Special Situation: Quipt Home Medical Corp. (NASDAQ:QIPT)

An inflecting fundamental story with a pinch of Activism

Summary

Home Medical Equipment provider trading at a depressed 3.2x EBITDA valuation on the cusp of fundamental inflection

Recent activism has received minimal coverage from industry analysts but is expected to lead to the announcement of a strategic review

A 78% recurring revenue business highly insulated from a potential recession, with KPIs making a new high last quarter

Several headwinds impacting fundamentals last year are now in the rearview, supporting an improved organic growth outlook

Company Overview

Quipt Home Medical provides home healthcare equipment (HME) and respiratory therapy services for patients with chronic conditions like sleep apnea. They source and supply essential medical devices, including oxygen concentrators, CPAP/BiPAP machines, and ventilators. The company works closely with doctors and insurance providers to ensure patients receive the right equipment, offering in-home setup, training, and 24/7 support.

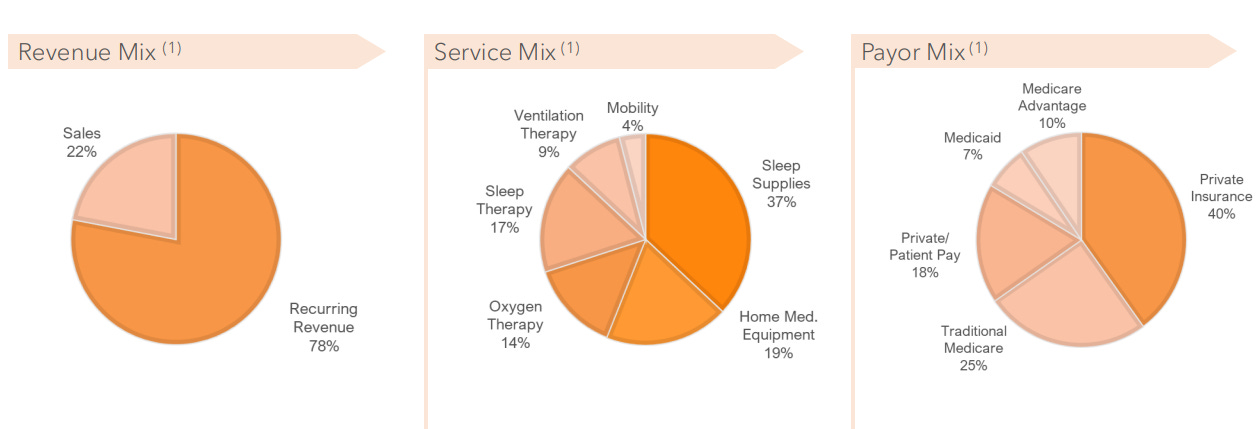

The company generates revenue primarily through selling and renting home respiratory equipment and providing ongoing service and support to patients in the United States. Close to 80% of revenue is generated through recurring revenue streams (respiratory resupply, oxygen therapy, etc). Here’s a breakdown of their main revenue streams and associated payor mix:

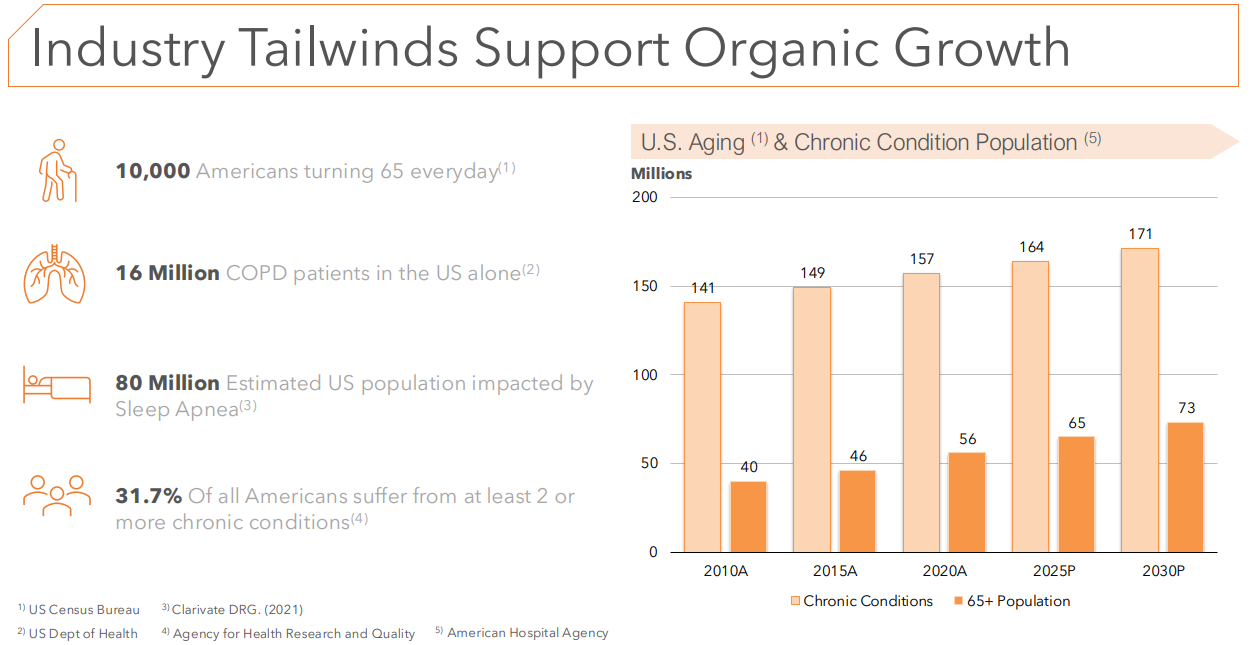

The industry is benefitting from secular tailwinds driven by an aging population and the rising prevalence of chronic diseases. The shift toward value-based care and patient preference for in-home treatment has also been a tailwind. Both factors have helped and will continue to help the industry sustain a mid-single-digit revenue growth rate.

Context on Recent Weakness

Following a period of strong performance from 2017 to 2022, Quipt was hit by multiple company and industry-specific headwinds.

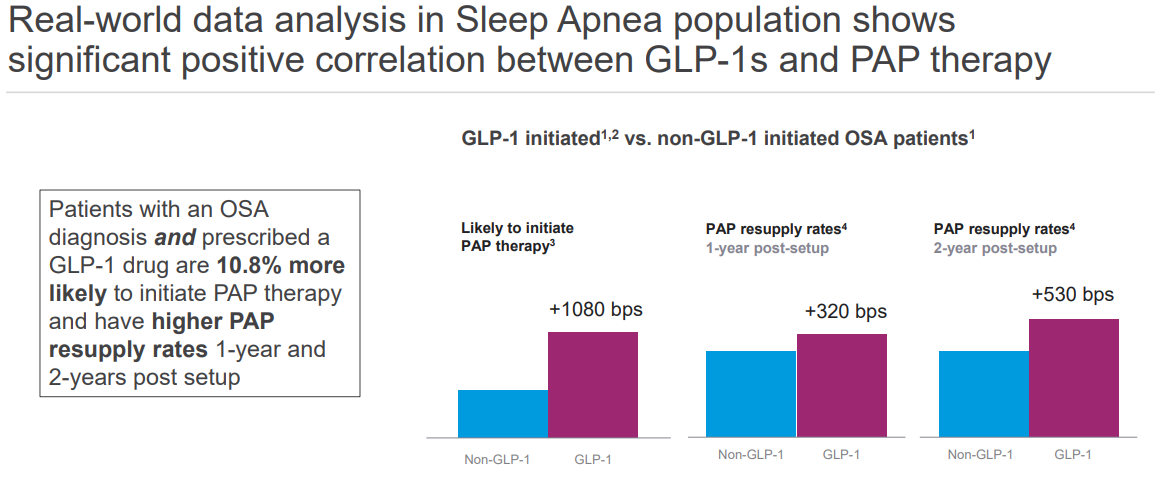

The widespread adoption of GLP-1 for weight loss sparked concerns within the industry about its potential to decrease the need for CPAP machines used to treat sleep apnea, which is closely linked to obesity. This apprehension notably compressed market multiples for DME companies. More on this below.

