East Side Games Group Inc. (TSX:EAGR) Pitch

Emerging mobile game company with a net cash balance sheet trading under 3x EBITDA and 5x normalized earnings

Summary

Emerging mobile game studio with a net cash balance sheet trading under 3x EBITDA, 5x FCF, and 5x normalized earnings

Savvy management team buying back as many shares as they can while the stock is depressed

A significant number of games being launched through the year which should materially accelerate revenue & earnings growth

Multiple partnerships struck with major IPs should support revenue growth for the foreseeable future

Business Model

EAGR’s business model is threefold:

ESG primarily partners with well-known franchises to develop free-to-play mobile games targeted at mature audiences. Games are monetized through in-app purchases and ad placement. Ads are 23% of revenue, with in-app purchases generating the remainder of revenue. ESG has been able to reduce its development cost by partnering with content creators and ensuring an initial player base. They have historically focused on counter-culture games, creating a niche for themselves (e.g. Marijuana themed-games, mature content, and LGBTQ+ audience). Many of these new games are based on successful franchises, like The Office, and RuPaul’s Drag Race show.

The company builds its games through its proprietary GameKit software. The software has a built-in Greybox UI, ad management & analytics platform, and automated monetization triggers. Effectively, it helps get their games out faster and at a lower cost. Two iterations have been developed: IdleKit and MatchKit. Through MasterKit, management will be able to develop other genre rapidly, such as shooter games ("ShooterKit"), endless runner games ("EndlessRunnerKit"), Clash Royale games ("ClashKit"), and card games ("CardKit"). MasterKit has allowed them to come to market with games at a record speed. For example, they’ve built and launched Cheech & Chong: Kush Kingdom in less than 6 months. The game’s mechanics are extremely comparable to their Bud Farm: Munchie Match game. Effectively, Cheech & Chong was a plug-and-play for them. They are looking to do the same with many other IPs.

More recently, they’ve been partnering with smaller studios to develop and/or support the games. The economics of the games are either shared or a fixed monthly fee is paid to the partner to take care of support functions. This strategy has proven instrumental in flexing their cost structure up and down during the difficult market environment which I outline a bit lower.

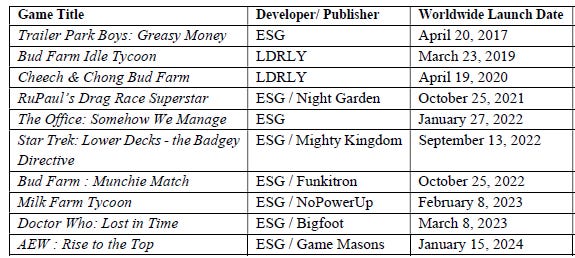

Here is a snapshot of their current games:

Recent Developments

Like many other gaming companies, 2022 was a challenging year for EAGR:

With the dissipation of COVID-19 and the rapid rise in inflation & interest rates, the mobile gaming industry saw its first-ever revenue decline in 2022. The situation was exacerbated by Apple’s IDFA changes in 2021 which made user acquisition spend ineffective. Management decided to cut down massively on UA spend following the changes which led to a deteriorating profile: sequential revenue decline, ballooning costs, and weakening game KPIs. The stock drew down 80% from its peak.

To make matters worse, one of their studio partner, Truly Social Games, sued them for $100m in December 2022. I will spare you the details of the lawsuit, but needless to say, it was the last straw for many investors. The stock proceeded to drop another 70% in the following 11 months.

Following underperformance for most of 2023, CEO Jason Bailey started taking drastic actions to right the ship: He shut down several non-core initiatives and shifted resources towards core operations. In August of 2023, he also announced a major restructuring, laying off 20% of its staff. Profitability improved sequentially every quarter of 2023, and Jason turned on the buyback valve, repurchasing shares as aggressively as restrictions allowed. Lastly, EAGR won its lawsuit with Truly Social Games in December of 2023.

Why Own EAGR

So what exactly are you buying today?

EAGR’s success in monetizing IP is leading to additional partnerships with multiple content owners. This model is not too dissimilar from many other companies (COTY, LANC, IPAR, etc.). Effectively, management is diversifying the risk from any one licensor, while almost guaranteeing the success of a game launch. Every time a property releases a new movie or a new season, an immediate bump in its # of downloads is seen, with no additional marketing cost. Management doesn’t have to spend years developing IP that has a 90%+ chance of failure, they simply capitalize on their relationships and sell their past track record of generating royalty streams.

