Quick Value Pitch: Danaos Corp (NYSE:DAC)

3x EPS stock that trades under 0.5x book value with almost all of its earnings locked in for the next three years, actively buying back stock and increasing its dividend

I've debated for some time if I wanted to make this investment public. It is not my typical style (GARP/inflection). I am also usually apprehensive about pitching ‘value’ stocks with no catalysts, especially in a cyclical industry. However, this opportunity seems almost too good to pass.

So, here it is:

Company Overview

Danaos is a Greek shipping company. Alright, alright, I know most of you will want to stop reading here but bear with me; this pitch is smaller than usual, and you might like it more than you think.

The company possesses 73 containerships and 10 dry bulk vessels. Currently, the majority of its revenue is generated from the containerships, which are leased (chartered) to liner companies such as Maersk, Hapag-Lloyd, and Zim, through multi-year fixed-rate charter agreements. Essentially, the company does not operate the containerships; instead, it leases the asset and generates a return on its investment.

Danaos came public right before the Great Financial Crisis and spent the following 12 years de-leveraging the business.

The Thesis

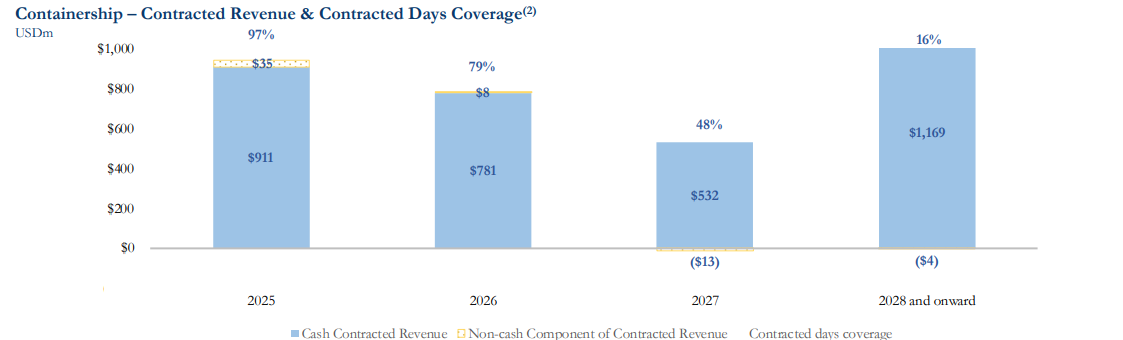

Amid the pandemic and the subsequent Red Sea Crisis of 2024, Danaos’ management capitalized on the robust containership market to significantly reduce debt and secure contracts for nearly all of its vessels at strong charter rates. The company is projected to generate over $25 in earnings per share (EPS) annually throughout 2025, 2026, and potentially into 2027/2028, with a stock price of $83. Below is a straightforward chart detailing their 'contracted revenue’ over the coming years:

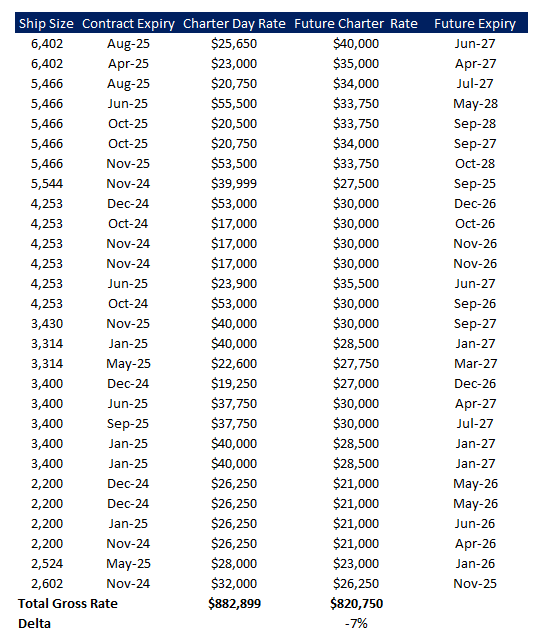

This revenue is contracted at very high charter rates. I predict that by mid-2025, coverage for 2026 will exceed 90% and be over 60% for 2027. The table below shows a snapshot of some of their ships with upcoming expirations that have been extended. It does not depict their entire fleet since many vessels’ contracts do not expire until 2028 or 2029.