In February 2024, alongside the Q1 2024 earnings results, management revealed that the company had received a civil investigative demand from the U.S. Attorney’s Office for the Northern District of Georgia under the False Claims Act. The stock dropped for several weeks following that announcement.

Quipt was also hit by multiple external headwinds throughout the calendar year 2024:

During the global pandemic, regulators raised Medicare reimbursement rates—referred to as the 75/25 blended rate—to assist the durable medical equipment sector. This increase was eliminated on January 1, 2024, impacting organic growth by 2%

The Change Healthcare (Owned by UnitedHealth) cyber-attack impacted the business materially in 2024. The attack hurt QIPT’s ability to determine patient eligibility and materially impacted their receivables collection process

The company experienced the withdrawal of Medicare Advantage members due to a shift in strategy with one managed care provider

The fast rise in interest rates brought their M&A playbook to a screeching halt, despite their robust balance sheet (1.5x levered)

All of the issues listed above led management to miss their targeted 8-10% organic growth rate and contributed to the modest decline in revenue and EBITDA in recent quarters.

Trends Are Improving in Real Time

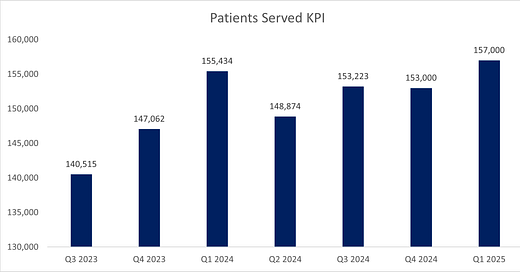

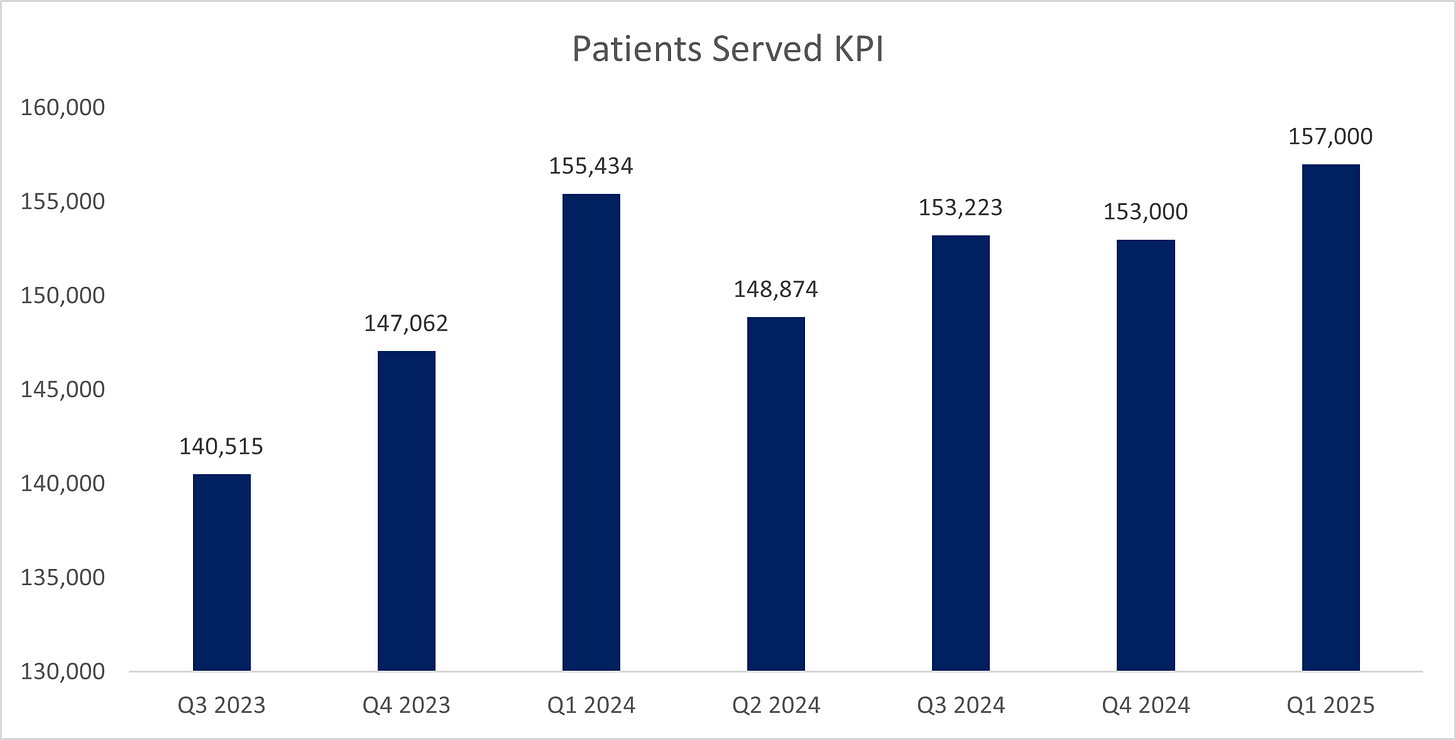

While the stock languishes at lows, trends have been improving in real time. Patients served, a key KPI for the company, bottomed in fiscal Q2 2024 and reached a new high last quarter:

This is also true for other KPIs, such as a number of set-ups and resupply.

