businesses, I mean 5-25-employee businesses. Not your 200-employee VC-backed software company. It is your neighbor’s 10-employee veterinary clinic or the local landscaper. Businesses use the product to manage their social media, generate leads, schedule management, process payments & invoices, build & manage their websites, optimize SEOs, etc.

Initially, the company only had one product: its business center, which came out in 2019. Since then, it has expanded its product offering, becoming an all-encompassing platform for managing all aspects of the business. It includes a Marketing Center, a Command Center, Keap marketing automation tools, a Reporting Center, and a Workforce Center, the latter two of which are in the beta phase.

The CRM space is competitive. On the upper end of SMB, Thryv’s competition includes HubSpot and ServiceTitan, both publicly traded and its closest comparable. However, they’ve been slowly moving upmarket, creating a vacuum Thryv is actively filling. HubSpot’s ARPU is over $13K, compared to Thryv’s at $4K. HubSpot’s bread and butter are companies with 200-700 employees, generating 70% of its annual recurring revenue. Thryv focuses on companies with 25 employees or less. While HubSpot’s product offering might be deeper and more complete, Thryv’s simplicity has allowed it to offer a better price point for its target market.

At the bottom end of the market, the company believes it competes primarily against single-product software such as Intuit Quickbooks, Square’s customer products, and MailChimp. Hundreds of other smaller CRMs are available, but most are not scaled.

Despite many competitors, the company’s software segment has consistently grown across most KPIs. They are clearly doing something right.

Why Do I Think the SaaS Growth Will Sustain?

