Jakks Pacific Inc. (NASDAQ:JAKK) Pitch

Toy company trading <6x EPS, with significant business momentum, 25% of its market cap in net cash, and a phenomenal 3-year outlook. Buyout likely imminent.

Summary

Toy company trading <6x EPS, with 25% of its market cap in net cash, 15% FCF yield, and a phenomenal 3-year outlook.

$7.00 in earnings power as early as 2026/2027 for a stock trading at $27.70.

A number of business wins should lead to a material acceleration in EPS as early as Q1 2025.

On the cusp of capital return with a significant shareholder gaining board representation.

Recap Since My Last Pitch

I initially discussed Jakks Pacific on substack in 2021, which you can find here. The stock traded at $11.74. After years of mismanagement, I made the case that a new CFO had been actively cleaning up the business, and the story was at a significant inflection point. The thesis played out much better than I expected:

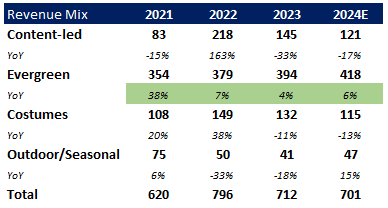

Revenue grew from $520m in 2020 to $712m by 2023 and peaked at $796m. It is also higher than 2019’s revenue of $599m.

EBITDA grew organically from $18.9m in 2019 to $75m in 2023

EPS grew from -$0.73 in 2019 to $4.62 in 2023, with net income margins expanding from -1.2% to 7.0%.

Management paid down over $184.5m in net debt + preferred shares during the pandemic, and its net cash balance will balloon to what I believe will be $80-95m by year-end 2024. This is $24/share in equity accretion, with FCF consistently above $50m!

Surprisingly, the stock’s multiple actually compressed! It is now 3x my estimated 2025 EBITDA, compared to 5x EBITDA when I initially pitched it in 2021. This multiple is completely unwarranted, and I believe the story has never been better.

Jakks Pacific is a Significantly Stronger Business Since my Last Pitch

Jakks develops and sells toys and costumes for those unfamiliar with the story. The company has historically capitalized on licensing existing IPs, primarily with Disney, for its animated movies. Its business model is similar to public companies like Coty or InterParfums, which license beauty brands.

During the pandemic, management worked tirelessly to diversify the business and reduce its exposure to key suppliers. The company has struck multiple blockbuster deals, and some of its smaller partnerships will likely support strong growth for the foreseeable future.

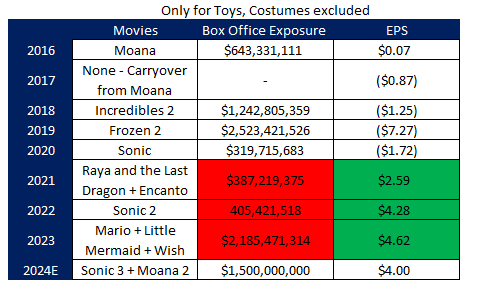

In 2019, management won the Sega toy license from Jazwares (Berkshire Hathway). At the onset, the partnership was relatively immaterial. However, Sega grew Sonic into an international movie franchise with three movies and a spin-off show (Knuckles) released. Each adaptation grew more considerable than its predecessor, and a fourth movie has already been announced. Sega further signaled its intention to become a global IP powerhouse, reviving multiple dormant franchises for which Jakks owns the master toy agreement. I believe Sonic grew to be nearly 10% of its revenues.

In 2013, Jakks secured the Nintendo toy license. Similarly, the partnership was relatively immaterial, as the toys primarily targeted gamers and niche collectors. Nintendo had a breakthrough in 2023 with the release of the animated Mario Bros. movie, a significant improvement from the 1993 live-action movie (watch it if you want a good laugh). It grossed $1.36 billion and became a box office hit. It is just the beginning: During their FY 2024 earnings release, Nintendo’s management stated, ‘We recognize that movies are a very effective way to generate interest in Nintendo games, and we will continue to work on movie production going forward.’

