Xponential Fitness (XPOF) Update

XPOF reported Q4 2024 results on March 13th. Here is the link to my initial pitch for those who haven't read it.

Unfortunately, I was wrong about this one, plain and simple. Taking a 50% hit in less than a month is painful. I haven’t sold my position yet, but I’m also not buying more. I hope to get clearer insights at their upcoming investor day in May.

Alright, let’s get the bad stuff out of the way:

Q4 2024 results came in higher for revenue ($83m vs estimates at $81m), but EBITDA was lower ($31m vs consensus $35m)

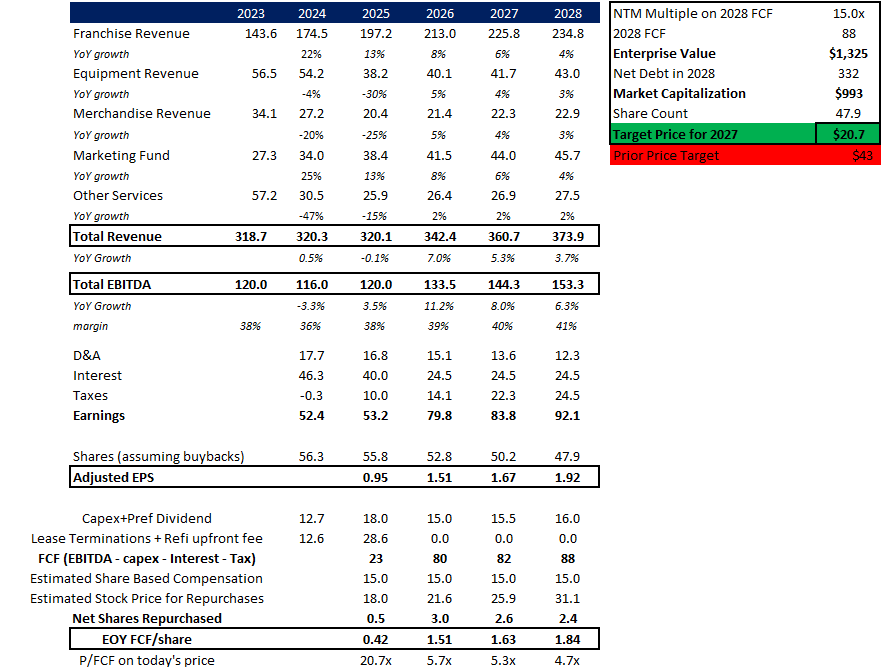

More importantly, the company’s 2025 guidance completely missed the mark. Revenue is projected to be $315-325m, essentially flat but well below my $337m number, and EBITDA $120-125m, up 5% YoY but below my $135m number. Net studio openings are set to be at 210, well below my 300-400 range.

The results were not great, and the guidance even less so. A few other issues likely scared investors:

Management restated the 2023 financial statements and made minor changes to the 2022 and 2024 financials. I believe the accounting errors were the least of investors’ worries. The 2024 10-K was subsequently filed the next day

The Franchise Disclosure Documents for their brands had yet to be filed, and management expected them to be filed in the coming weeks, which impeded their ability to sell licenses. This created additional uncertainty. As of the date of this post, all FDDs except for Lindora have been filed

Closures will remain elevated in 2025 as the company prunes out underperforming franchisees, which means lease termination expenses will remain elevated. Coupled with legal expenses, FCF likely remains muted for the year

The CEO hinted at additional brand divestitures if trends do not stabilize quickly. It would make sense for Rumble and CycleBar to be on the chopping block

That being said, a few positives came out of it:

System-wide sales are set to grow 13%, with same-store sales growing mid-single-digit. The disparity between system-wide sales and revenue is primarily related to equipment & inventory sales, where the company is looking to switch its business model