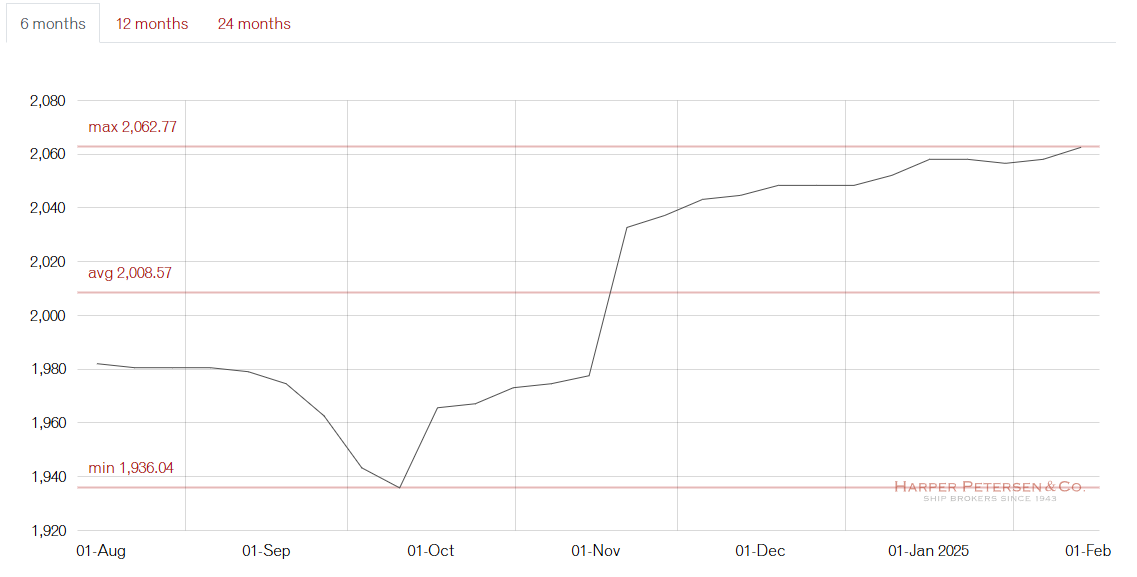

You may be wondering: When will earnings drop in this cyclical industry? All signs indicate the contrary. The Harpex index, shown in the image below, monitors global price trends in the charter market for containerships and recently reached a new all-time high! Danaos management is strategically extending the terms of most of its charters to enhance earnings.

