Bragg Gaming Group Inc. (TSX:BRAG) Pitch

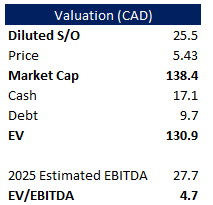

iGaming B2B Provider with a net cash balance sheet trading <5x EBITDA growing revenue double-digit with significant business wins in the recent months.

I’ve been posting on X regularly about BRAG and a few people have asked me about my thesis, so I've decided to do a substack post. For those who follow me on X, you’ll remember that I have owned and traded in and out of the stock over the last few years. However, This is probably one of the best times to be a shareholder, and I am very excited for the next few quarters/years.

Summary

Leading iGaming B2B provider with a net cash balance sheet trading <5x EBITDA

The company has faced multiple headwinds but continues to grow, driven by a strategic focus on high-margin proprietary content and expansion into new markets.

Founder Matevz's return as CEO and board revamp have strengthened leadership, with significant insider stock purchases

A clear beneficiary of the global iGaming legalization, a market set to grow double-digit for the next decade

Significant distribution gains, new markets & client wins will prove to be material drivers of 2025 growth

Quick Business Overview

Bragg Gaming is a B2B iGaming technology & content provider. They offer a player account management platform, back-end infrastructure, sports betting technology, managed services & gaming content (slot games primarily) for iGaming operators like Ceasars Digital, Draftkings, Fanduel, etc. Business split is as follows:

PAM & Turnkey Solutions - a platform solution that includes hosting & security, account management, AML & KYC compliance, user monetization tools, automated operational processes, and managed services (handling of marketing, and website customer service). This is the second-highest-margin segment

Aggregated 3rd Party Content - Offers third-party content, primarily online slot games, through their remote gaming server. Smaller or localized gaming studios rely on aggregators as significant capital & regulatory costs are required to distribute games to different operators/jurisdictions. (For example, every game has to pass licensing tests in Italy and the USA). This is the lowest-margin segment

Exclusive 3rd Party Content - The same as the above 3rd party content, but contracted exclusively. This is the second-lowest-margin segment

Proprietary Content - Bragg develops proprietary content through its three studios (Atomic Slot Lab, Indigo Magic, & Wild Streak). This is their highest margin segment as games carry a 100% gross margin. It is also their strategic focus.

Brief History

Over the years, the company faced multiple business-breaking headwinds, but somehow, fundamentals have continued to improve:

In July 2021, Germany, representing over 30% of Brag's revenue, moved from a ‘grey’ to a regulated market. The gaming authorities poorly handled the transition, leading to most of Brag’s customers exiting the market that same year. Despite the loss of Germany, revenue grew by 14.4% in 2021 thanks to their entry into the newly regulated Netherlands market that same year through Betcity. Betcity became the biggest Dutch operator, commanding 30%+ market share at its peak.

From 2018 to 2023, BRAG cycled through 5 different CEOs. Many made disastrous capital allocation decisions.

In 2021, the prior management team acquired two US-based iGaming content providers: Wild Streak Games & Spin Games. They significantly overpaid for both acquisitions and primarily used equity to fund them. (though to be fair, they used equity when the stock traded at a ridiculous valuation). Both businesses barely contributed to their 2021 and 2022 growth.

Betcity's success ultimately led to its acquisition by iGaming juggernaut Entain, in early 2023. From the get-go, Entain signaled that they would move substantially all of Betcity's cost structure in-house to boost profitability. Bragg constituted the majority of Betcity’s fixed cost structure; At its peak, Betcity represented 42% of Bragg's revenue. In 2023, Brag extended its agreement with Betcity until late 2025 but lost a chunk of revenue related to its managed services. More to come on this topic below.

In September 2022, facing a working capital crunch driven by their growth and investments in content, the former CEO & CFO agreed to take on a death spiral convertible debt, with warrants, from Lind Partners. If you are unfamiliar with this type of product, just know that I have never seen a stock fully work until the debt has been cleared. The stock drew down 40% in the following months.

