Snipp Interactive Inc. (TSX-V:SPN)

Net cash technology company with 60%+ gross margin trading at 0.4x revenue, 5x EBITDA, growing double-digit, benefitting from the current macro-environment

Summary

Net cash technology company with 60%+ gross margin trading at 0.5x revenue, 5x EBITDA, growing double-digit with some of the highest profile customers you can think of

A clear beneficiary of a challenged consumer environment and potential inflationary pressure from tariffs

A recent contract exit is masking a company growing at 21% with an expanding margin profile

Recently launched a product with Bank of America and PNC that I believe could more than triple its revenue base

Highly incentivized board with 35% ownership and significant capital markets expertise

Business Overview

Snipp Interactive is a Platform-as-a-Service (PaaS) company specializing in customer acquisition, retention, and engagement. Its modular Snipp platform offers various tools to help brands design and manage promotions, loyalty programs, rebates, and more, all of which aim to drive brand sales.

Bear with me; I know it all sounds like tech-gibberish, but it’ll make a lot of sense soon. Here is a summary of Snipp's key product offerings with direct links to their use case to better understand the products:

SnippCheck: A mobile receipt processing solution that enables brands to execute purchase-based promotions and loyalty programs by validating consumer purchases through receipt images. Here is a link to a promotional campaign Snipp activated with Starbucks

SnippWin & SnippRewards: A promotions, rewards, and sweepstakes platform that facilitates various promotional activities, including contests, instant win programs, and gamification, to engage consumers and enhance brand visibility. Here is a link to a contest program in partnership with Conagra

SnippLoyalty: A modular customer loyalty platform offering flexible earn-and-burn mechanisms, deep personalization, and segmentation to drive customer engagement and retention. Here is a link to a case study where they built Bally’s loyalty app

SnippRebates: A SaaS platform that allows brands to set up and manage rebate programs, offering streamlined digital rebate processing that is flexible, efficient, scalable, and secure.

SnippInsights: A platform that provides advanced basket analysis, dynamic reports, and actionable insights for analyzing consumer behavior and purchase patterns.

The company handles all the back-end and front-end infrastructure needed to run the programs, including program design and fraud detection & prevention. Historically, the business operated through short-term high-margin contracts, whereby its technology and services were licensed to customers for a specific promotional program, and short-term low-margin revenue, where revenue was based on a pre-determined redemption percentage of the program. Management has recently focused on long-term recurring revenue streams by licensing its data solutions, APIs, and enterprise products.

Despite being a $20m market cap stock, Snipp boasts some of the most impressive blue-chip customers you will find in a micro-cap business:

Snipp operates within a rapidly growing industry. The company reports a 35% rise in digital coupons available over the past five years. The market is expected to expand at a double-digit growth rate, propelled by increased smartphone penetration, inflationary pressure & economic challenges, and new collaborations between brands, financial institutions, and retailers.

In early 2024, management launched its new Snipp Financial Media Network product with Bank of America and Triple, a PNC Financial subsidiary. I believe this product will be a game-changer and could completely transform the business.

Snipp Financial Media Network: A Game Changer

SPN first introduced its SnippMEDIA division on June 13, 2022, when Tom Burgess was appointed President. Management has been discussing the Snipp Financial Media Network (FMN) ever since but had very little revenue or profit to show for it until recently. In 2024, FMN launched with two of the biggest American banks, Bank of America and PNC Financials (through Triple), allowing it to reach and gather data on over 30m+ individuals.