The focus on counter-culture content also means that the company can monetize niche IP with a loyal base that would otherwise generate almost no profit for the licensor. This is a win-win as licensors can generate extra high-margin revenue while it often leads to solid economics for EAGR. For example, Cheech & Chong have likely made more money through EAGR’s mobile games, than their movies, shows, or promotional products. It’s also worth noting that these IP partnerships are often too small for competing studios to care about and too big for start-ups to take on. Management has effectively secured a position in a niche market of the mobile gaming space.

In their most recent Q1 2024 call, Jason mentioned that content owners are hungry to sign deals. They also have a higher number of IP partners they can choose from and the economics of the deals have gotten materially better.

I also don’t want you to believe that they are solely reliant on external niche IP. After all, they secured high-profile IP for their games (The Office, Power Rangers). They are also having momentum with their properties. Two recent launches have been successful and are demonstrating record KPIs. This includes Bud Farm: Munchie Match and Milk Farm Tycoon.

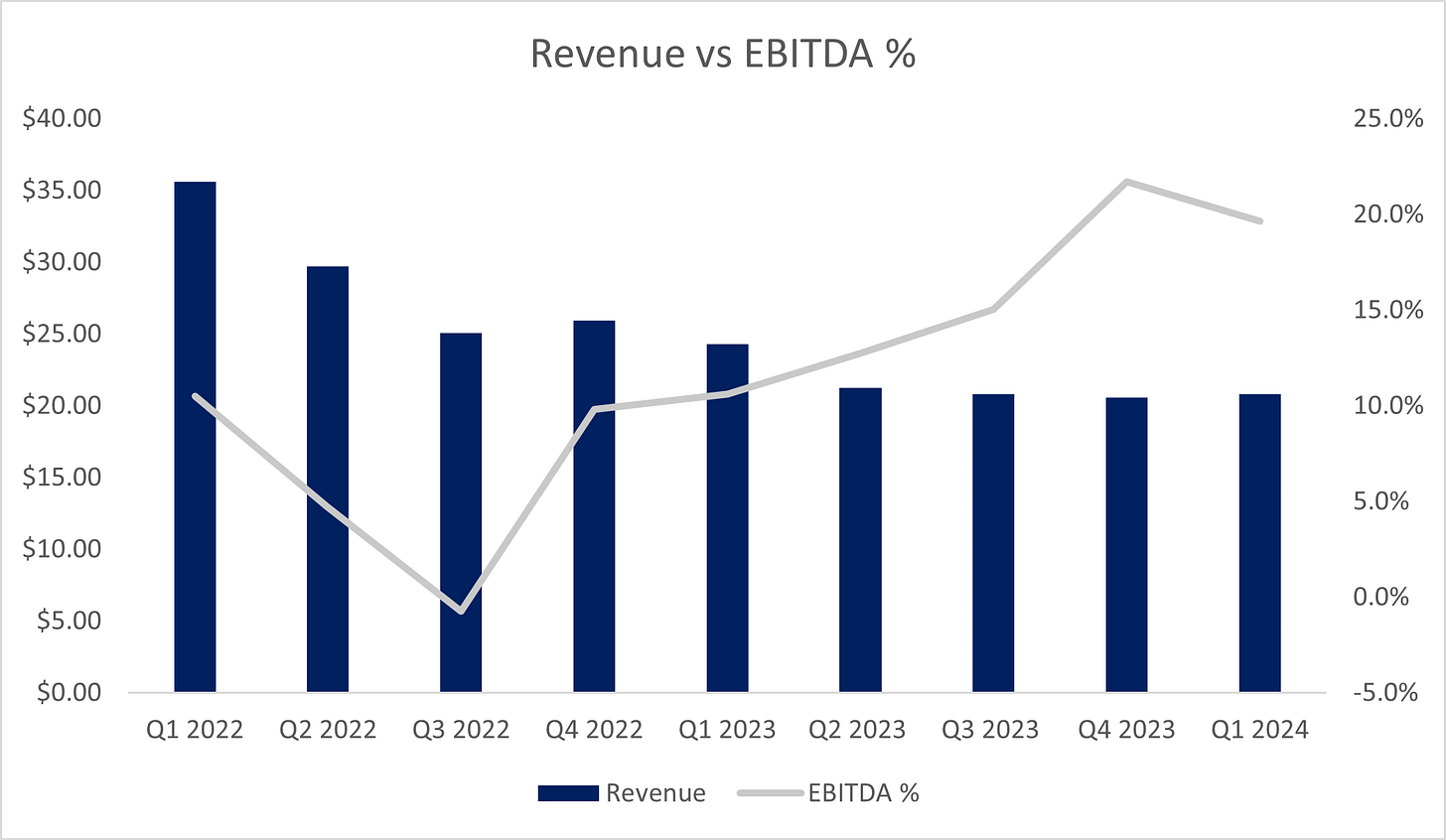

Despite significant revenue pressure, management has shown to be quite disciplined, improving EBITDA margin materially from <6.5% in 2022 to 19.7% as of Q1 2024. Many of the costs associated with launching recent games (AEW, Cheech & Chong, Power Rangers, Queer Eye) have been accrued yet margins continue to improve which leads me to believe there is still significant juice to their margin profile.