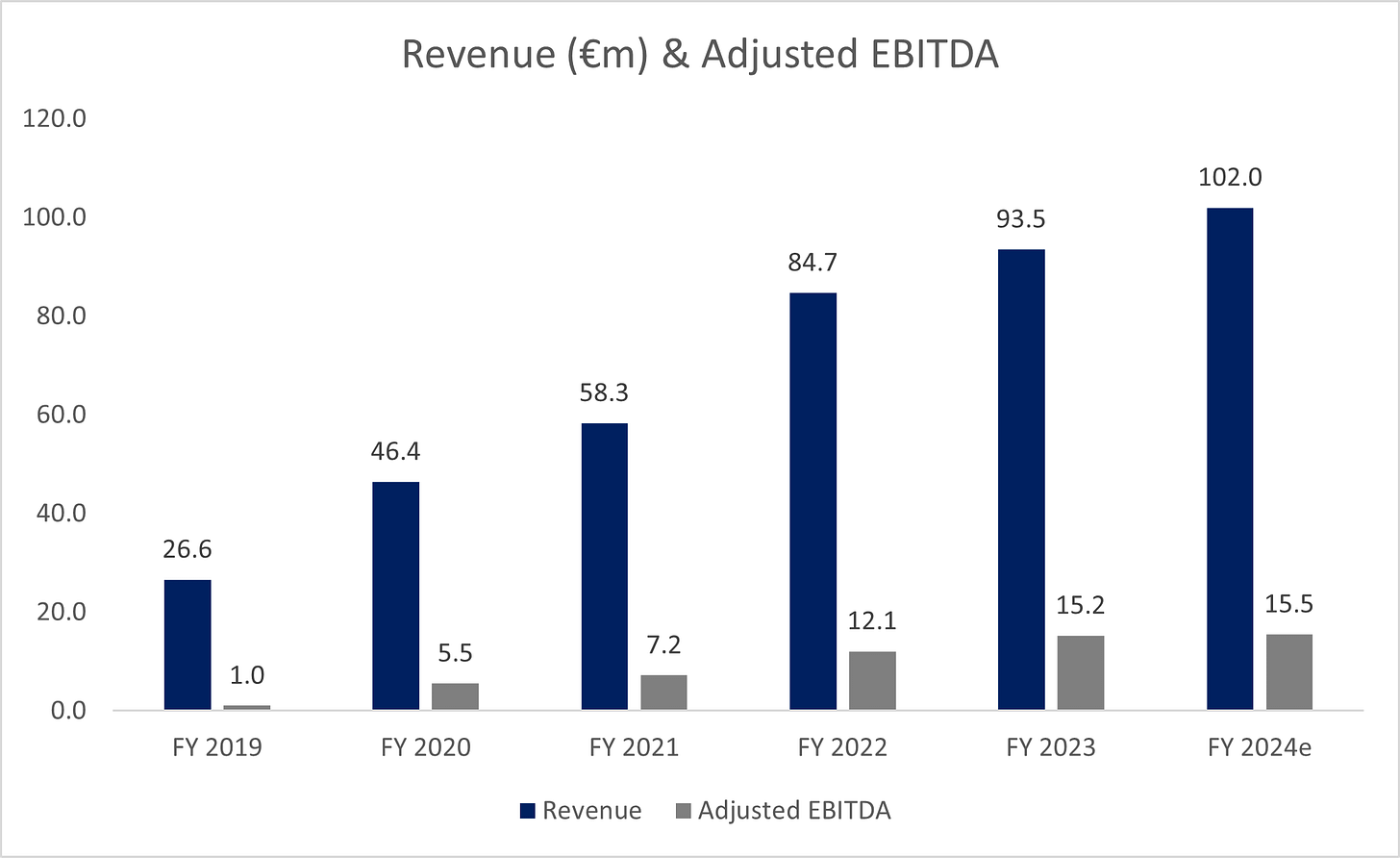

You would think that with all these headwinds, the financial profile of the company would look volatile and devoid of growth, but that's not the case at all:

I am trying to showcase that despite multiple business-breaking headwinds and a lack of leadership, Bragg effectively runs itself and has continuously emerged bigger and stronger.