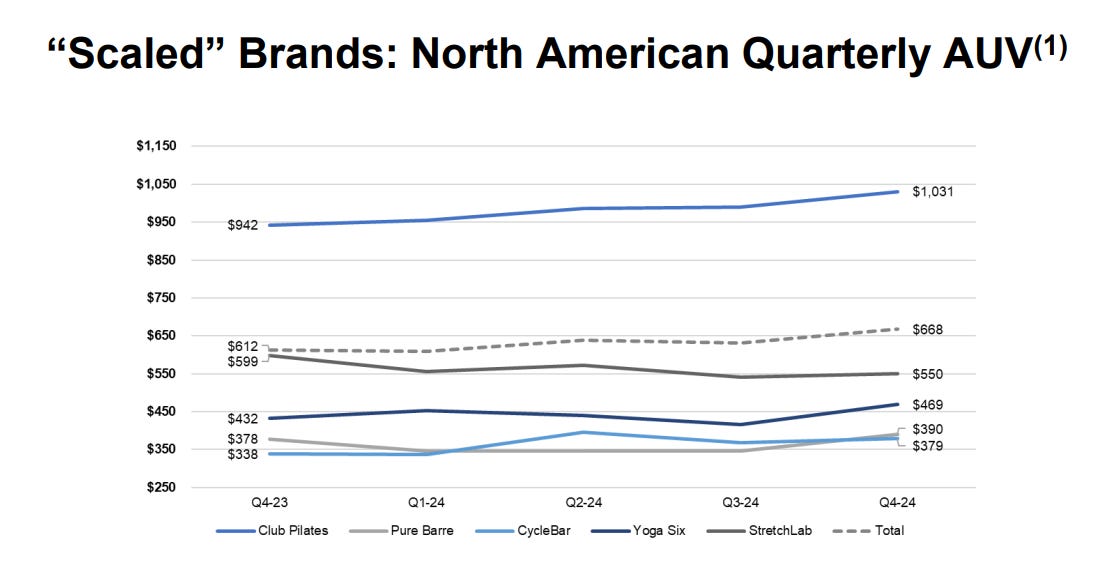

AUV made a new high at $668K in Q4, driven by Club Pilates, Yoga Six, and sequential improvement in StretchLab. Here is a chart outlining the performance of their scaled brands:

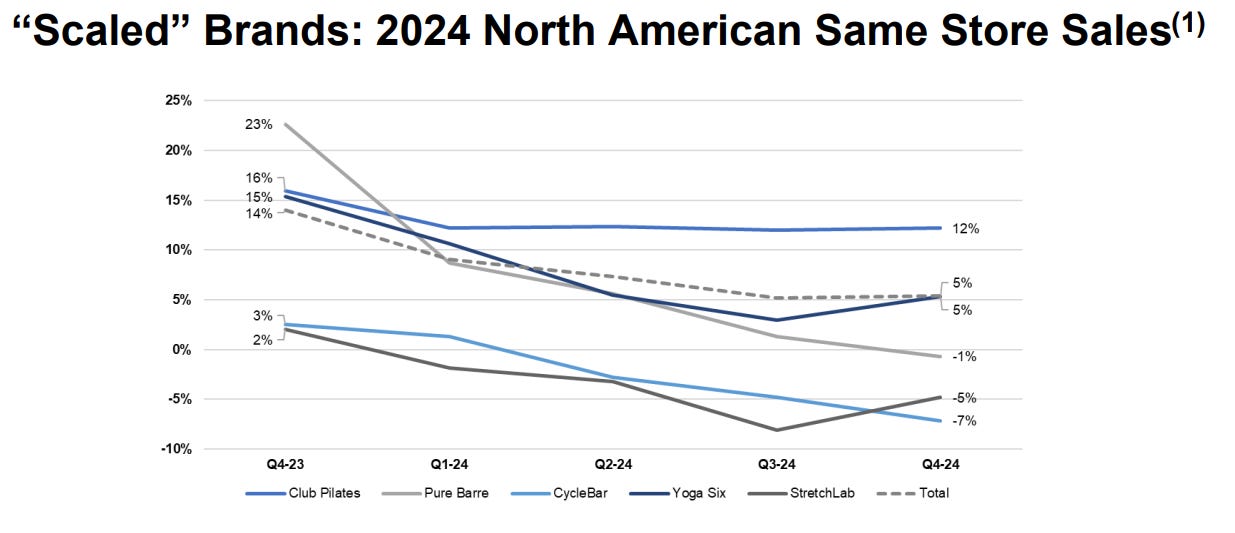

Same-store sales for their most scaled brand, Club Pilates, continue to remain very strong. However, despite signs of stabilization, many other brands have weakened:

I can’t deny that this could be an interesting opportunity moving forward. Club Pilates’ valuation is probably still around the same ($17 per share). Once the underperforming franchisees are cut out, the overall brand portfolio should be in a better place. International opportunities are starting to grow, and free cash flow will be much higher if franchise closures stabilize. However, there’s definitely heavy lifting ahead: Management needs to get same-store sales for Pure Barre and StretchLab back on track, as they still account for 28% of total system-wide sales. The CEO has mentioned the possibility of selling off some smaller brands, but it’s unclear how that will impact EBITDA (likely positively). Here’s an updated model that shows how my target price has changed after the ‘kitchen sink.’

Beyond the numbers, the real issue is convincing the market that XPOF isn’t just a mix of brands that might end up being fads; Fitness stocks often end up falling into that bucket. XPOF’s portfolio approach was a solid pushback against that negative perception, but now that’s starting to be questioned. Especially if they begin selling off several brands. Who's to say Club Pilates won’t end up like StretchLab? We need to see some solid improvements in other brands quickly. Otherwise, it’s tough to justify a valuation of 15x FCF. The CEO could be right when he says the company expanded too fast and just needs to get its processes in order. However, until churn drops to 3% and the other brands show better health, this stock is likely to trend sideways.

If there's one thing I've learned from this, it's that timing turnarounds can be tricky. Waiting for that classic ‘kitchen sink’ approach often seems like a smarter play when a new management team takes over. I haven’t sold my position yet, but I’m also not buying more. I hope to get clearer insights at their upcoming investor day in May.

Bragg Gaming (BRAG) Update

Bragg reported Q4 2024 results on March 20th.

Bragg remains a top conviction idea for me as revenue visibility is quite high, and the business is insulated from all the macro-noise.

The Q4 results were pre-announced in late January, so there's nothing new there. However, the company exceeded its pre-announced EBITDA by 2.6%, laying the groundwork for a more achievable 2025 guidance.

Here are a few interesting tidbits from the filings:

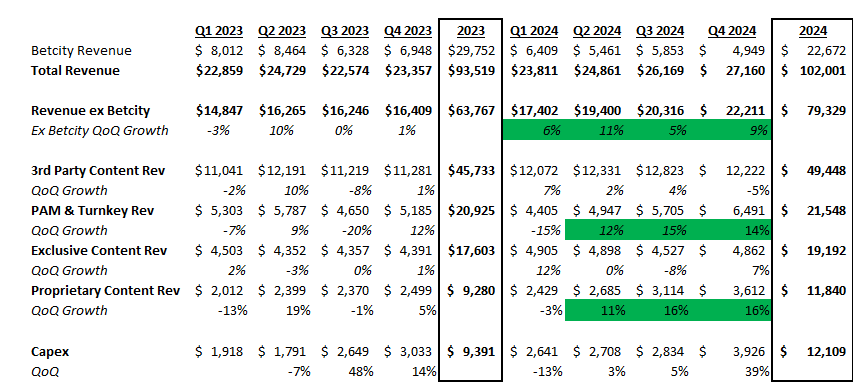

Betcity, Bragg’s biggest customer, declined from 22% of total revenue in Q3 to 18% in Q4. This is a great development, as reduced reliance on Betcity should lead to a higher multiple. Despite Betcity’s revenue declining 15% QoQ, and 29% YoY, Netherlands revenue grew 33% QoQ and 97% YoY!

Growth ex-Betcity was 9% QoQ and 35% YoY

PAM & Exclusive content continues to grow at an explosive pace, at 14% and 16% QoQ. PAM increased despite a 15% QoQ decline in revenue from Betcity, which is impressive:

Pipeline momentum seems to have continued into Q1, with the launch of their newest game far exceeding expectations and multiple PAM opportunities in Europe and the Americas. The guidance also contemplates no additional deals, but multiple Caesars-like deals are in the works.