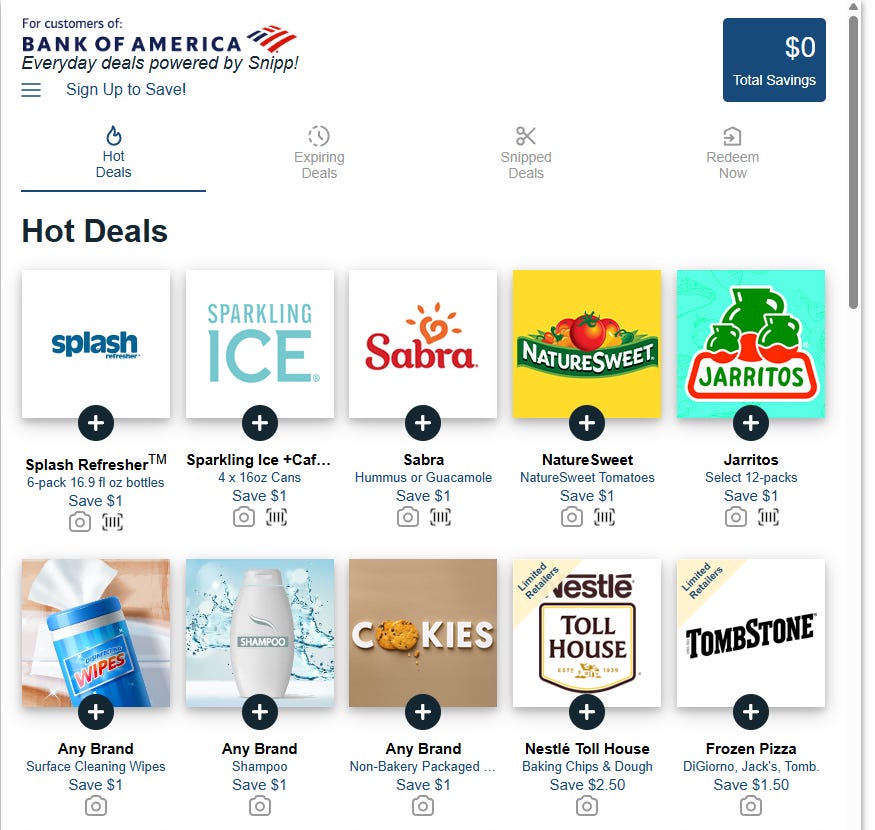

So what exactly is the product? Through the banks’ websites and apps, Snipp offers a platform that allows customers to redeem specific deals and promotions and earn cash-back offers from consumer brands. For example, customers can log into their bank app and receive SKU-level offers, such as a $35 coupon for Carnival Cruises. Here is a view of BoFA’s app, created by Snipp:

Snipp effectively serves as an intermediary between banks and consumer brands. The platform enables them to capture customer data, which can then be monetized. This platform lets brands get first-party and SKU-level data that would otherwise be inaccessible. For banks, this product enhances engagement and introduces a novel approach to client retention.

Snipp is set to monetize this product in two ways:

Generate a percentage of the promotion’s redemption value within the banking app. This is a high margin ‘recurring’ type revenue and has yet to be monetized

Contract consumer brands for large-scale targeted promotions using newly acquired first-party data. This will be executed both within the app and through emails, alerts, and other means sourced from the bank and Snipp’s databank.

In January 2025, the company announced its first FMN contract with a top food and beverage company. Through this program, the brand will offer ‘Buy X Get Y’ promotions to targeted customers.

Management already has multiple additional large-sized banks and credit unions in the pipeline. FMN could transform Snipp from a micro-cap unknown Canadian-listed microcap business into a digital marketing powerhouse. While I believe management can grow double-digit core revenue for the foreseeable future, FNM could generate $100m+ in revenue alone, with significant EBITDA margin expansion as the product scales.

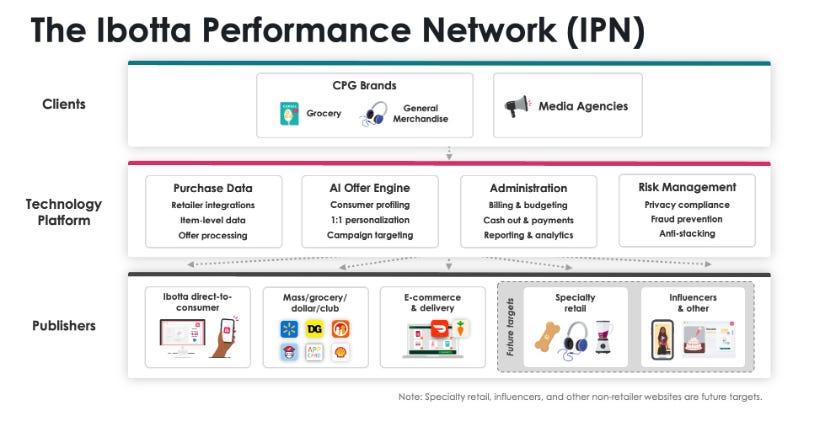

For context, publicly-traded peer Ibotta operates a product called the Ibotta Performance Network (IPN). In 2024, Ibotta generated $180m from the product. Here is a picture of its offering:

It’s effectively the same offering but for different verticals. I wouldn’t be surprised if Ibotta looks to acquire Snipp to expand its offering to banking partners.