Return of the Mac, Activism & Strategic Review

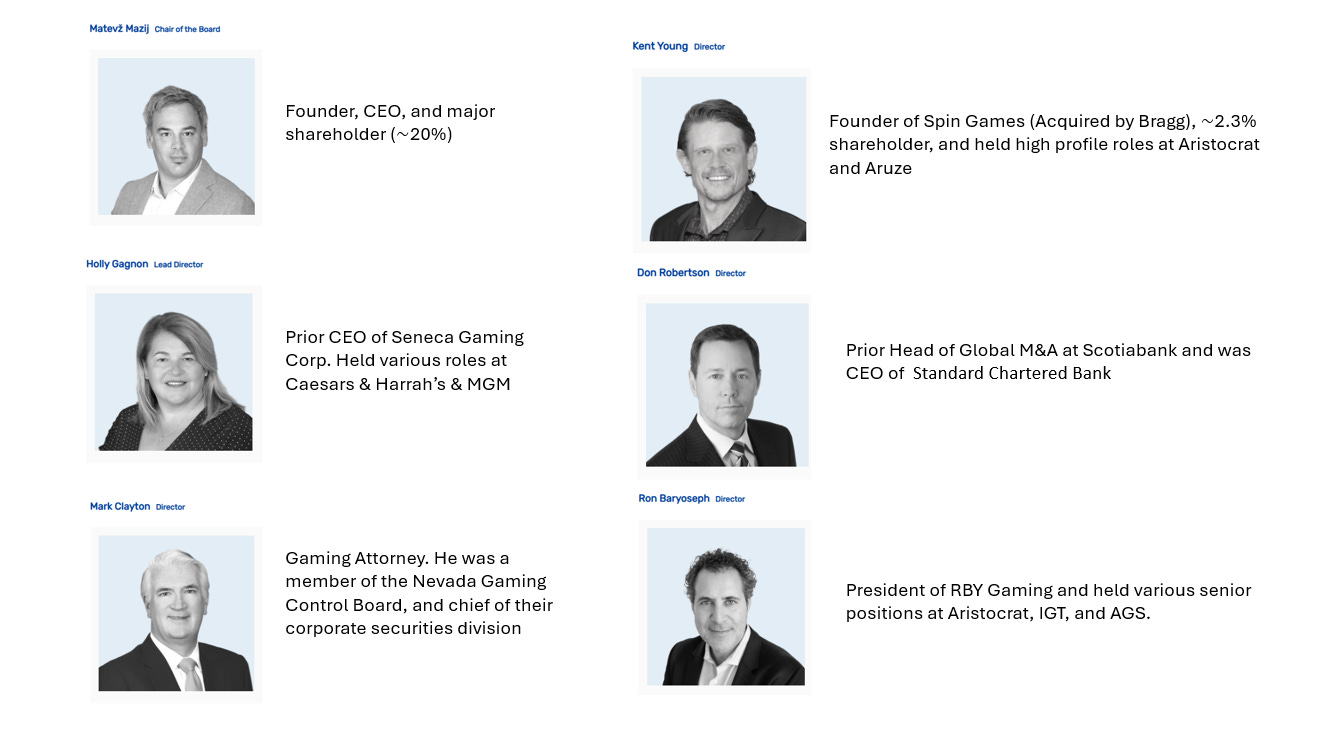

After years of frustration and the realization that the existing management/board team was not doing right by its shareholders, founder Matevz was elected as Chairman of the Board. He immediately revamped the board, letting go of most board members and hiring professionals with extensive capital markets & iGaming experience:

I have not invested in many microcap companies with this type of experience at the board level. Matevz ultimately became CEO in August of 2023, and swiftly strengthened the executive team, bringing gaming veterans across all corporate functions.