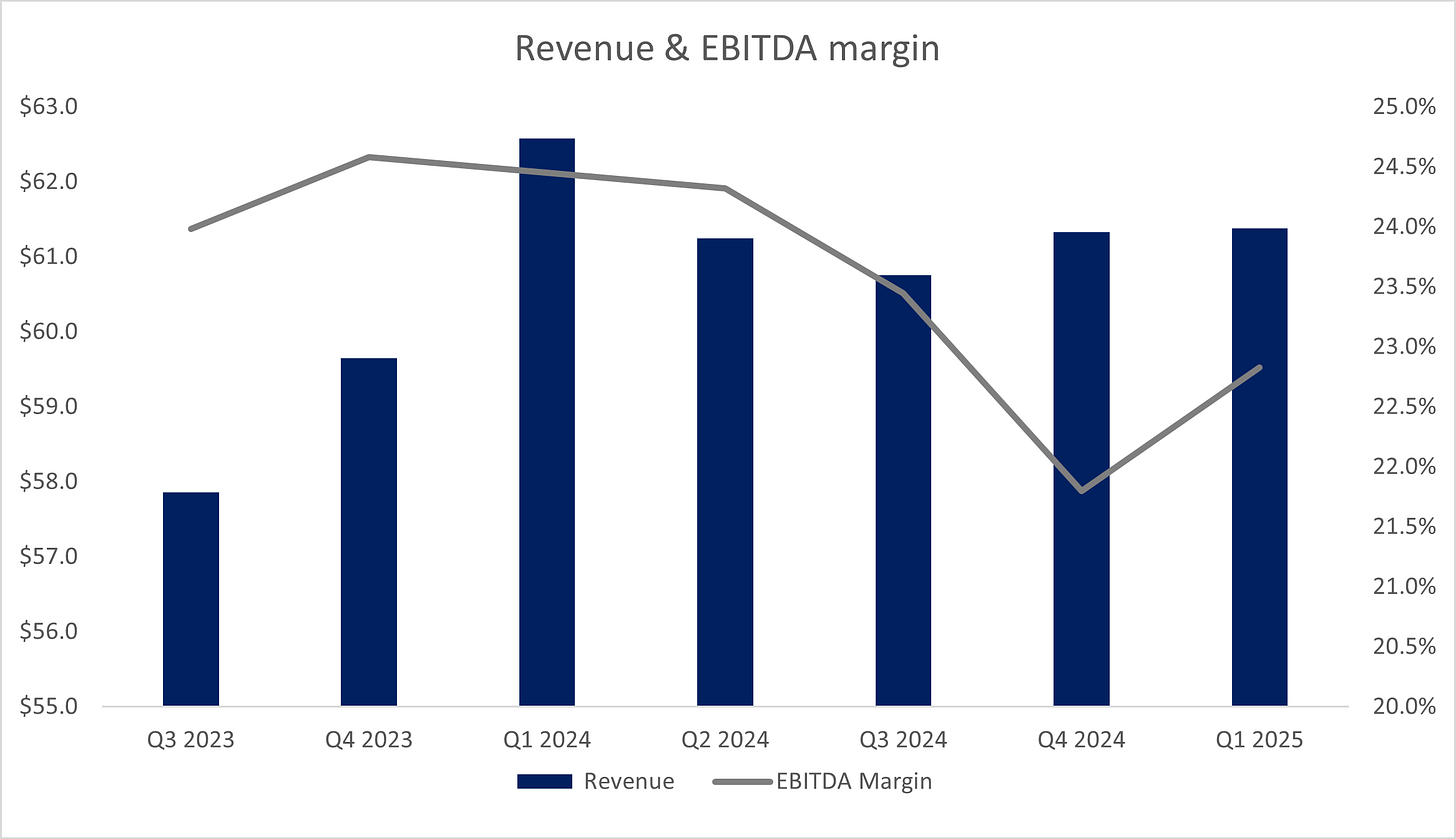

While taking longer to show, both Revenue and EBITDA margin have stabilized and started improving sequentially:

In their latest earnings call, management stated that demand remains consistent, and the team is confident in returning to their sequential 2% organic growth target. This statement is supported by open market purchases by the CEO and a board member, amounting to 144,000 shares.

People's concerns about GLP-1 adoption and its effects on sleep apnea are also slowly fading away. Resmed, the biggest maker of CPAP machines, did a study with nearly 1 million patients and found that those prescribed GLP-1 drugs are more likely to start CPAP therapy and resupply at higher rates:

One potential additional near-term tailwind is the House of Representatives recently introducing a bill to re-implement the 75/25 blended rate. The bill seems to have bipartisan support and could be a pricing tailwind.

Lastly, the False Claims Act investigation I mentioned earlier has been a significant concern for the stock and has played a big role in its price drop. But these kinds of investigations are pretty common in the industry. Every HME company has faced scrutiny in the past, including all the publicly traded competitors. Historically, the fines have been on the smaller side. Take Lincare (Linde), for instance; they serve about 2 million patients and pull in over $2 billion in revenue, yet they settled with regulators for just $25.5 million over fraudulent billing practices in early 2024. False Claims Act Settlements for 2024 averaged $5.2m and are substantially lower if one removes the outsized settlements from larger companies.

Given that QIPT decreased by 30% after the investigation, a scenario where the settlement is double the average would probably serve as a significant catalyst for the stock!

Activism

On December 12th, 2024, Forager Capital Management, which has been a shareholder of QIPT for some time and had consistently filed 13-Gs, filed a new 13-D. The fund outlined that it may take action regarding its investment in the company. A few weeks later, another firm, Kanen Wealth Management, started aggressively buying shares and also filed a 13-D. On January 25th, 2025, Kanen went activist, outlining its intent to solicit proxies for the election of its own nominees to the board of directors.

On February 1st, management quickly entered into a standstill agreement with Forager Capital. Why would Forager enter a standstill agreement so quickly after filing a 13-D? My rationale is simple: Forager entered into an agreement because management promised them something. I believe that ‘something’ was hinted at in their latest earnings press release, dated February 10. Below is their Q4 2024 commentary:

‘‘We are well-equipped to allocate capital toward strategic opportunities, while also investing in organic growth to build long-term shareholder value.”

Compare it to the commentary from Q1 2025, which saw a notable change in the language used regarding management’s strategic initiatives:

“Furthermore, we remain committed to exploring and pursing all avenues to drive shareholder value.”