A Consumer Backdrop Characterized by Inflation: The Perfect Environment For Its Business?

Grocery prices have increased significantly in recent years. Coupled with financially strained consumers, Snipp’s core products are key in helping brands incentivize purchases, grow loyalty, and access SKU-level consumer data without relying on retailers.

With Trump’s latest tariff policy, North America's chances of a recession are rising rapidly. I believe the company is well-positioned to capitalize on this scenario. Historical data from the Great Financial Crisis indicates a more than 29% surge in coupon demand in 2009. Consumer goods businesses were there to meet the demand: Coupon supply increased 11%, and average coupon value was up 9%. Remember that Snipp relies both on long-term recurring revenue contracts and short-term redemption-tied contracts.

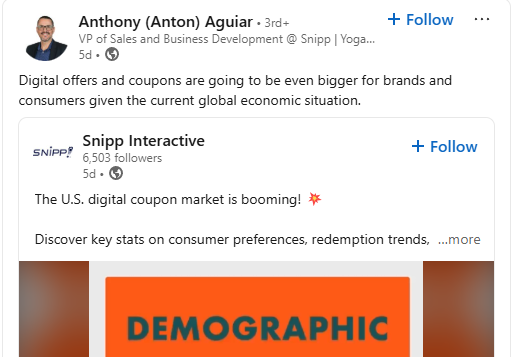

It seems like some of the employees agree. Here is a quote from the VP of Sales at Snipp on LinkedIn:

Additionally, consumer brands increasingly view retailers as competitors due to the growing sophistication of private label brands. Consumers are increasingly seeking value and actively trading down to private labels. Often, consumers cannot tell that the products they buy are private labels. Brands are looking for ways to promote their brand outside of the retail network, and SnippMedia fits that need perfectly.

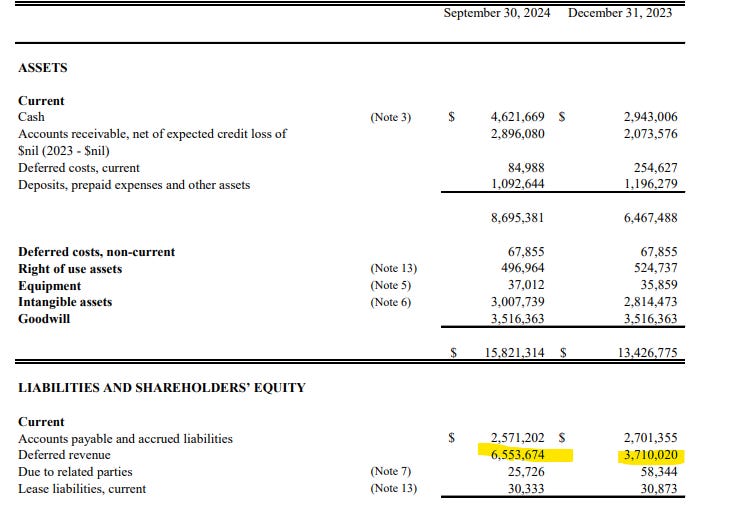

I believe this, coupled with their focus on long-term recurring revenue, is part of the reason we are seeing significant growth in their core business. Bookings backlog reached a high in 2024, and deferred revenue, an indicator of future revenue recognition, was up 27% YoY and 77% over Q4 2023.

A Highly Institutional & Aligned Board of Directors

In contrast to typical micro-cap firms, SPN’s board includes members with extensive experience in capital markets and shareholders who are well aligned:

Atul Sabharwal: Chief Executive Officer & Director and owns 16.4m shares (5.7% of the shares O/S)

Sarfaraz Haji: Chairman of the board and CEO of Lark Investments, a family office. He personally owns 1.4m shares. Lark Investments itself owns 53m shares (19% of the shares O/S)

Brian Tunick: Director and prior Senior Manager at RBC and JP Morgan, specializing in retail. Following his retirement from the industry, he accumulated 9.5m shares personally (3.3% of the shares O/S) and was eventually instituted on the board following multiple conversations with the CEO

Sina Miri: Independent Director and current Chief Technology Officer at Bally’s. Bally’s took a stake in SPN in 2022. They paid $0.25/share, or a 56% premium versus the prior day’s closing price, for 25m shares (9% of the shares O/S)

Each board member holds a significant stake in the stock and does not receive any compensation for their board responsibilities.