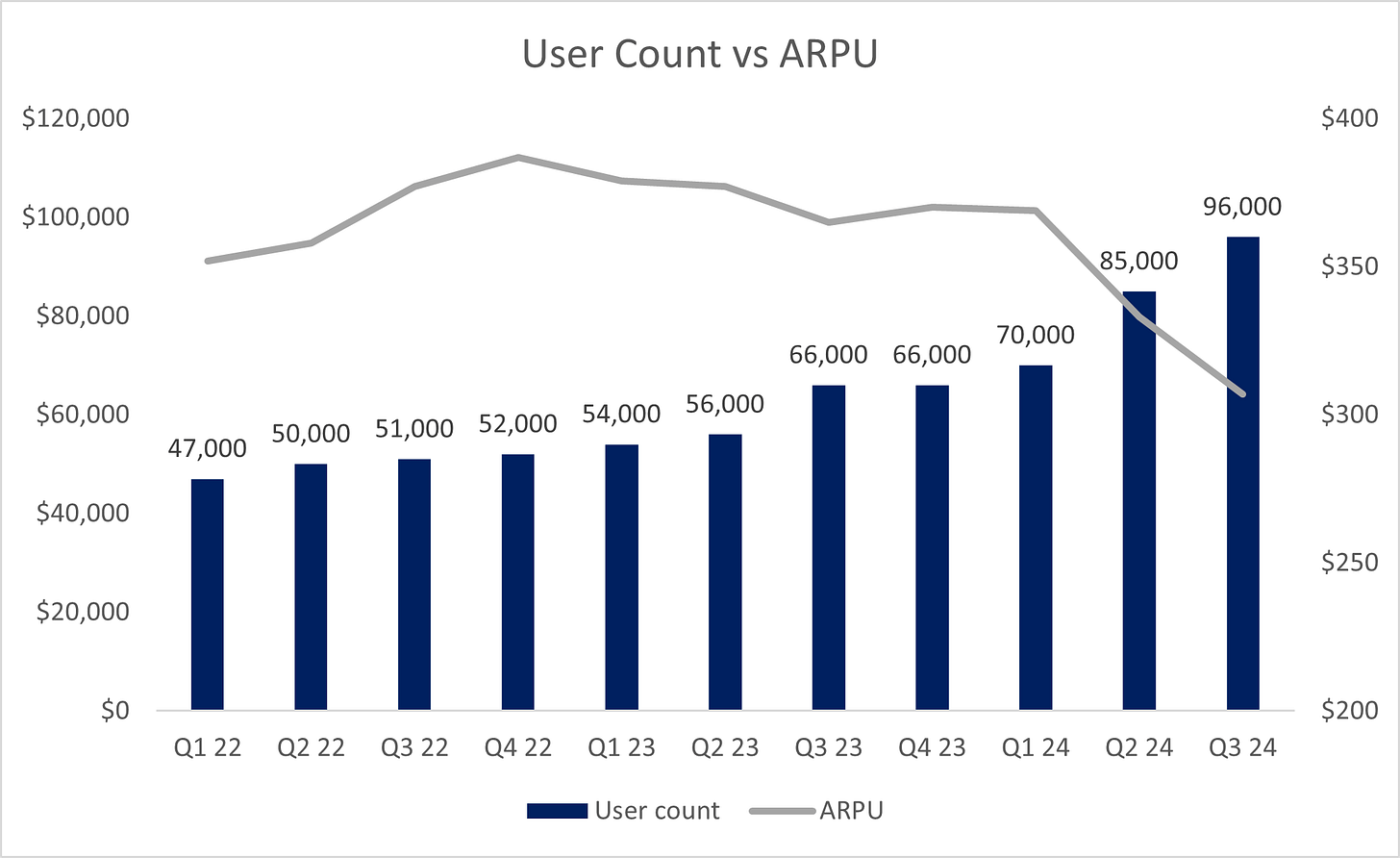

Thryv’s management has several levers to pull to sustain the growth rate for several years. First, it has access to over 200,000 SMBs who are or have been YP clients. Capitalizing on this, they’ve implemented an aggressive strategy to convert Yellow Pages clients to their software platform before they lose them. Most YP services are already offered to these clients through their Marketing Center software. However, the Marketing Center has a significantly lower price point, at $171, versus SaaS ARPU of $380. Effectively, this strategy has caused a very rapid acceleration in user count but materially reduced its ARPU:

ARPU dropped from $387 in Q4 2022 to $307 as of Q3 2024. The strategy is taking advantage of the fact that upselling these customers will be significantly easier and cheaper than re-acquiring them or finding new clients. The company already sees mid-teens ARPU growth one year into this strategy as these customers upsell into different ‘centers.’ Multi-center adoption has also rapidly expanded: 2% of customers had more than one product in Q2 2023 versus 12% as of Q3 2024. Basically, management has a clear line of sight in doubling its user count and expanding its ARPU by over 50% through multi-product adoption.

There is also a massive secular tailwind afoot. Boomers are retiring, and millions of small businesses will be up for grabs by the younger generations. According to an article by The Guardian, Boomers represent 21% of the US population but own 51% of privately held businesses. Many of these businesses continue to use outdated means of managing the day-to-day, especially in the blue-collar verticals that Thryv focuses on. As these businesses switch hands to the younger generations, they will revert to products like Thry’s CRM. It should be a tailwind for the foreseeable future and gives me confidence in underwriting 20%+ growth for the software segment.

Comparing Thryv

Alright, how much do we pay for a software company that is growing 29%, expanding gross margins by 560 bps, and has high visibility into future growth?

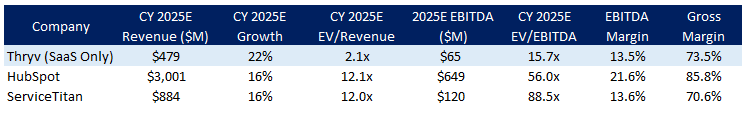

Well, let’s compare Thryv’s software segment to its closest competitors, Hubspot and ServiceTitan:

THRY sticks out like a sore thumb. Both comps are 10x more expensive. ServiceTitan’s financials are actually inferior to Thryv’s on all metrics.

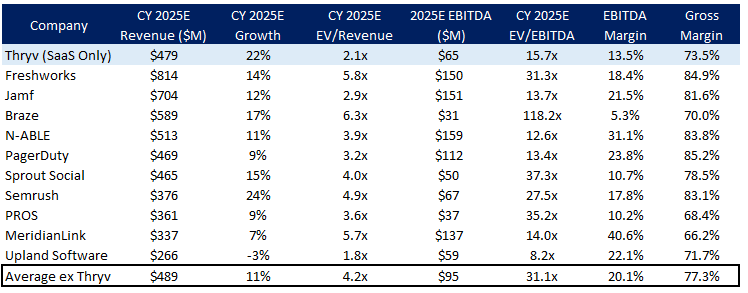

It can be argued that the above competitors/comparables are much bigger with entrenched platforms and customers, thus warranting a higher valuation. To a certain extent, that is true. However, even if we compare it to software companies of similar size, the valuation makes no sense:

Despite growing twice as fast as the average software company in the above table, its SaaS business trades at a 50% discount. This analysis also assumes no revenue/EBITDA will be generated from the marketing services business moving forward, which is not the case. Management expects to harvest $250-300m of FCF from the print business from 2025 to 2030. It’s also worth noting that the fast decline of Marketing Services is leading to more costs being proportionally allocated to the SaaS segment, dampening margins today. Regardless, management expects significant operating leverage for the SaaS segment.