In November 2023, Jeremy Raper, a special situation & activist investor, became involved with the stock. he released an engagement letter, urging the board to sell the business following years of underperformance. Matevz obliged, and a strategic review was initiated in March 2024. I was invested in the stock at that point. However, following a major rally and new headwinds which led me to believe they would not sell, I exited my position. I outlined part of my reasoning in a tweet in early 2024.

This brings us to recent events: In November 2024, the board concluded its strategic review with no sale announced. The stock dropped 30% on the day. While many are angry and frustrated with the stock, I believe this is an attractive entry price for investors as the business has reached an inflection point and fundamentals have gotten significantly better since the return of Matevz.

Why Invest Now?

Despite extreme stock volatility in the last 3 years, the business has never been stronger:

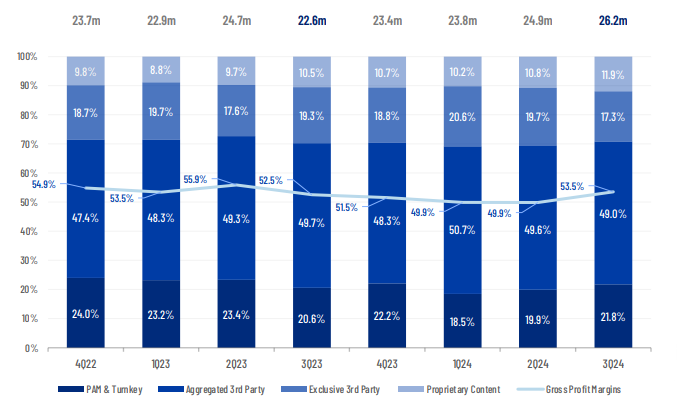

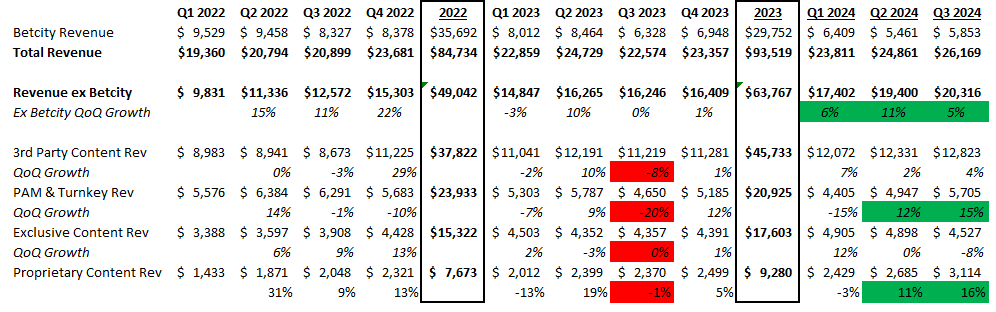

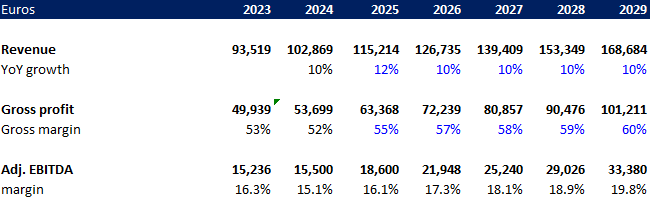

Their investments are finally starting to pay off. As shown in the picture below, revenue growth is materially expanding, with sequential growth at 6%, 11%, and 5% in the last three quarters. More importantly, their 2 strategic segments, PAM & Proprietary Content, are growing at a double-digit clip sequentially!! & gross margin expanding by 360 bps sequentially!! As the mix of proprietary content continues to grow, we should see a material lift in gross, EBITDA, and operating margin.