Jakks is transforming from being Disney’s puppet to a multi-national toy powerhouse. Everyone traded the stock based on the box office performance of key Disney IP. Many people I’ve spoken with continue to believe the company is primarily hit-driven. To a certain extent, it remains true. However, it’s actively changing: In November of 2023, concurrent to their Q3’23 earnings results, management announced that it had secured a game-changer contract with Authentic Brands Group (ABG) to manufacture and distribute a range of products for its diversified brands.

Jakks has a long history of manufacturing seasonal products. ABG is a $21b revenue juggernaut, so the opportunity could completely transform the business. More importantly, the products ship to brand new retail partners like Academy Sports, and shipments occur in the first half of the year; this is key to the story as Jakks Pacific generates all of its earnings in Q3. Contracting ABG will materially reduce seasonality, reduce holiday selling dependence, expand its retail coverage, and ultimately support a better valuation. ABG alone could add $100m+ to the topline in 3+ years. Shipments have already started, and I expect Q1 and Q2 2025 earnings to be far superior to last year’s results, thanks to this partnership.

That being said, I do not want you to believe that Jakks is losing or in the process of winding down its Disney relationship. To the contrary, Jakks has won almost every toy license for Disney’s new IP animations in recent years, excluding Pixar movies. It includes Raya and The Last Dragon, Encanto, and Wish. Their success has led to further wins with Disney into new categories like the ILY 4ever dolls and Disney Musical Minis. But the biggest came last year: the company won the Simpsons toy license. Super7 was the prior licensee and did a poor job distributing the product. Revenue contribution in 2024 will be relatively small as the company tests reception and distribution. However, momentum should build in 2025, and it will become a growing eight-figure contributor to the company’s evergreen revenue. And hey, we might even get a second Simpsons movie!

Beyond its licensors, its relationship with retailers like Walmart & Target has never been better. They actively provide the company with more opportunities to gain shelf space outside licensed toys. For example, Jakks now manufactures Target’s private-label line of baby dolls. They now make Target-branded toys, like the checkout lane, which Target has outlined as one of their best-selling toys. Retailers also love Jakks’ products as they are relatively cheap, with most products under $50 and the average being around $20.

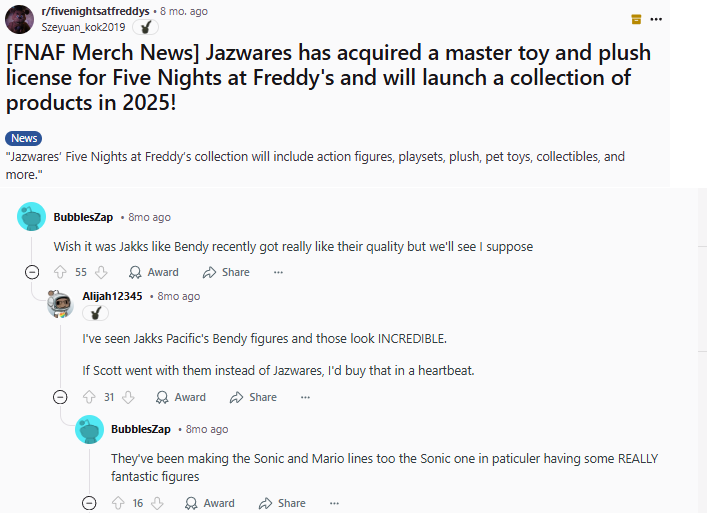

Jakks gains in its retail customers are not a fluke. It became apparent after I scrolled through various forums and realized that fans love Jakks’ products. Heck, in some forums, fans are begging the IP owner to transfer the toy licenses to Jakk! Here are the top comments on a Reddit post where Jazwares was announced as the Five Night at Freddy’s toy licensee:

It is a significant change in perception. Ten years ago, Jakks Pacific was known for poor-quality toys, lacked product support, and was actively shunned by the fanbase.