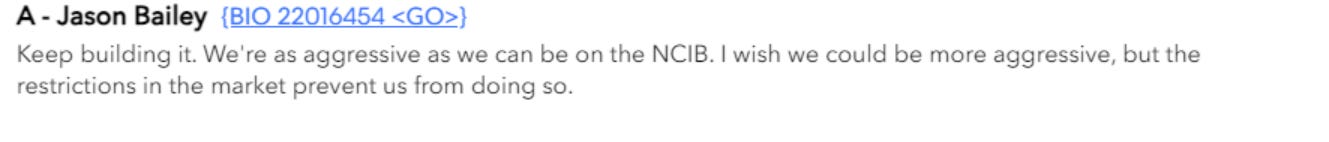

Today, the company is generating a significant amount of FCF. With net income being a good proxy for FCF, I would expect them to generate 10m+ FCF this year. The mismatch between D&A and capex is coming down, driven by lower capex spent on non-core operations which is leading to a significantly cleaner EBITDA/FCF conversion and higher earnings. While many micro-cap companies lack capital allocation expertise and burn FCF into unprofitable endeavors, Jason seems to have understood the game: He is hoarding up cash on the balance sheet and using it to buyback as many shares as he can while valuation is depressed (but is limited by TSX volume limits). Here is a snippet from the Q1 2024 earnings call:

You are buying a highly incentivized management team, with significant stock ownership: the board in aggregate owns 60% of the shares O/S, and Jason himself owns 50%. This does not include other/prior insiders who retain an additional 9% of shares. The board does not receive a salary and only receives option-based awards. Even looking at the executive team, salaries are reasonable and fair. Jason only pays himself $180K/year, the CFO is paid $150K/year and the rest of the management team has a salary in aggregate of $1.25m/year.

the IPO was set to be a liquidity event for insiders, but obviously, it did not go as planned. If the stock remains at a depressed valuation, I would not be surprised if the management eventually sells the company.

Catalysts

While the stock has rallied materially off the lows, I believe the market isn’t appreciating the number of initiatives that should materially accelerate revenue growth:

The company expanded its GameKit from only being able to release Idle games to Match3 games. Following the success of their first Match3 game, Bud Farm: Munchie Match (which has 500K+ downloads on the Play Store), a new one was released, Cheech & Chong: Kush Kingdom in May 2024. They soft-launched a new game based on the famous show ‘Queer Eye’ which will be released in Q3/Q4.