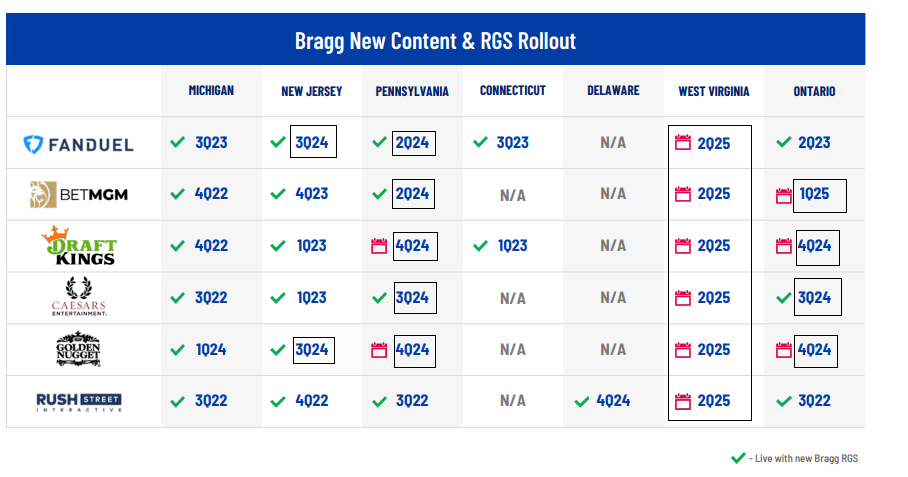

This growth rate will be sustained for a while as the company has materially ramped up its content production and expanded its distribution footprint globally (see picture below). Management has guided to double-digit revenue growth with improved cash flow generation and operating leverage for 2025. In the last 3 quarters alone, the company has launched in 3 new jurisdictions with 6 different operators. They will also double the # of games released in 2025. USA revenue grew 42% QoQ in 3Q2024 and I expect further sequential growth. The US iGaming market is growing 30%+ YoY.

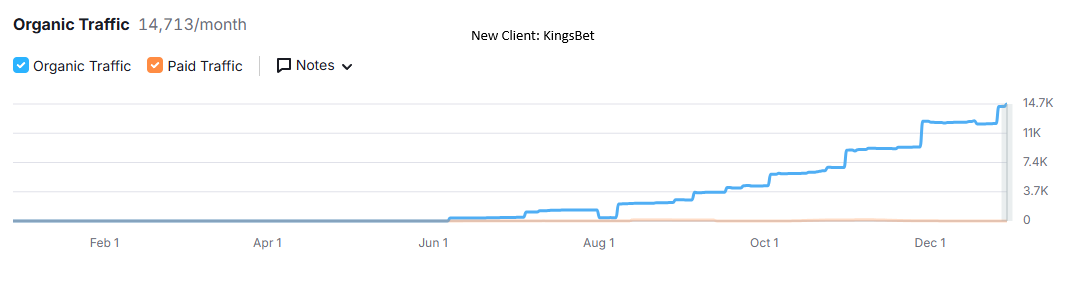

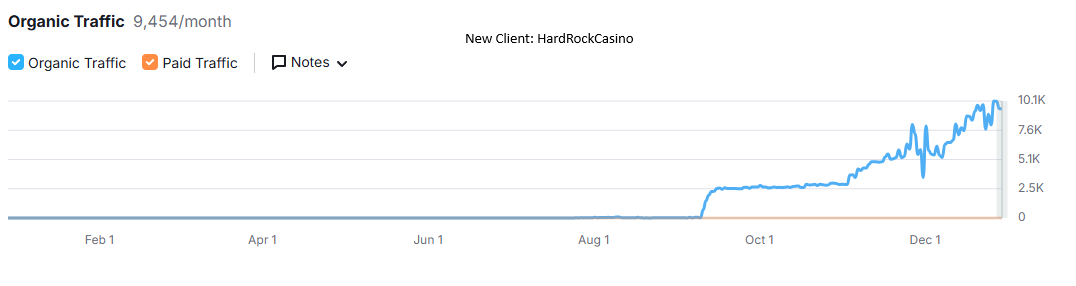

Late into Q2, Bragg onboarded two new turnkey solution clients: HardRockCasino in the Netherlands & KingsBet in the Czech Republic. Looking at the two pictures below, traffic on those websites is ramping up fast. Traffic numbers are relatively low, yet, Czech Republic revenue increased from €238K before the launch to €1.06m, in one quarter! Similarly, Dutch revenue ex-Betcity grew 41% QoQ and 97% YoY! As these two websites grow and invest in marketing, it should materially lift growth and margins headed into 2025.

