Earning season is slowly coming to an end - with the recent market volatility, I thought it would be appropriate to provide an update on my recent pitches

Jakks Pacific (JAKK) Update

Jakks reported Q4 2024 Results. For those who haven’t read my initial pitch, here is the link to it.

Results came in below my estimates: EPS came at $3.79 vs my $4.03 estimate but higher than street estimates. Part of the miss was due to direct selling expenses, up 25% and significantly higher than I expected. Adjusting for it, EPS would have been $4.08. I obviously got a little too excited for the fourth quarter. However, this quarter has changed very little in the long-term story. I was quite happy to hear management discuss the next 24-36 months and the potential to bring the company to new heights.

Importantly, management announced a $1 annual dividend, payable quarterly. This is in line with my expectations and a major step forward for the business as they start returning capital to shareholders. The stock now yields a 3.7% dividend. This represents less than a 30% payout and I expect it to grow as they build momentum in their evergreen business. Five years ago, Jakks was on the brink of bankruptcy; In 2021 the company fully-paid its death spiral convertible debt, cleared its debt in 2023, and its preferred shares in 2024. The turnaround has been impressive.

There continues to be noise around tariffs and that might continue to contribute to the stock’s near-term volatility. Trump has announced an additional 10% tariff on all Chinese goods which is set to come in effect March 4th. The lack of manufacturing capability domestically for the industry, and the fact that the majority of action figures & dolls are manufactured in China, means that tariffs will ultimately be passed on to the consumer. Jakks’ relative low price point could ultimately benefit from the environment.

I expect the first half of 2025 to be strong; last year the business was facing a weak movie slate, and write-down of inventories due to Wish’s box office bomb. This year, the company will be shipping ABG products, Simpsons & Dog Man toys and likely will benefit from the carryover of Moana and Sonic from the streaming releases. International momentum also seems to be picking up. Despite the difficult comparison in the back-half of the year, management expects to grow both revenue and earnings this year - this means that Jakks is set for 3 years of very strong earnings growth. My ultimate earnings power for the business remains unchanged at $7 which I believe they could achieve in 2027. This would be driven by international expansion, ABG rollout and Simpsons, and the 2027 movie slate of Frozen & Sonic. At the current stock price, you are paying <7x LTM EPS for a business set to grow CAGR double-digit for the next three years (building into 2027), and actively reducing its box office dependency. I also expect $30m of FCF at a minimum every year (barring any major working capital swing), or a mid-teens FCF yield to the EV, with upside to $40-50m FCF in 2026, 2027 and beyond.

Along with the earnings result, management also put out an 8-K with the company’s yearly bonus structure. Interestingly, this year, both CEO and CFO were awarded RSUs that vest if the stock price reaches $45, $52.50, and $60. I believe this is the first time the company has awarded its executive RSUs that are directly tied to stock price performance. This also comes at the same time as the company amends its change of control provisions for its executives. Maybe it’s nothing, maybe it’s something. But at a minimum, management is well incentivized to get the stock working.

Bragg Gaming (BRAG) update:

For those who haven’t read my initial pitch, here is the link to it.

There have been a number of positive announcements since the management pre-released in-line Q4 results and guided to a blowout 2025, which I discuss in this link:

Four new customers were announced:

Svenska Spel in Sweden, Estoril Sol Digital in Portugal, Loto-Quebec in Canada and TeamMexico in Mexico. Both Svenska and Loto-Quebec are the largest player in their respective jurisdiction and are state-owned entities.

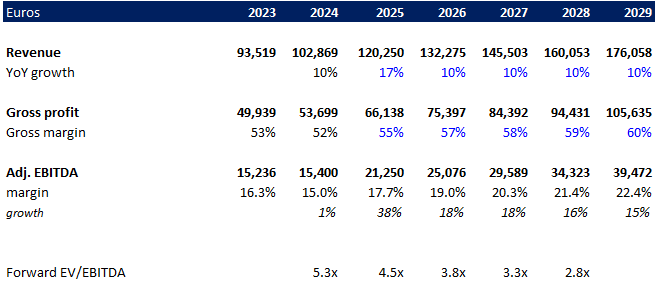

Despite the 27% move in the stock since my pitch (from $5.43 CAD to $6.90), the valuation barely changed; the stock was 4.7x my 2025 EBITDA estimates, and now it is 5.3x the updated guidance. Here is a quick updated model following their 2025 Guidance:

Outside of their guidance update, one of the most interesting developments was an interview done by Bragg’s LATAM director. In the interview, she outlines that the company expects to add more Portuguese partners in the future. But the most important comment was regarding the recently announced Caesars deal:

In addition to our focus on LatAm, we’re also focused on the North American market, where we are working to fold in our technology solutions to our great existing content footprint. You can see evidence of this in our recent partnership with Caesars, and there will be more announcements of this sort in the coming months. Independent of those two markets, we’re always looking for new operator partners and to grow our business globally and you can expect more action in this arena over the next 12 months.