The sole negative of this earnings report is the 39% QoQ rise in capex. As previously mentioned by the company, they are accelerating their game release schedule from around 50 to nearly 100 in North America. This uptick in game investments typically leads to several one-time certification expenses. Additionally, the certification and licensing fees associated with entering new regions (e.g., Brazil, Delaware, New Virginia) and launching with different operators further drove capex up. Management stated that capex should remain consistent as revenue scales in 2025, setting the stage for accelerated FCF generation.

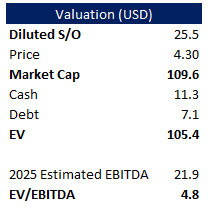

My updated valuation is as follows:

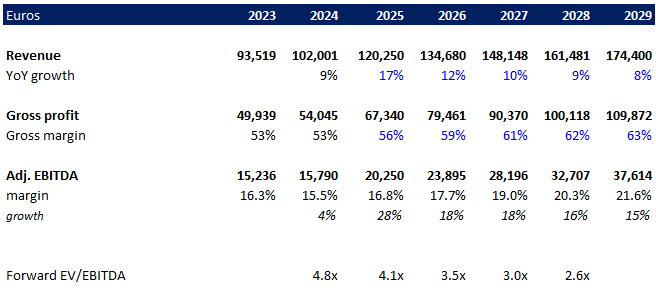

Based on my forecast, BRAG now trades at 4.9x 2025’s, 4.1x 2026’s and 3.5x 2027’s EBITDA for a double-digit, secularly growing business:

Since my mid-February update, a couple of industry tailwinds have popped up: Arkansas just rolled out an iGaming bill a few days ago. Plus, Finland has launched its gambling reform bill, which is gearing up the market to open in January 2027. I wouldn’t be shocked if Bragg lands PAM clients in Finland.

Keep an eye out for the upcoming refinancing of their debt and the renegotiation of their Betcity contract at the end of the year.

East Side Games (TSX:EAGR)

East Side Games reported Q4 2024 results on March 24th. Here is the link to my initial pitch for those who haven't read it.