Brazil has regulated its iGaming market, and Bragg is one of the few B2B providers that has secured a license before the January 1st launch. Brazil is set to be one of the biggest iGaming markets, sized at US$1.4B and set to grow to $4b by 2030. The company already secured relationships and content with the top operators in the country. I expect announcements throughout 2025. It is also likely that many PAM opportunities will crystallize in the next 12-24 months.

Betcity, which accounted for 42% of revenue in 2022, is now 22% as of the latest quarter. The company has been facing a contract renegotiation headwind since Q3 2023 and will run against easy comparables for the next several quarters. In addition, Betcity is facing significant competitive pressure in the Dutch market. Its parent company, Entain, has outlined it as its worst-performing asset for several quarters now and is looking to divest it. Completing a platform conversion during this process would be completely irrational. But that does not even matter. Why? Because in the Netherlands, every iGaming platform must be licensed and approved by regulators. Entain does not have a platform licensed in the Dutch market and market research leads me to believe they have not been trying to get licensed. Effectively, Entain has no path to internalize the platform by the end of 2025 and certainly does not have the incentive to disturb operations while they are looking to divest the asset.

I forecast Betcity to be under 15% of revenue by the end of 2025 regardless. Lower customer concentration should support multiple expansion.

To top it all off, the management team & board have loaded up on the stock, cumulatively purchasing $451K worth of stock in the open market in December 2024. This is the first time insiders have purchased in size since…ever. It’s also great to see that the one buying the most shares is the new CFO. He is the most in-tune with next year’s forecast. Given he hasn’t been with the company for long, something is getting him excited.

Longer-Term View

Beyond the near-term catalysts outlined below, there are multiple reasons to get excited about the story:

As Bragg continues to shift its mix away from distribution into PAM and proprietary content, we could see a material acceleration in gross margin and EBITDA margin expansion. In the past, the company guided to 60%+ gross margin and 25%+ EBITDA margin. This is not an outlandish scenario as many iGaming B2B providers have scaled their EBITDA margins above 40% and net income margins above 20%. Even smaller unscaled B2B providers like Kambi boast a 30%+ EBITDA margin.

The iGaming market still has more than a decade of growth ahead. In the United States, only 6 states have legalized online casinos versus 38 states offering Sports Betting. For states offering both, iCasino GGR quickly surpasses Sports Betting GGR. What would happen to the TAM if 30+ states end up legalizing iCasinos? Beyond the United States, LATAM is seeing a wave of legalization. This phenomenon is slowly sipping into Africa and Asia, where the markets remain untapped for the business. Could Bragg recreate the success it had in the Netherlands elsewhere? It sure feels that way.

The company’s products are also gaining steam, especially in the US & Europe. Beyond seeing it in its revenue growth and client wins, Bragg has been nominated for multiple years now in the biggest gambling award events of the industry. In 2024, the company won the Industry Innovation of the Year award at the SBC Awards North America for its Bragg's FUZE™ player engagement toolset. They were also nominated for 7 awards at CasinoBeats for their content innovation. In 2023, the company won Technology Provider of the Year for its PAM & turnkey solutions.

Lastly, as the business grows, I would expect customer concentration to decline significantly. Geographic diversification should also improve supported by outsized growth in regulated markets. These two elements, coupled with improving PAM customer count, should support further valuation upside.

Why does this opportunity Exist?