Management has also strategically grown its evergreen product line, which the market underappreciates. I estimate that 66% of its sales will come from evergreen + seasonal products in 2024, which are not box office dependent.

Significant gains are also being made internationally. Jakks is chronically underrepresented outside the United States: 21% of its total revenue comes from foreign sales, compared to 30-50% for its peer group (Mattel, Hasbro, and Funko). Management has invested in two new distribution centers in Italy & Mexico over the last 12 months and plans to multiply their business in Europe & LATAM. Its international expansion could add 10-15% to its topline over the next 3-5 years.

Alright, so Jakks is a better business. But how does that help me make money with the stock if it seems nobody cares and it still trades at 3x EBITDA, right? Well, I think the set-up moving forward is extremely attractive.

Box Office Set-up is Looking Awesome; Earnings Could Hit a New High

The above performance was achieved despite an abysmal cinema market, where Jakk’s box office exposure was a fraction of its pre-pandemic level.

The following 3 years will be the best movie set-up for Jakks in a very long time. Some of its more prominent licensed IP have scheduled movies: the recently won Dog Man license will be released next week, Snow White in March 2025, Wicked Part 2 in November 2025, Toy Story 5 in June 2026, Mario Bros 2 in April 2026, Moana live-action in July 2026, Frozen 3 in 2027, and Sonic 4 in 2027. Other potential releases include a Zelda live-action movie and a sequel to Encanto (which was one of Jakks’ biggest successes).

I also believe there is upside to current expectations for Q4 2024. Moana 2 and Wicked are significant properties for the business, but many do not realize that Moana is one of Jakks’ biggest properties. Their box office outperformance could translate into additional shipments for Q4 and 2025, especially when released on streaming. One interesting development during Q4 is that the company’s competitor, Mattel, initiated a major recall for all its Wicked dolls due to label issues. They printed a porn website on the packaging! It was a complete disaster that happened right before the movie's release. Retailers have potentially replaced Mattel’s shelf space with Jakks’ products instead.

Reduced seasonality, improved partnerships, and new contracts are all great reasons the stock should re-rate. However, I believe the story’s most crucial catalyst will be in 2025.

Line of Sight to Capital Return

Until early 2024, Jakks was restricted from returning capital to its shareholders. It was due to its preferred equity, which had to be paid in full before the board could initiate capital return. Management fully paid it off in March of 2024.

Since then, management has hinted a few times that capital allocation decisions should be announced soon. Based on my discussions with the company, implementing a dividend to attract longer-term shareholders seems to be their preferred route. While I would prefer share repurchases, I think this is a positive first step in changing the stock’s narrative.

Many fear they might announce a big acquisition, destroying all they have worked for in recent years. I don’t think this is a realistic scenario. Why? Lawrence Rosen remains a shareholder, owning nearly 20% of the outstanding shares. Rosen now has representation on the board through director Neilwantie Mahabir, CEO of Rosen’s business.

Jakks is Primed for a Take-Out, and History Supports this Assumption

It was difficult for me ever to envision Jakks being acquired. After all, it was a toy company that owned no IP. One supplier historically made up 50% of its inventory (Disney). Two major retailers made up 50%+ of sales. All of its earnings were generated in one quarter (Q3).

However, my opinion has changed. I think it is essential to contextualize the changes to understand why selling Jakks now would be a good idea.

After the death of his co-founder, Berman (Jakk’s CEO) almost ran the business to the ground. He has been working for more than a decade to fix his mistakes. I think he wanted to honor his late co-founder’s legacy (and pay himself a nice salary at the same time). Today, Berman is 60 years old and has more money than he will ever need. The business is in a better spot than ever, and he likely isn’t as hungry as before.