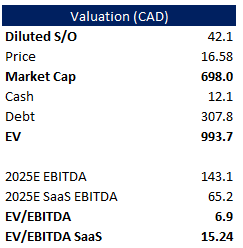

Valuation

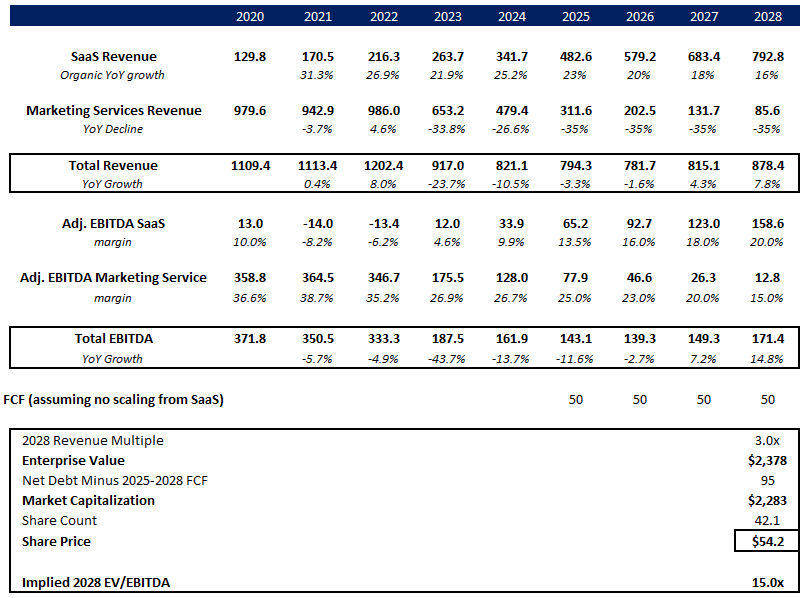

An investor day was held on December 3rd, 2024, to outline long-term targets. In 2025, they expect 18-20% SaaS growth, mid-teens EBITDA margin, and 75-78m revenue contribution from the Keap acquisition. They expect a 35% decline in revenue for marketing services as they lengthen the print cycle from 18 months to 24 months. However, they will maintain their mid-twenties margin. The company expects 20% SaaS growth and 20% EBITDA margin in the medium term. Using some of the assumptions above, I get the following valuation:

Assuming they can continue showcasing an 18-20%+ SaaS growth rate, it is not crazy to believe the stock can re-rate to 3x the next twelve months’ revenue. I have also assumed no scaling in FCF for the SaaS business, which obviously won’t be the case. At a target price of $54.20, the stock represents a 226% upside in two years.

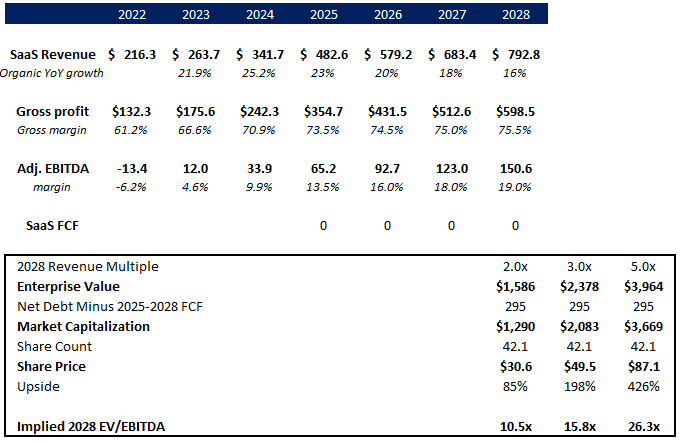

We can also assume the Marketing Services’ revenue and cash flow are worth nothing, which is a fair assumption. This would get me to the below scenario:

5x revenue does not seem unreasonable when looking at the valuation of all other small-cap software in the above comp sheet. Whatever number you put into the model, THRY easily has 5-10x upside longer term. I also believe there is material upside to 2025’s software growth estimate. The company has guided to 18-20% SaaS revenue growth but has achieved 29% in Q3 2024.

Given the valuation, I am happy to own the stock for a few years, knowing I could 10x my money with significant downside protection.

Risks

SMB dependence - average monthly churn is 1.5%, and small businesses fail often.

Debt & Perceived leverage remain an issue for most investors, which I discussed above.

A faster-than-expected decline in Marketing Services could lead to near-term top-line pressure; however, that has been well communicated, with management’s 2025 revenue guidance already being bombed at -35%.

There was an SEC Subpoena related to the company’s non-GAAP treatment of marketing services customers versus SaaS customers. This seems immaterial, but at worst, they could be fined a nominal amount.

Closing Remarks

This is a pitch for those who are happy to ride out potentially bumpy quarters but are okay with holding the stock today, given the substantial 3-5-year upside. It’s also worth noting that the company’s industry classification under GICS is communication services. Since its software segment represents over 50% of its revenues, management could request a classification into the technology sector.

Disclaimer: I am long NASDAQ:THRY. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

Excellent writeup

Thanks for the write up!