The stock has been hit over the last year by multiple technical factors and one major overhang which should resolve imminently

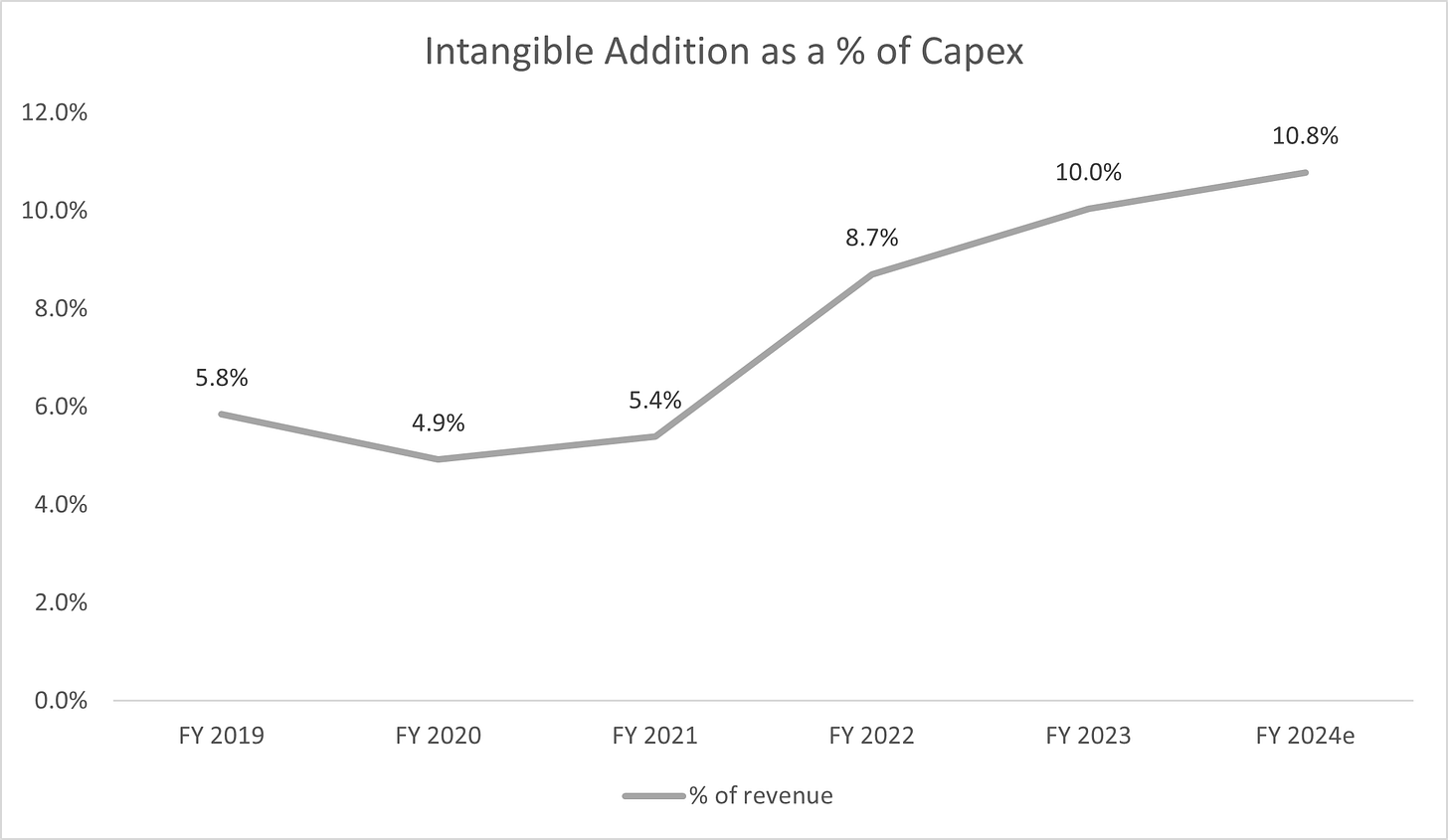

Over the last 3 years, Bragg went through major capital & operational investments. These investments climbed further when Matevz became CEO. Investments were made to strengthen their gaming, technology, legal, and commercial departments. Capex as a % of revenue expanded quickly which depressed cash flow generation (and further contributed to their working capital crunch). However, I believe capex as a percentage of revenue peaked this year. All their gaming studios are fully ramped up and investments to improve game output are now behind them. This was confirmed in the latest earnings call when the CFO expressed his view that they have all the necessary tools to start driving operating leverage. I also had a positive discussion with him, where he outlined that cash flow generation is now a top priority for management.