At the same time, a significant shareholder (Rosen) now has board representation and has been in the stock for over three years. Mr. Rosen is the owner of LaRose Industries, a toy company. He made a fortune in the toy sector and sold his business to Mattel. I don’t think a toy magnate like him is simply passively investing in a micro-cap. JAKK is a very illiquid stock, so getting out of it will be difficult for Mr. Rosen. What is his ultimate goal? He owns 20% of the company, bought additional shares in 2024, and is close to the CEO. He could be the buyer.

Even if he isn’t a buyer, we have multiple companies that have made a bid for the company in prior years:

Meisheng Cultural made a bid for the company in 2018.

Jazwares has been acquisitive in the past and has a highly complementary business model to Jakks. Especially since they recently entered the costume market with Marvel. They also made a bid for Jakks in 2019.

Just Play, another toy company, had bid for the company in 2019. Centerbridge, a private equity, backed them.

During Just Play and Jazwares’ bids, Jakks Pacific’s EV was $200m, with $30m equity and $170m of debt+preferred. The business was distressed, burning through cash, and had extreme supplier concentration. Today, the EV is $220m (assuming $80m in cash), and EBITDA is 4x higher. This valuation makes no sense, and a competitor or private equity firm is bound to pay attention.

Earnings Power

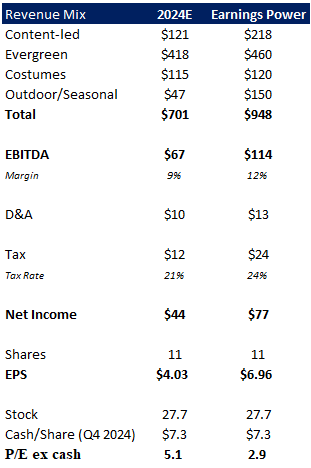

The stock’s earnings power is significantly higher than the current level of earnings. Let’s assume the following for our analysis:

Content-led products return to 2022 revenue levels of $218m (Achieved with one movie release only, Sonic 2, and a tailwind from Encanto’s streaming success).

Seasonal products, deeply affected by Covid and 2021 container issues, return to 2021 levels of $75m (2019 was $90m) and layer on $75m of additional revenue from ABG.

Costumes/Halloween products return to pre-pandemic revenue levels of $120m.

10% growth in its Evergreen business, and net cash is $80m in Q4.

12% EBITDA margin, above the 10.3% level achieved in 2019 but significantly lower than most of its peers (Funko, whose business model is the most similar, has achieved 15%+ EBITDA margins on similar gross margins).

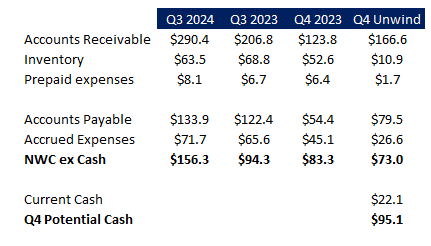

The scenario above gets me to earnings per share close to $7.00. For simplicity, I did not include interest income. It is not a crazy outcome and could be achieved in 2026 and/or 2027 when ABG ramps up, and the strong movie lineup hits the box office. Assuming no FCF is returned to shareholders from now until then, the stock is 2.9x EPS at today’s price—a pretty good bargain, if you ask me. Meanwhile, the company continues to generate $40-50m+ in FCF. While I understand the Q4 cash balance is not representative of the full year given working capital requirements, simply using a smoothed-out cash balance gets you to $40m in net cash plus an additional $40-50m of FCF coming next year. Below is the working capital unwind and potential Q4 cash balance:

8x on $7 EPS would be a $56 stock. However, let’s not even go there. I assume the company will make $4.00-4.15 in EPS in 2024 and $5 in 2025; using 8x in 2025 gets me to a $40 stock today.

Set-up Into Q4 Earnings & Comp Analysis

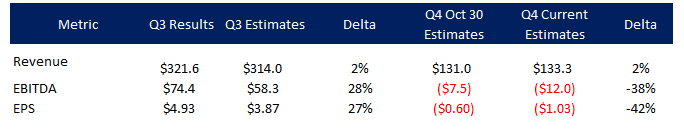

Despite reporting Q3 2024 results that came significantly ahead of estimates, sell-side brokers decided to reduce Q4 estimates materially for both EBITDA and EPS for God knows what reason, all the while increasing revenue.