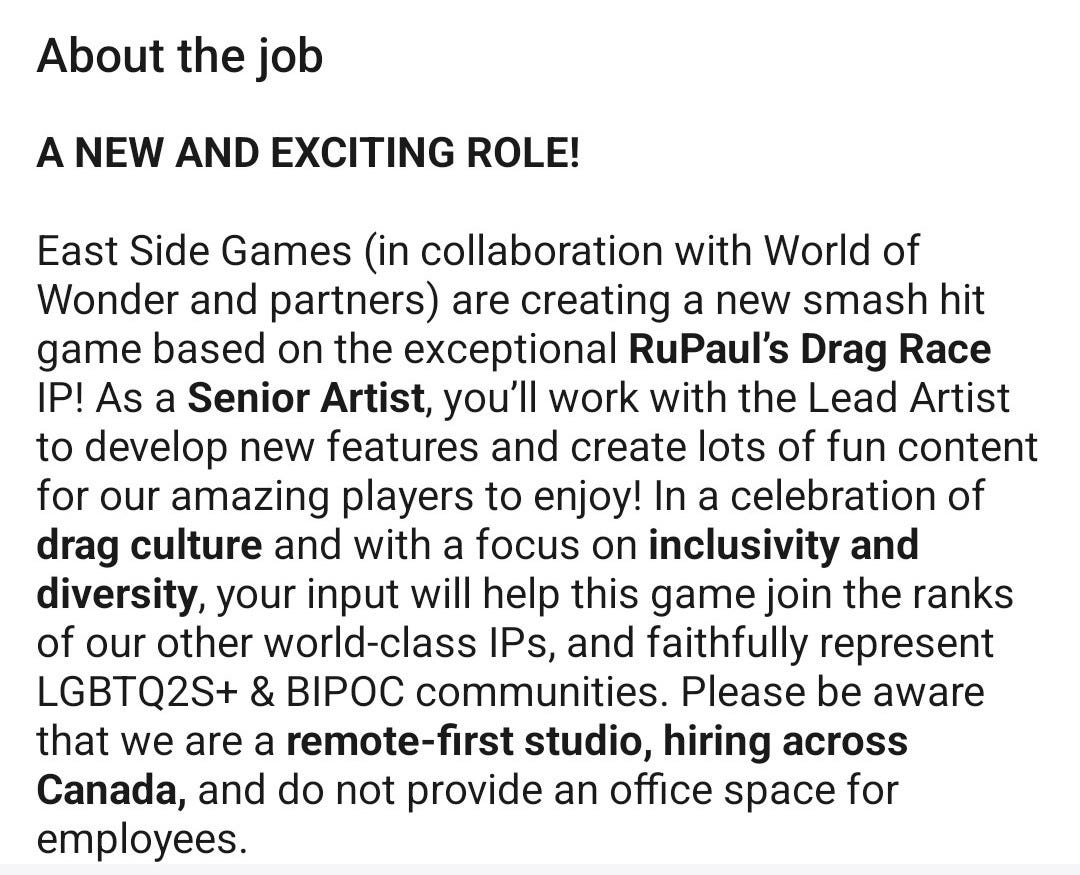

I believe they will be releasing a new RuPaul game as well given a senior artist job posting on LinkedIn by the company which hinted at it. (See pic below) - The first RuPaul game was widely successful with over 2m+ downloads on the Play Store and 46K+ reviews.

AEW: Rise to the Top idle game, was launched in January of 2024. The company also soft-launched in Q2 a new Power Ranger Idle game and hinted at 2 other launches in the back half of the year. Effectively, they will release more games in the next 6 months than they've released in the past 2 years.

Management has also hinted at an acceleration in their revenue growth for Q2:

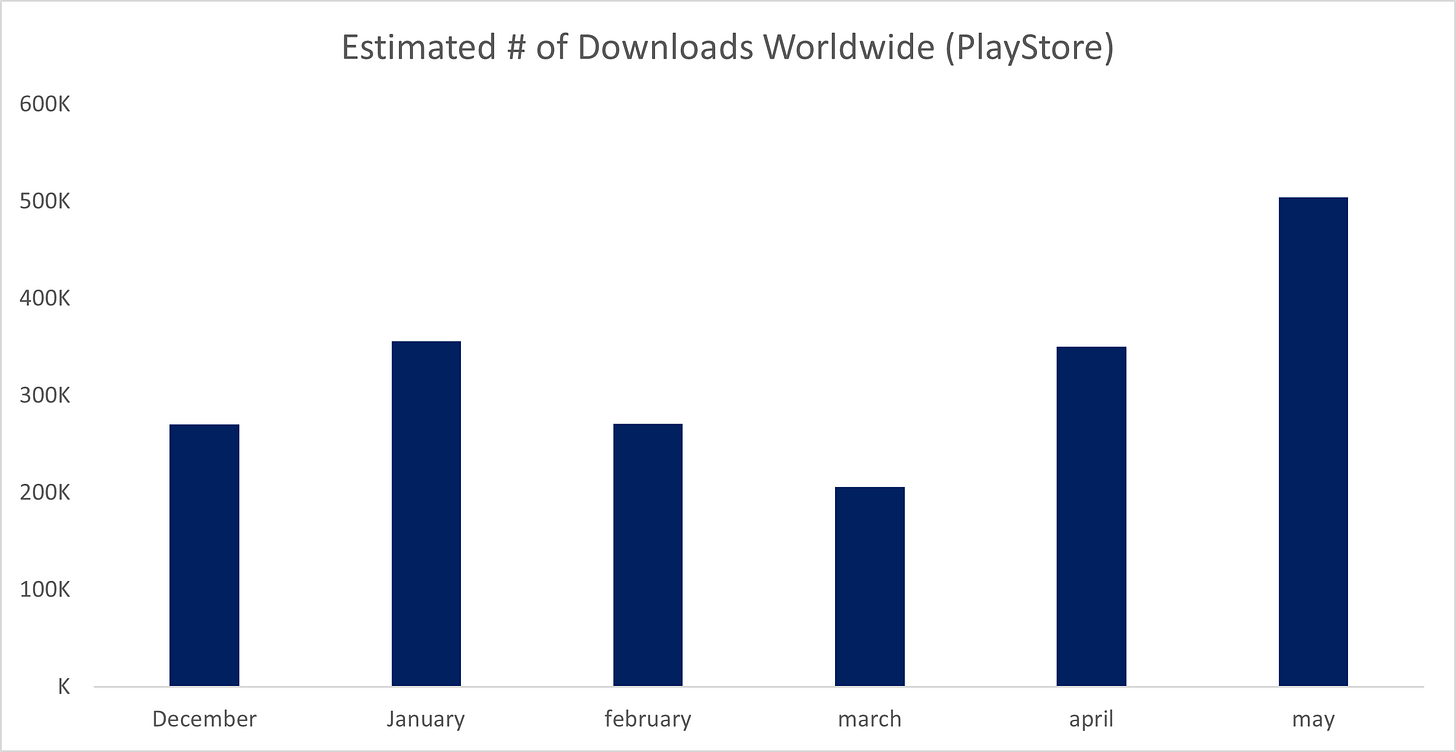

This also seems to be corroborated with third-party download data for the Play Store: I tracked their top 11 games and these are the download trends (I removed the initial bump from new launches for comparability purposes):

We can see a clear acceleration into Q2 - this is likely a function of the incremental UA spend they mentioned in their Q1 call. The # of downloads would be significantly higher if I added new games recently launched (AEW and Cheech & Chong) and included the app store.

Valuation & Capital Structure

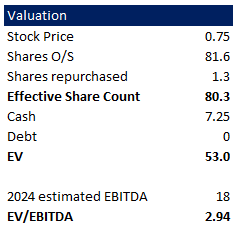

The company has a clean capital structure: 81.6m shares O/S and has bought back 1.3m shares it has yet to retire (for net S/O of 80.3m). they have 7.25m net cash and it should build every quarter.

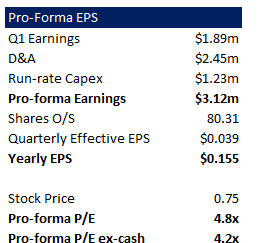

In addition, there is a mismatch between current capex spend and D&A flowthrough to the P&L. I believe Q1 capex is more representative of what D&A should be in 2025 and beyond (1.2m in capex vs 2.4m in D&A expense in Q1). As legacy amortization flows through the P&L, I would expect it to add over 6c/share in EPS per year. Assuming no improvement in earnings beyond the normalization of D&A expense, earnings would be $0.155/share. The stock is effectively trading at 4.8x EPS (and close to 5x FCF ex-working capital movement).

Revenue has effectively stabilized around 20.8m since Q3 2023. Driven by their recent game launches and the qualitative commentary in the Q1 call, I believe the company should return to growth in Q2 2024 with a path to double-digit growth and $0.16-0.20 of earnings. using 8x EPS on $0.20 of EPS and 11m of net cash I expect them to have by EOY the stock’s fair value should be $1.74.

I truly believe my assumptions are conservative and the company could earn significantly more than $0.20c/share if any of their new launches is a hit. It is also not crazy to believe that the stock is worth more than 8x EPS.

Risks

The disadvantage of their business model is the reliance on large studios that could pull the plug on the games. They also have minimum guaranteed royalty payments - if a game is not successful, it could hurt their profitability. ESG has been investing in mitigating these risks through multiple new partnerships as outlined above.

Similar to all mobile game companies, there is a “fad” risk to most of their games. However, many of their games have proven their longevity. For example, Trailer Park Boys: Greasy Money was launched in 2017 and remains one of their top game, generating millions in revenue.

Significant insider ownership; this could lead to a ‘take-under’. That said, the management seems to be doing the right things for stockholders. They’ve been buying back shares and focusing on growing earnings. I doubt this risk materializes.

Closing Remarks

The next catalyst for the stock will be Q2 earnings where they will likely provide additional details on the performance of their recently launched games and those still in soft launch. I would also expect them to provide additional details as it pertains to their UA spend and the impact on user growth and user retention.

Ultimately, you are buying a net cash gaming business, with inflecting growth and profitability metrics, trading at depressed valuations, and with a multitude of catalysts ahead.

Finally, I want to thank everyone who took the time to read this article. If you like the content I publish, please take a moment of your time to subscribe and follow me on Twitter @InflexioSearch

Disclaimer: I am long TSX:EAGR. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

This was great, thank you

This was great.thabk you