Why This Opportunity Exists

Snipp acquired a business called Gambit in 2022. Gambit Rewards is a platform that integrates loyalty programs with online gaming and sports betting. It enables users to convert unused loyalty points from various rewards programs into digital play tokens, which can be used to participate in free-to-play games and place risk-free bets on sports events. At the time, the company had three major customers: Swagbucks, Bally’s, and Dave & Busters. Unfortunately, the acquisition led to a material negative impact on profitability, as one of their contracts, Swagbucks, became deeply unprofitable. SPN’s gross margin dropped from 56% in 2021 to 31% in 2023, primarily due to campaign mix changes and costs related to integrating Gambit. To improve profitability, management sunset the contract inherited from Gambit, which has led to a revenue decline of 29% for the first nine months of 2024. However, gross margins have sharply rebounded, improving from 28% in the first nine months of 2023 to 60% in the first nine months of 2024! The company is set to return to overall topline growth in Q1 of 2025, with Q4 being the last quarter impacted by the contract exit.

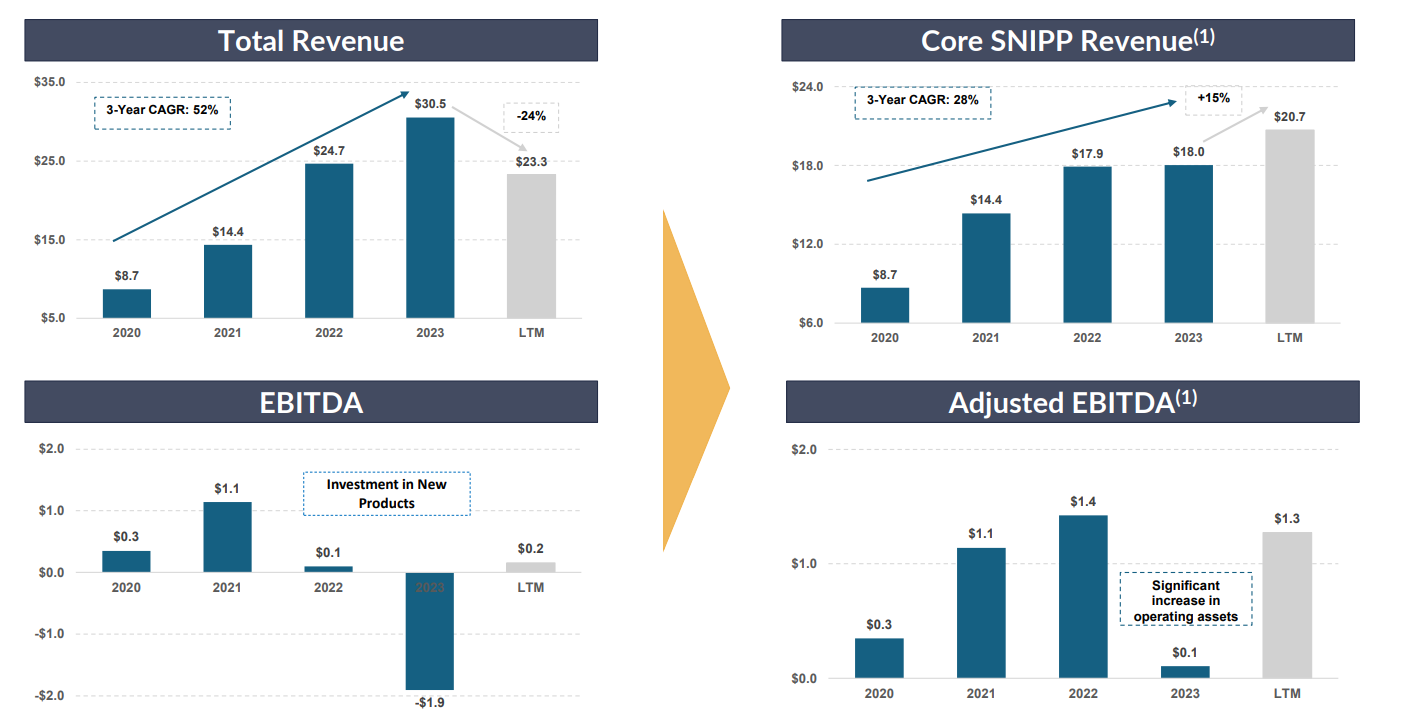

Despite this major headwind, core revenue has continued its steady march up, growing 21% for the first nine months. The presentation is updated as of Q2 (growth accelerated into Q3) but provides a clearer view of the core trends:

As if that headwind was not enough, the company encountered delays in filing its audited annual financial statements for 2022, primarily due to revenue-recognition errors. The British Columbia Securities Commission issued a temporary cease trade order (CTO) in July 2023, restricting trading for the stock due to the filing delay. This CTO remained in effect until January 2024. The stock plummeted more than 50% over the course of 2024 when the ticker began trading again! Basically, anyone looking into the company would quickly skip the stock because of the CTO situation and the crazy swings in revenue and profit margins since 2022.

After posting strong Q3 results, with revenue up 21% for its core business and an improved EBITDA margin to 10.5% of revenue, the stock shot up from $0.07 to $0.12. However, it gave it all back, driven by the market meltdown in recent months. This feels like a great setup to enter the stock, especially given that three contract renewals and two new contracts were announced since its last earnings results.