The issuance of the death spiral convertible debt has been a major overhang. This has weighed on the stock as I believe the mechanisms of the paper attract short sellers (A continuously lower stock price would theoretically force the company to issue an infinite number of shares, further bringing the stock down). However, the company finally paid off the legacy debt during Q3 2024, removing a major technical overhang.

In early 2024, the company borrowed $7m from one of its Major shareholders. The debt has become current, causing many to worry about the refinancing risk. The amount is relatively small, and the company has improved growth and margins compared to prior quarters, which means management should be able to secure this relatively small financing. I expect a revolver to be announced from which they can draw for near-term working capital needs.

Lastly, in October 2024, the Netherlands introduced a new set of rules limiting player deposits across the iGaming market. This will likely cause a drop in revenue for Dutch operators. This has been pressuring the shares for some time. In their Q3 call, management stated they felt comfortable reiterating guidance given they were already halfway through Q4. These new rules will be positive to the longer-term story as they will reduce the concentration to Betcity and the Netherlands, supporting multiple expansion. It will also improve the competitive landscape of the market. LiveScore, and Tambola, two operators in the Dutch market, have already exited.

Valuation & Precedents

The stock trades at 4.7x EBITDA. What should one pay for a secular double-digit grower, that will grow FCF at a much faster clip, while materially expanding margins, and diversifying its customer & geographical base? More than 5x, in my opinion.

Conservatively modeling 10-12% revenue growth and margins expanding at 90-100 bps over the next 2 years, and using 6x EBITDA gets me to a stock worth CAD $9.50-12 or 75-121% upside. I could see significant upside to my model on the margin front, especially given the most recent quarter’s gross margin expansion.

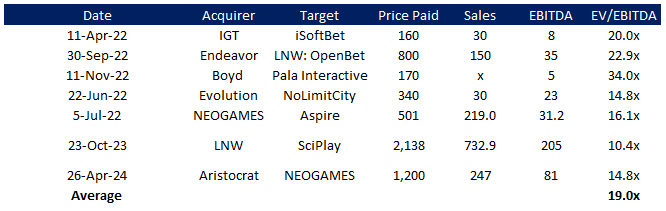

As shown in the engagement letter written by Activist Jeremy Raper, precedent transactions in the space support a much higher valuation. Using the lowest valuation paid (outside of SciPlay which is not a true iGaming business), the stock would be worth CAD $16 or 194% upside.

The obvious question I will get from the above comparative analysis is that the board tried to sell and was unsuccessful, so the analysis is pointless. Wrong. In their last press release, management signaled that they remain open to a ‘liquidity’ event. They’ve identified key focus areas raised by prospective buyers (stronger cash generation, increased revenue diversification, accelerated proprietary content growth, and enhanced margins). Notice how all these issues are already improving as we speak? The precedent table remains as relevant as ever.

Closing Remarks

There are a few key events to watch for in the coming months. BRAG’s Q4 call in April should clarify the impact of the regulatory changes in the Netherlands and growth for 2025. the debt refinancing should also be a clearing event. For transparency, I started buying the stock following the Q3 results around CAD $4.50 and averaged up all the way to $5.20.

Ultimately, you are buying a net cash gaming business, with inflecting growth and profitability, trading at depressed valuations, and with a multitude of catalysts ahead. (sounds familiar? See my post on TSX:EAGR which I still like.)

Finally, I want to thank everyone who took the time to read this article. Finding time to write a post has been challenging but I hope it proves useful. If you like the content I publish, please take a moment of your time to subscribe and follow me on X @InflexioSearch as I share ideas more frequently.

Disclaimer: I am long TSX:BRAG. The information contained above is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed herein based on such investors’ own review of publicly available information and should not rely on the information contained herein.

BRAG options look pretty juicy imo. Not much time premium.

Great update, appreciate you doing it