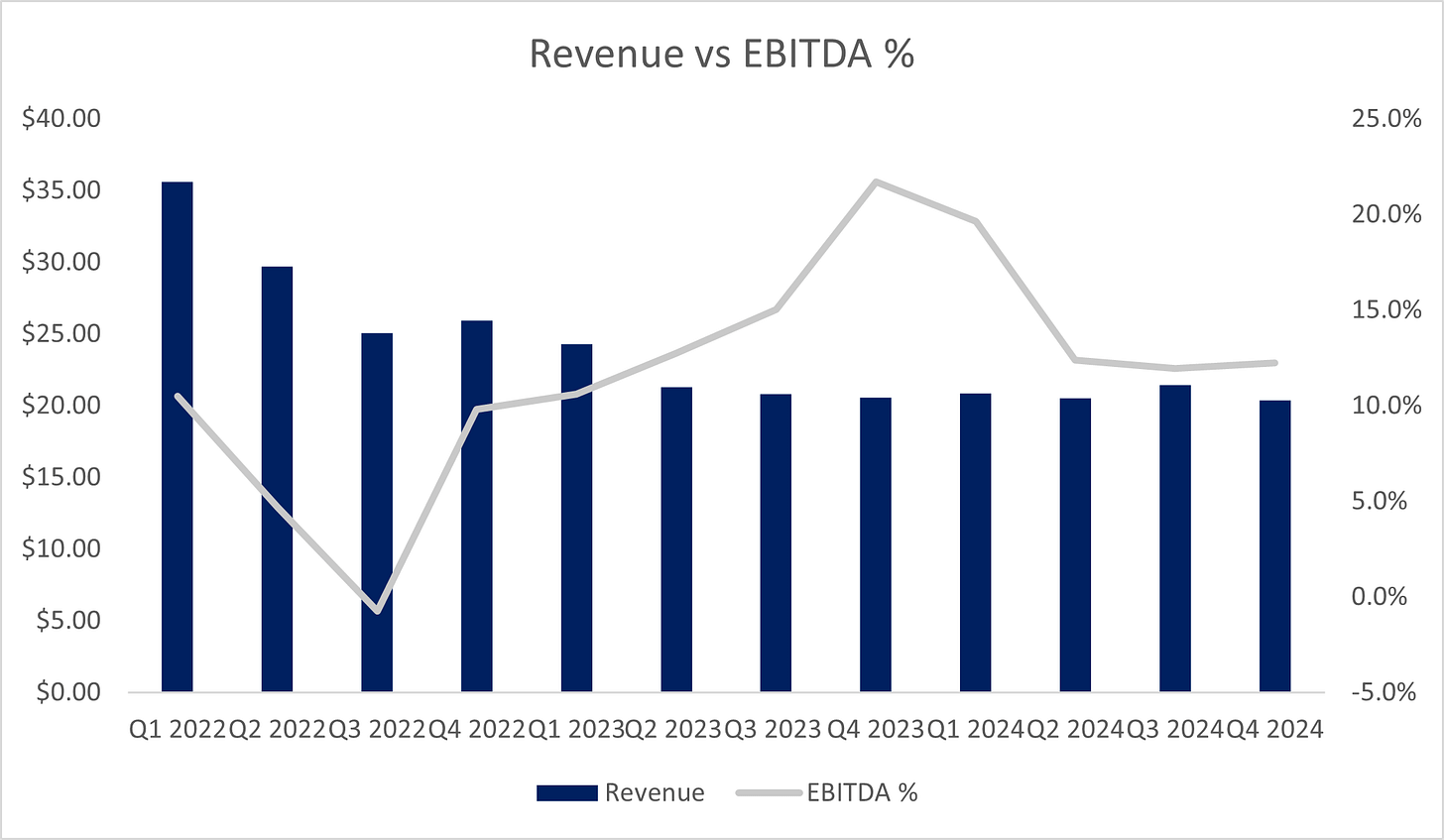

EAGR’s Q4 results were tepid. Revenue was down 5% QoQ and 1% YoY, and EBITDA was 3% QoQ and 45% YoY. KPIs deteriorated, with DAUs down 10.6% YoY and MAUs down 6% YoY.

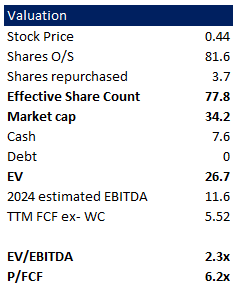

Given the excessively cheap valuation on EBITDA & FCF and two potential blockbuster games coming out, I continue to hold the position. The company is aggressively buying back as much stock as it is allowed and is finding creative ways to bypass the TSX’s daily volume rules by actively sourcing blocks to retire shares.

Excluding one-time costs of $1.2m in Q4, FCF ex-working capital swings would have been $6.7m, and the stock would be trading at 5.1x normalized FCF

Management announced two new games in its Match-3 category: RuPaul’s Match Queen and Squishmallows Match. The company believes both of these games have blockbuster potential. Note that the existing RuPaul game is currently the company’s biggest game. With the launch of these two games, the company should return to growth. They’ve also rolled out their long-standing Trailer Park game on the Epic Games Store, and about 21% of their recent downloads are coming from there. Store fees are 12% of revenue, which is significantly better than the 30% charged by Google and Apple. This could be a good way to boost their margins without added costs.

Conclusion

After a stellar 2024, 2025 is starting out rocky for a few names in my portfolio. I feel less excited about some names, some have reached my target price, and some have simply not been executing. Given the recent drawdown in the stock market, various new opportunities are popping up. I expect to cull a few ideas in 2025 (some that I haven’t pitched here, but you can track on my X account) to make space for higher-conviction stocks.

Disclaimer: I am long NYSE:XPOF, NASDAQ:BRAG, and TSX:EAGR. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

Thanks! Bragg looks really interesting. Seems like the market is overlooking what kind of company it is...might take a while to playout as they eventually scale and then hopefully just buyback stock

XPOF - should have just ripped the bandaid off when new management came in. Just abandon all guidance / future growth targets. Turning a significant growth runway into a 'rebuilding year' is quite something. And calling out that they are basically going to stop giving away franchise licenses to unqualified people means closures should remain elevated for the next 12-24 months.