Either I am completely wrong, the sell-side is sleeping at the wheel, or management is sandbagging expectations for the fourth quarter. What I do know is that John is one of the most conservative CFOs I have ever met. Make what you wish of that statement.

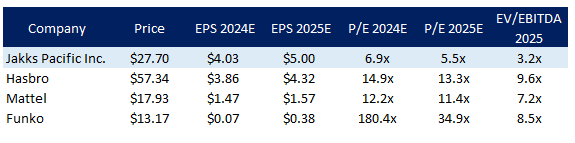

I want to point out that the Q4 results are inconsequential to the bigger picture, but I always like to know the short-term earnings set up to help with position sizing. Looking at its comps, the stock is deeply undervalued:

I will never argue that Jakks should trade at Hasbro or Mattel’s multiple. They are both highly scaled toy companies, with many of their toy sales derived from their owned IP. However, I want to remind everyone that Jakks’ business model resembles Funko’s. With a very levered balance sheet, Funko trades at 8.5x estimated 2025E’s EBITDA and 6.8x 2026E’s EBITDA. My 8x EPS assumption above does not seem aggressive, especially if earnings consistency continues to improve.

Risks

Tariffs have been topical for many investors. Jakks manufactures substantially all of its products in China. During Trump’s initial tenure, toys were exempt from tariffs. This makes sense, as toys are not a strategically important sector, and Americans have little appetite for working in low-level production. A tariff on toys is also seen as a tax on kids.

Some might call me crazy, but I think tariffs would be a short-term minor negative but a long-term positive for the company. First, the US has very little toy manufacturing capacity, so the tariff will likely be passed on to the consumer, creating an inflationary tailwind on earnings. Second, 70% of the business is FOB origin, meaning the buyer takes possession of the goods at the time of shipping and pays the cost of tariffs on arrival. Lastly, there is no substitute for the toys they make. If you want an Encanto or Sonic figure, only Jakks has it. I don’t think parents or collectors will substitute the Sonic figure for a puzzle because the price has increased from $10 to $12. What is also likely to happen is that parents will trade down from $50-100 toys into Jakks’ price range, further increasing demand. From there, management would have plenty of time to diversify its supply chain base. Recent developments suggest Trump is more worried about Mexico & Canada than China. He recently discussed this with China, and WSJ/Reuters articles imply a positive trade conversation.

I have purposely released this pitch ahead of potential tariffs as I believe any material decline in the stock’s price due to the tariffs would be a buying opportunity.

The company remains dependent on box office performance, and while management has done a great job diversifying its reliance on Disney, it can still face air pockets. Since Wish the movie bombed at the box office, Q1 2024 saw a write-down for Wish toys. The back half of 2025 will be lighter box office-wise compared to 2024. However, looking at the business on a full-year basis is always better for getting a clear picture of earnings trends.

ABG has yet to ramp up, so seasonality remains a key risk. If the holiday period is weaker than expected, it can lead to massive discounts for retailers, which will depress earnings.

Walmart, Target & Amazon represent 63% of the company’s total revenue, which is not too dissimilar to other consumer products companies.

Closing Remarks

There are many ways to win with this stock, and the strong balance sheet provides downside protection if one of the risks plays out. 15%+ FCF with imminent capital returns, and good visibility for the next 3 years. For transparency, I started buying the stock at around $19 in May 2024 and have averaged up around $27

Disclaimer: I am long NASDAQ:JAKK. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

Awesome write up. Best I have seen congrats. I have been in/out the last few years. Best position yet! How big a dividend you think they need to do? And why not keep doing 10% buybacks ? You don’t get a multiple on cash? Who needs 100mm in cash? Have in place a nice size buyback, maybe people sell into some crazy DJT rule? Nice job