Fast-forward to March 4th, 2025, Kanen enters a standstill agreement. Pursuant to the agreement, Kanen has withdrawn its proxy solicitation in exchange for the establishment of a new board committee to ‘‘review and provide analysis and non-binding recommendations to the Board pertaining to Kanen’s previously communicated recommendations related to corporate governance and other areas related to the Company’s operations.’’

It’s almost too obvious that the company is to announce a strategic review and put the business up for sale. But the market doesn’t seem to care. Only one sell-side analyst discussed the activism, and none have done any work on the potential outcome of a potential strategic review; I believe Quipt is the perfect acquisition target for building a platform, especially given recent private equity interest in the industry.

A Clear Acquisition Target

Following Owens & Minor's consolidation of Apria in 2022 and Rotech in 2024, Quipt became the fourth largest player in the HME sector.

Adapthealth, Lincare, and Owens & Minor dominate the market, accounting for around 50%. Beneath them, the market remains fragmented, consisting of over 6,000 small regional and local service providers.

Since the mid-2010s, private equity interest in the space has significantly increased. A 2023 report by PESP identifies 51 known private equity firms with direct interest in DME companies. Many of these firms are considerably smaller than QIPT. If a major private equity firm were looking to scale quickly, who would be a better acquisition than QIPT, especially given its favorable valuation?

It’s also worth noting that a similar-sized operator, Performance Home Medical, was acquired by PE Grant Avenue Capital in 2024. The advisory firm that led the process outlined on its website that Grant Avenue was actively looking for an acquisition to establish a DME platform.

Interestingly, Forager Capital Management is a shareholder of both QIPT and sister-company Viemed (VMD). Quipt had spun-off VMD in 2017. Could Forager push the two entities to re-merge, creating a much bigger, scaled player?

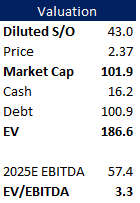

Valuation: Both a problem and a Catalyst

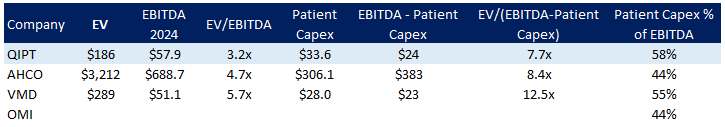

There is one small problem with Quipt: Yes, it’s cheap… but the whole industry is cheap:

On EBITDA, QIPT is much cheaper than its comps. However, the gap quickly recedes when factoring in patient capex, which is the capital expenditure required to service its existing patient base, is relatively high. This further reinforces the point that Quipt would be better out of public markets and as part of a private equity platform.

The most recent precedent transaction took place in July 2024, when Owens & Minor acquired Rotech for 6.3x LTM EBITDA. If a similar multiple is applied to QIPT, it would suggest a target price of $6.58, or 177% upside. If no transaction occurs and organic growth resumes at its 2% QoQ rate, QIPT could align with peers at 5x, which would give us a target price of $4.70, representing 98% upside.

Risks

The False Claims Act investigation ends up being significantly more material than anticipated, leading to a decline

Trump’s administration could impact the industry through Medicare changes. However, the DME industry seems to have bipartisan support on many issues… so far

GLP-1 ends up being a real secular headwind, but that seems unlikely given market participants ascribe a rich valuation to CPAP manufacturer Resmed

Conclusion

QIPT bets on a fundamental inflection amidst a potential strategic review announcement. I want to be candid that investing in QIPT’s competitors (AHCO, OMI, or VMD) could also make sense. However, the combination of extremely depressed valuation, a relatively good balance sheet, inflecting fundamentals, and activism makes this one a little more interesting to me.

Disclaimer: I am long NASDAQ:QIPT. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

interesting idea....think one risk not mentioned is implants like Inspire. Sleep Apnea suffers all hate using CPAP (its uncomfortable + unsightly) - if an affordable / insuranced covered surgical implants can permanently fix the issue they will opt for it...granted this is relevant for the entire industry (a bit like GLP1).