Risks

Snipp relies on revenue from short-term contracts tied to redemptions. These contracts can be unpredictable, and any changes in promotion timing or the loss of a contract can significantly affect a quarter's results.

FMN’s ramp could create near-term cost pressure as management invests in new customers, a sales team, and its technology. However, this would be offset by material revenue acceleration.

This is a micro-cap; liquidity is sparse, the stock and profitability have been volatile in the past, and the company has faced some filing issues, as discussed. Keep that in mind when looking at the stock.

Valuation

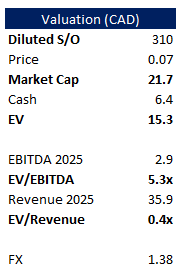

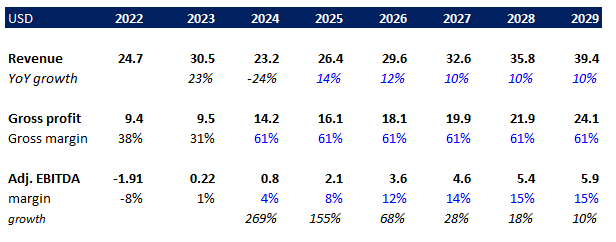

SPN capital structure is as follows:

I expect the company to sustain double-digit growth, anchored by the expansion of its core business into new categories (For example, Snipp recently entered the toy space), continued macro tailwinds, and ramp-up of FMN in 2025 and into 2026/27. Operating leverage should kick in as the company returns to growth in 2025, and EBITDA could reach mid-teens eventually:

It’s worth caviating that if FMN ramps much faster than expected, management might sacrifice some margin to invest in its growth as it could be an opportunity worth well over $100m in revenue.

Given its gross margin profile, it wouldn’t be a stretch for the company to trade at 1x revenue, which would be a stock worth $0.12 on 2026’s revenue numbers. Using 8x EBITDA on 2026’s number, I get to a stock worth $0.11.

However, looking beyond the short-term figures, this business has the potential to more than triple its revenue base, given FMN, the microenvironment, and the favorable industry trends. Looking at other companies in the space, there is a path to a 30%+ EBITDA margin and a 15%+ FCF margin in the long run. I wouldn't be surprised if a strategic buyer like Ibotta or a financial buyer, such as vertical market acquirers like Constellation Software, seeks to acquire the business. It would be a perfect platform from which to expand.

Conclusion

I am effectively buying a net cash business set to grow by double digits for a very low revenue and EBITDA multiple for the foreseeable future. The stock also has significant optionality: the monetization of Snipp FNM and inflationary pressure/recession from tariffs, which could boost digital coupon demand.

Disclaimer: I am long TSX-V:SPN. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.