Bragg reported preliminary results today:

Revenue and EBITDA, as expected, will come at the low-end of their guidance, which the company has been communicating for several quarters.

Remember that this guidance was set before the new CFO joined.

More importantly, the company provided 2025 Guidance:

Revenue EUR 117.5M to 123M or CAD$176M to $185m, representing 15% to 21% growth

EBITDA EUR 19M to 21.5m or CAD $28.5M to $32.3M, representing 23% to 40% YoY Growth

Both metrics are ahead of estimates (Revenue for 2025 was estimated at $112m and $18m, respectively).

This is quite bullish. However, the most important aspect to the press release was the commentary on business momentum:

Brazil to represent 15% of revenue by EOY. This is much higher than their initial estimate of 10%. It makes sense as Brazilian market performance so far is extremely strong relative to expectations

USA to represent 10% of revenue

The above guidance also does not include ‘A robust pipeline of opportunities is under development, which, if realized, could further enhance 2025 performance but are not yet reflected in the current guidance’

A number of PAM opportunities seem to be in the work

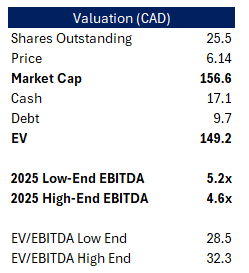

Here is the current valuation on yesterday’s close

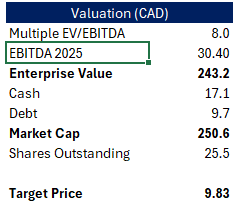

4.6x EBITDA for a company set to grow double-digit this year and likely the next several years seems ridiculous. Here is my target price on 2025’s EBITDA:

This is simply on 2025’s multiple. Bragg has significant upside for future years. More importantly, they’ve already fixed a lot of the issues a potential buyer would be worried about

The new regulatory limits in the Netherlands seem contained, as Bragg expects flat revenue from its PAM segment despite the headwind in 2025

The company now has significant visibility into new markets (USA, Brazil, Czech Republic), and eight new iGaming bills have been introduced in the US for the following states: Indiana, Maryland, Virginia, Wyoming, Massachusetts, Hawaii, New Hampshire, Hawaii, and New York

Margin trajectory seems to be in the bag given EBITDA guidance

And all the above should lead to improved FCFA conversion

Any way you look at this, and this stock should be meaningfully higher with clear visibility into CAD $10. At 12x EBITDA, the upside would be CAD$15

You’re hitting this idea out of the park Inflexio! Shows the value of using periods of shareholder despair to take a new sheet of paper out of the drawer and do some valuation work.