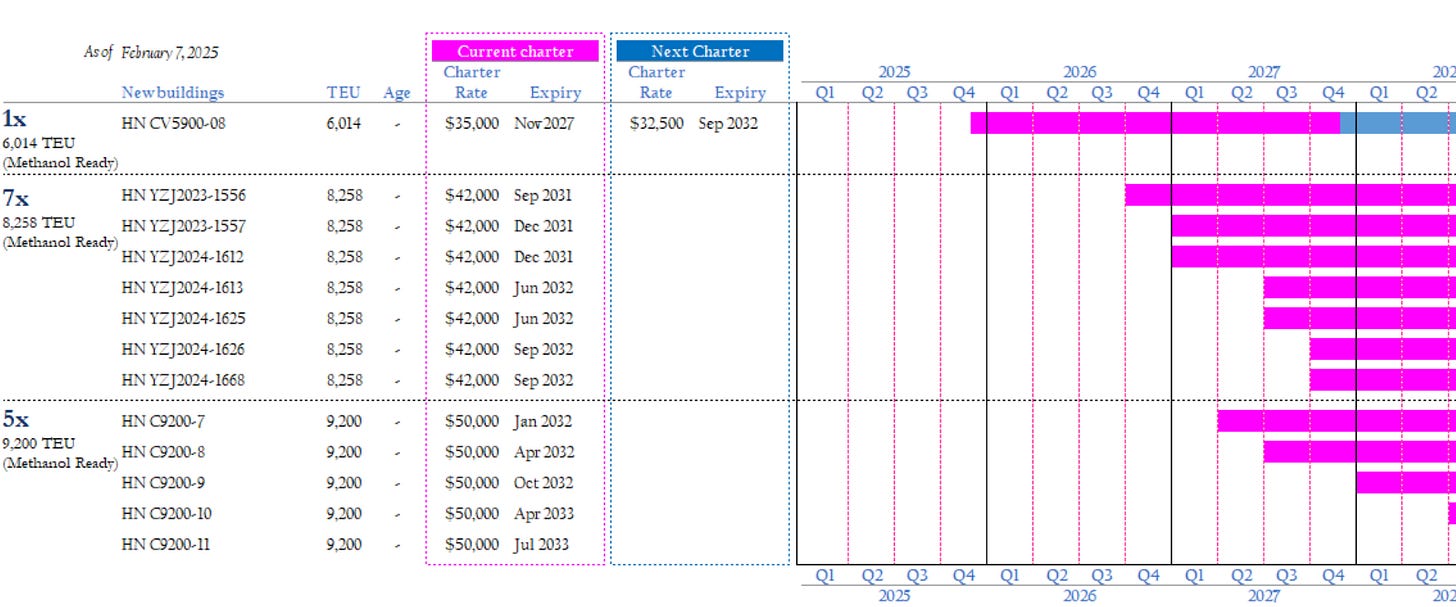

The company is also using this strong market to order new ships and contract all of them for an average duration of 5 years. Management has effectively bridged its earnings all the way to 2032. Here is a list of 13 out of 15 new ships and their contracts:

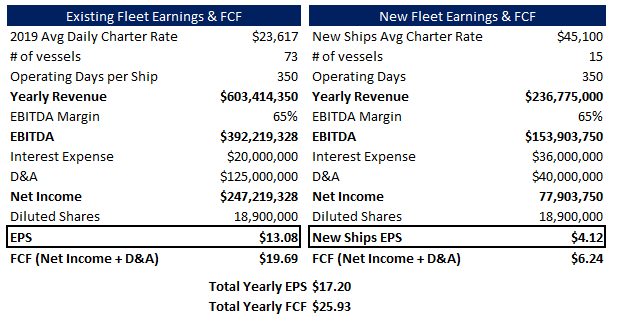

Even if daily charter rates drop when the earnings coverage for 2025-2027 concludes, the company will still be adding 27% more capacity at strong charter rates for the following 5 years. The stock’s new earnings potential from 2027-2032, even if rates return to 2019 levels, is projected at $17.20 per share. Here’s the quick math:

Some believe 2019’s daily rate of $23,617 is not conservative. However, from 2008 to 2020, the industry faced a significant downturn, and Danaos’ rates still averaged over $20,000/day. Even during the GFC, the average charter rate for a 4,400 TEU containership fell from $36,000 in May 2008 to $20,000 in April 2010. It’s also worth noting that the average TEU capacity of Danaos’ vessels has grown to over 6,000. Below is a picture from a competitor showcasing the 10 and 15-year average charter rates relative to prevailing markets:

Charter rates are higher than the historical average but aren’t exuberant. This is especially true for bigger ships, which seem closer to historical levels.

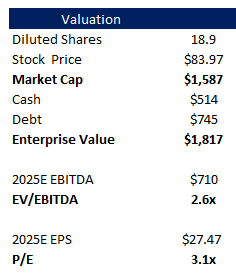

Effectively, Danaos has over $3,400m in contracted backlog at a 70% EBITDA margin or $2,380m in value, with a remaining average contracted charter duration of 3.7 years. DAC has a market cap of $1,587m and an Enterprise Value of $1,817m. So, not only do the earnings of its existing backlog cover more than the current EV, but you also get all the ships for free and all future earnings associated with those ships.

Historically, counterparty risk was the only thing that derailed Danaos’s contracted earnings. Many liners went bankrupt in the last decade, forcing management to renegotiate contracts. That said, I urge you to look at all publicly traded liner companies; they are flushed with cash! Its customers simply cannot walk out of these contracts.

The math above doesn’t include earnings from the 10 dry bulk ships they bought near the market lows. Management will remain opportunistic; if the dry bulk market continues to deteriorate, they will look to acquire more assets for cheap. Danaos’ fleet average age is also relatively young at 15 years, with the bigger ships closer to 10 years. While some older Danaos ships may be phased out, they account for less than 3% of their contracted backlog. This means that replacement capex should be minimal for the next 5-7 years.