The Caesars partnership has higher margins than the corporate average, and another similar deal could materially accelerate margin expansion.

Another major development was the recent renewal of Kambi’s contract with Betcity. Why is this relevant? Well, Betcity is Bragg’s largest customer at 22% of revenue as of Q3 2024 but likely lower as of Q4. There has been a lot of worry surrounding Betcity’s plans to internalize its sportbook and player account management (PAM) functions, effectively cutting out Bragg and Kambi. This seems unlikely now, especially since Bragg’s PAM is directly integrated with Kambi’s sportsbook and Betcity’s mobile app. Bragg’s contract with Betcity ends Late 2025, thus, I expect management to announce the renewal of Betcity as a customer in the coming months.

In addition to company specific catalysts, the United States has seen a wave of iGaming bills introduced in recent months: Maryland, Virginia, New York, Indiana, Wyoming, Massachusetts, New Hampshire, Illinois and Hawaii. While I expect most to fail this year (Some like Indiana and Virginia have already failed), any new state would be a material positive for the business.

Bragg is my highest conviction idea and is my biggest position today. It is hard for me to find a better idea given the business momentum, partnership visibility, robust balance sheet, undemanding valuation, a macro-insulated story, and a very motivated management team that is looking to monetize. (I do have a bias for gambling stocks, though!)

Thryv Holding (THRY) Update

Thryv reported Q4 2024 Results on February 27th. For those who haven’t read my initial pitch, here is the link to it.

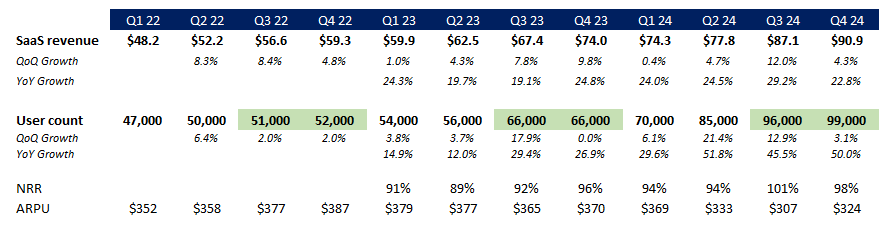

The overall quarter was solid. The company beat Q4 results estimates for revenue and EBITDA. SaaS' organic growth stood at 23%, which is in line with guidance, and management saw some upside from Keap. SaaS EBITDA reached a new high of 16.6%! 2025 guidance was a non-event, as they guided it during the investor day. Thryv’s SaaS achieved the rule of 40 for the second quarter in a row.

I’ve had a few questions regarding the sequential organic SaaS client growth, which was lower than in the past two quarters, and Q1 guidance. Both issues are simply due to seasonality, and this pattern is easily seen in past years:

Net adds in Q4 2022 were only 1,000, in Q4 2023, zero, and finally, in Q4 2024, 3,000. This is also what caused the perceived Q1 2025 SaaS revenue ‘weakness’ relative to consensus: the street was modeling fairly linear net adds through 2025.

Overall, my model, assumptions, and upside are unchanged. As I said in my write-up, this is a pitch for those who are happy to ride out potentially bumpy quarters but are okay with holding the stock today, given the substantial 3-5-year upside. This quarter changed nothing about that thesis; the story keeps chugging along.

Conclusion

Many over the last few days and weeks have asked me if anything has changed with these stocks, given the weakness in their share prices. This February/earning season has been particularly volatile, and many stocks outlined above have participated in that volatility. My conviction on these names is based on their respective fundamental developments, and I try to tune out the near-term noise (unless it directly impacts my thesis). I feel quite comfortable holding all my names listed above through a potentially challenging macro-environment, given their robust balance sheet and idiosyncratic fundamental stories. In the case of BRAG & JAKK, the gambling & toy industries have historically been resilient during recessionary periods, further bolstering my conviction in them.

Disclaimer: I am long NASDAQ:JAKK, TSX:BRAG, NASDAQ:THRY, and NYSE:DAC. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

Excellent coverage!

Thanks for the review. I’m a holder of THRY and agree with your sentiment - no change to the long-term story