All right, but this is a Greek shipping company. They will find a way to destroy value, right?

It doesn’t feel that way at all. Management is indicating the complete opposite. Here is their commentary on the last two earnings transcripts:

Q3 2024: Analyst: “Okay, thanks John, that's fairly clear. And just to summarize that simply, given the uncertainty on the new administration, what that means for environmental shifts going forward, that uncertainty plus the fact that newbuilding prices are high and you don't know where this container market is going, you're content with how things are and you'd rather when you order, do it opportunistically to give yourself a better ROE. And given that, it makes sense to just wait.” John (CEO): “Yes.”

Q4 2024: “Our profitability remains consistent, and we are using our strong balance sheet to increase dividends, continue the share buyback, and source opportunities to grow our company for the benefit of our shareholders.”

Danaos’ remaining contractual commitments for new ships is approximately $1,100m over the next 5 years. The management team is likely to finance the majority of commitments with debt. Even if they do not finance the ships, with ∼$600m of FCF/year, they will have ∼$380m in excess FCF/year to deploy. In Q4 2024, management repurchased $48m worth of stock; since January, an additional $15.7m has been purchased. These buybacks are extremely accretive, as the stock trades at 0.46x book value (BV is $180/share). The company has effectively repurchased 4% of the shares outstanding in less than four months. The board has also increased the dividend every year since 2020.

Finally, CEO John Coustas owns 48% of the outstanding shares and is vested in seeing the stock work. A stock trading at 0.46x BV with contracted cash flow usually attracts catalysts to unlock value. Could a potential sale be in the plans? Mr. Coustas is 68 years old and is likely thinking about the next steps for his estate/trust.

What’s Danaos Worth?

You are buying a 30%+ FCF yield, 3x EPS stock with almost a decade’s worth of earnings visibility that is actively buying back stock. Book value per share is accreting at $6.75/quarter, and the backlog grows with every passing quarter. But let’s keep it simple and be extremely conservative; the company will earn ∼$27 EPS per year over the next three years. If the P/BV discount remains consistent at 0.5x, the stock should be at least $131 in three years.

If the market starts realizing that Danaos’ earnings are sustainable, could it trade at 7-10x EPS on normalized earnings? In addition to the $80+ of EPS you are getting over the next 3 years? I think it’s possible. Then, it becomes easy to justify a target price of $200+ vs the current stock price of $83.97

Risks

This opportunity comes with risks, and while many of these are largely countered by the visibility of earnings, you might want to consider these concerns for further due diligence:

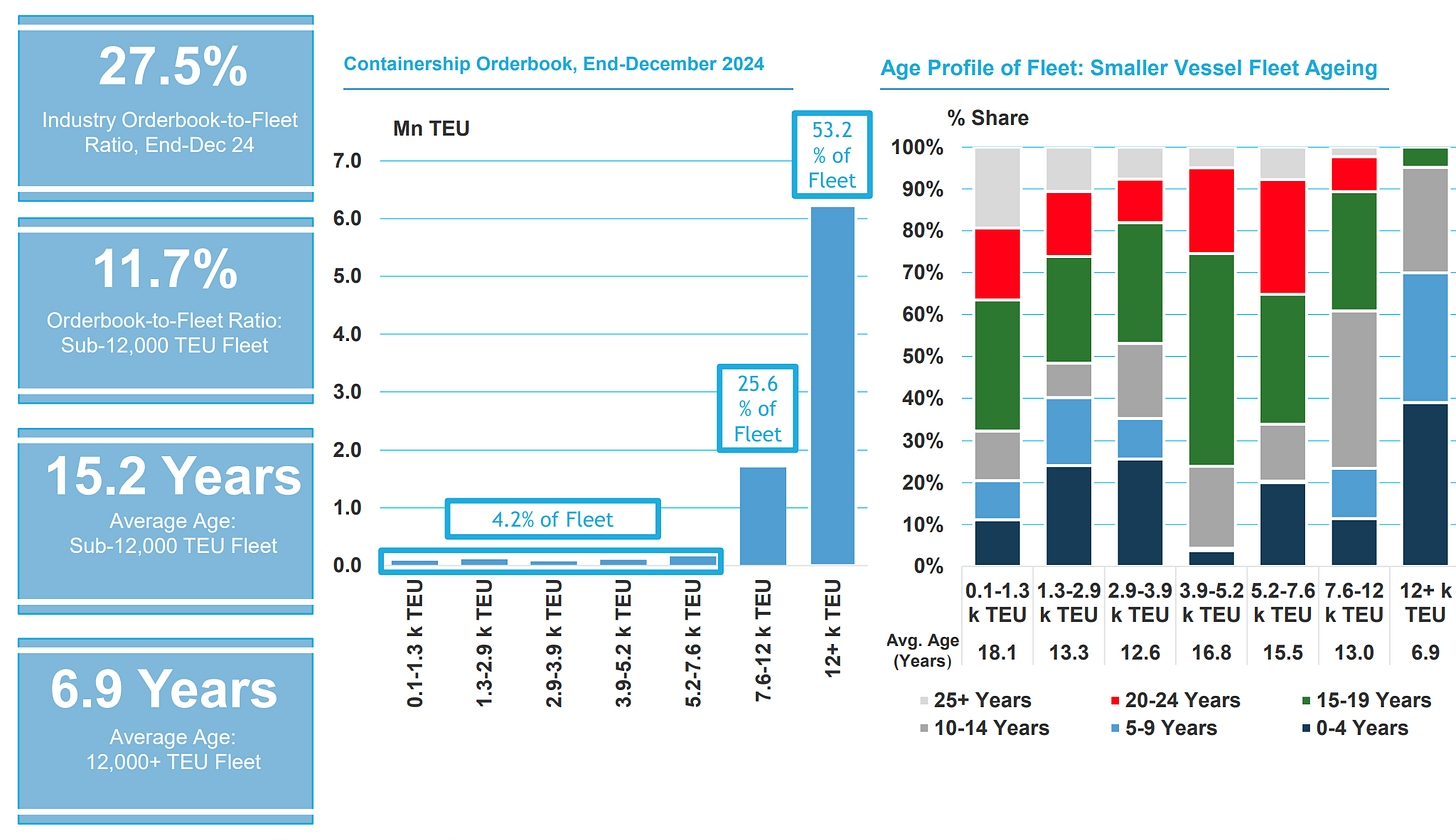

The containership orderbook in the industry has expanded considerably, with the orderbook-to-existing-fleet ratio now at 27.5%. This influx of new vessels could exert pressure on charter rates. The majority of these orders are for mega-large containerships capable of carrying over 12K TEU. In contrast, Danaos primarily operates smaller vessels where there are fewer orders and an older industry fleet age. Below is a chart from their presentation:

This supply is coming online as we speak. If geopolitical events were to subdue (specifically the Red Sea Crisis), we could see significant pressure on rates, which could weigh on sentiment.

President Trump advocates for US firms to bring their operations back home. The idea of de-globalization is also gaining attention. This shift could reduce global trade, potentially wreaking havoc in light of a substantial orderbook.

Tariffs are causing significant uncertainty in global trade. Nonetheless, it is important to recognize that tariffs have traditionally benefitted the industry.

A take-under by management is a possibility, especially if the stock remains undervalued for a significant period of time

Carbon emission regulations compel the industry to lower sailing speeds or retire older ships, effectively reducing supply. Relaxing these regulations could increase industry supply.

Closing Remarks

DAC is a relatively small position for me as it is not my typical ‘style.’ However, I have a hard time painting a picture with significant downside, especially in the context of management’s prudent capital allocation strategy.

Disclaimer: I am long NYSE:DAC. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time.

Thanks for the write-up- great profile.

It looks like they announced a syndicated loan up to $850M to fully fund their newbuild program (compared to the $1,100M you had estimated, if I'm interpreting correctly).

Source: https://www.shippingherald.com/danaos-profitability-remains-consistent-2-newbuilding-containerships-added-to-orderbook/#:~:text=firepower%20to%20explore%20accretive%20investments,of%20all%20vessels%20on%20order

Ticks three of my boxes: cheap, hated and in an uptrend.